The D.C. Policy Center launched its quarterly Business Sentiments Survey to provide a detailed, comprehensive picture of what the business community is experiencing to elected officials, the media, and the broader community. In its first iteration, 91 respondents – most of whom were business owners and executives –completed the survey.

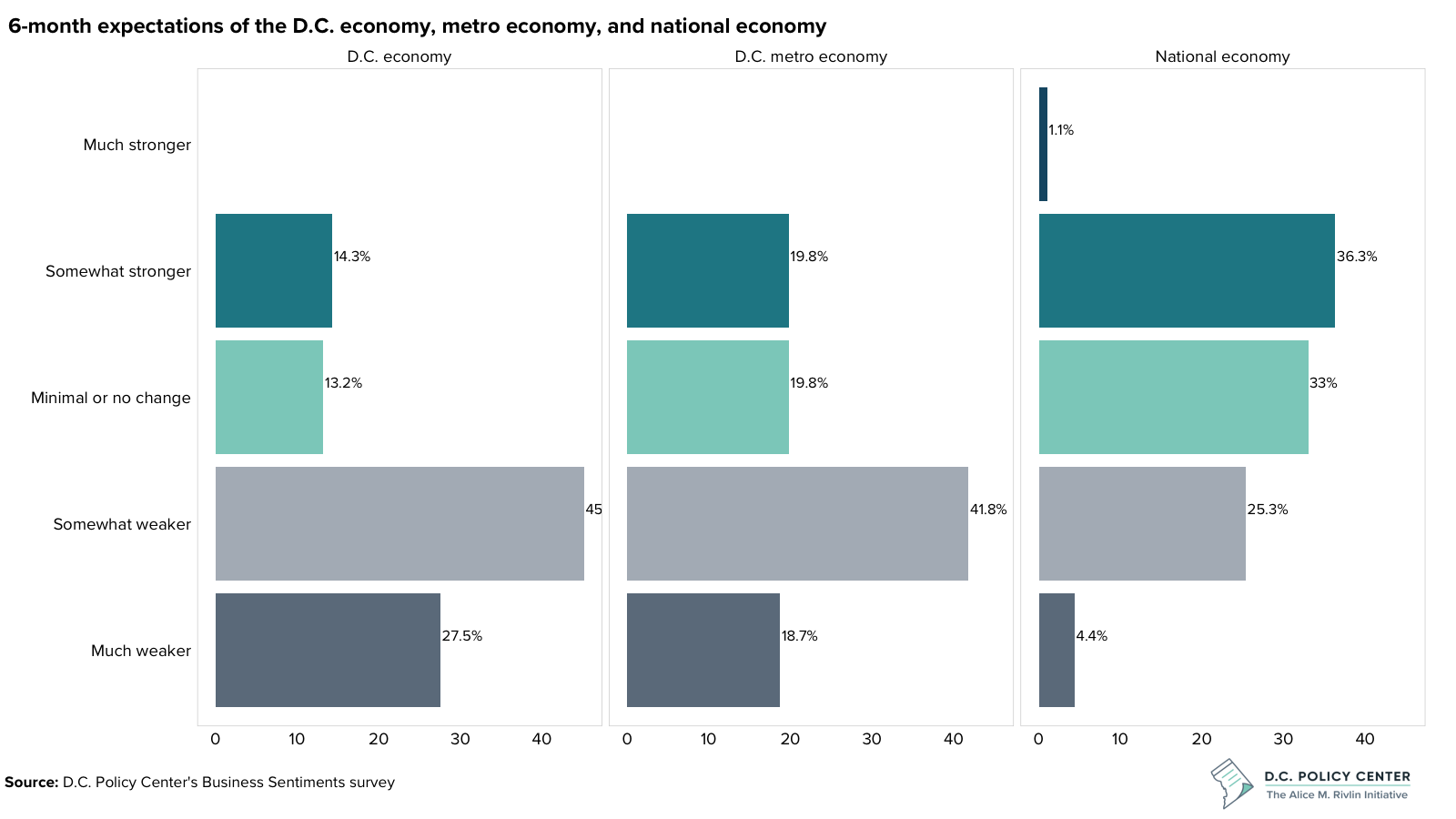

Large, established businesses account for a substantial portion of the survey sample. While the preliminary results reported here are raw and qualitative, some of the survey’s results align with existing data-driven research. One of the questions that respondents were asked was about their expectations of the local, regional, and national economy over the next six months.

Across the board, respondents reported a grim outlook for the D.C. economy, while reporting slightly sunnier expectations for the metro and national economy. The regional economy picked up steam in terms of employment growth between November 2022 and October 2023, and inflation in the national economy has moved closer —albeit slowly and unevenly—to the Fed’s 2 percent target.

The pessimism about the D.C. economy may reflect the fact that the D.C. economy experienced little to no job growth between October 2022 and October 2023. Additionally, given the strong representation of businesses in real estate, rental, and leasing in the survey sample, the pessimism may also be a function of the weak commercial real estate market.1 Office occupancy rates remain below pre-pandemic levels. As of November 2023, D.C.’s Central Business District (CBD) had a vacancy rate of almost 19 percent and an availability rate of 22 percent. With availability rates higher than vacancy rates, the commercial real estate market may further deteriorate as leases expire. And over the past year or so, the negative net absorption rate of D.C.’s office market was more than 2 million square feet. Each of these factors might explain the concerning outlooks on the D.C. and regional economy, especially for businesses most heavily affected by the woes of the commercial real estate market.

Future rounds of the Business Sentiments Survey will help to clarify and quantify businesses’ expectations for the D.C. economy. For the time being, these results allow a peek into the concerns of some of the region’s largest employers and longest standing organizations.