Note: D.C. updates on the spread of the coronavirus and COVID-19 are available at coronavirus.dc.gov.

This article was originally published on March 25, 2020. We will continue to update it as needed as the District’s response to the situation evolves. For more, see our frequently updated timeline of the COVID-19 pandemic and the District’s response.

###

The D.C. Council has passed multiple pieces of emergency legislation addressing the coronavirus pandemic:

- On Tuesday, March 17, the D.C. Council unanimously passed the COVID-19 Response Emergency Amendment Act of 2020 (B23-0718 or Act 23-247), which was signed by the Mayor and enacted that same day. The legislation provides a framework for the District of Columbia’s governmental response to the pandemic on many fronts. The text of the bill is available here, and the fiscal impact statement is available here.

- On April 7, the Council passed a second COVID-19 bill, the COVID-19 Response Supplemental Emergency Amendment Act of 2020 (B23-0733 or Act A23-0286), which was signed by the Mayor and enacted on April 10. This legislation provides additional authority to the Mayor to provide relief and supports to District residents, workers, and businesses.

- On April 21 the Council passed the COVID-19 Supplemental Corrections Emergency Amendment Act of 2020. This legislation amends and clarifies previous around mortgage deferrals and rent collected by landlords receiving relief, prohibits commercial rent increases, allows nightclubs to deliver food with drinks, and clarifies other provisions in previous response legislation. It also set the budget submission date as May 12.

As with all emergency legislation, there will not be a second hearing or congressional review on these emergency measures, which became law as soon as they were signed by the Mayor. As emergency legislation, the measures are set to expire after 90 days. During this time, the Council will consider parallel “temporary” legislation, which will be subject to a second reading and congressional review (along with mayoral approval), though it will not be assigned to a committee. For more on the D.C. legislative process for emergency and temporary legislation, please see the D.C. Council website, “How a Bill Becomes a Law,” under the section “Special Legislation.” Updates to draft legislation can be found at chairmanmendelson.com/circulation.

This article summarizes these measures as well as their implementation by Mayor Bowser’s administration, along with other executive actions that affect D.C. workers, residents, and businesses.

Read further for detailed summaries of the District’s emergency response, grouped by topic.

For more, see our frequently updated timeline of the COVID-19 pandemic and the District’s response.

D.C. Council in session to pass COVID-19 legislation on March 17. Photo / D.C. Council

D.C. COUNCIL AND GOVERNMENT ACTIVITIES

Budget may be delayed until May 12

The Mayor’s budget for fiscal year 2021 was originally expected to be released on March 19, but the Council’s has since delayed its deadline for submission until May 12.

The Office of the Chief Financial Officer (CFO) will put out a new revenue estimate in late April to reflect the expected impact of COVID-19 on the D.C. economy.

Duration of public health emergency

The Mayor is authorized to extend the public health emergency through mid-June (currently, it is through May 15).

Council and others can meet virtually

In order to facilitate social distancing, the Council will now meet virtually, offsite. ANCs, boards, and commissions can also suspend meetings or meet remotely. However, no board, commission, or other public body is required to meet during the public health emergency, or until the Mayor deems it is necessary or appropriate for them to meet.

Government operations

The measures give the Mayor the authority to mandate telework for D.C. government employees, and generally gives the Mayor greater flexibility in how employees are deployed, hired, and scheduled. D.C. government workers are currently on an agency-specific telework schedule until May 15.

FOIA and Open Meetings requirements

The time during the public health emergency does not count toward the time period during which public records requests, Freedom of Information Act (FOIA) requests, and requests for recordings from police officers’ body-worn cameras must be met.

Voting by mail

New measures allow broad use of voting-by-mail in for the Primary Election on June 2 and the Ward 2 Special Election on June 16. At present, the District of Columbia’s polling stations will remain closed on the dates for those elections, but 20 early voting centers will be open before those dates to accommodate additional voters. The D.C. Board of Elections strongly urges voters to request a mail-in ballot instead of voting in person. More information, including steps on how to request a ballot, is available here.

BUSINESSES AND WORKERS

For more on the potential impacts of COVID-19 on the District’s finances and economy, please see COVID-19 pandemic and the District of Columbia: What to expect?

The legislation extends protections and expands eligibility for medical leave under the District’s Family and Medical Leave Act (FMLA) by creating a new type of medical leave, “declaration-of-emergency” leave. Employees who are ordered or recommended to quarantine or isolate by D.C. Health are now eligible for up to two weeks of unpaid declaration-of-emergency leave without fear of losing their job.

Declaration-of-emergency leave is available to all employees during the period of the public health emergency, regardless of the size of the business. (FMLA normally only applies to employers with 20 or more employees.)

The extension to FMLA is in addition to the new federal paid medical leave provided through the Families First Coronavirus Response Act (FFCRA), which grants extended paid leave for employees who work for certain public employers, or who work for private employers with fewer than 500 employees.

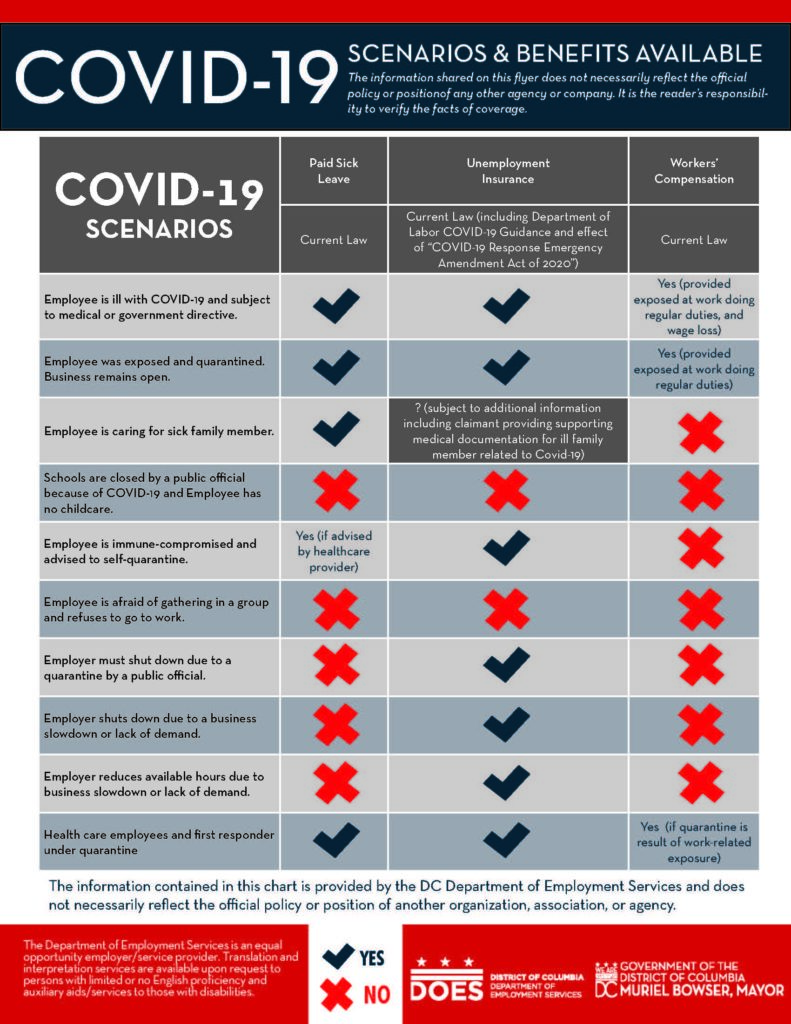

More information on who is covered—and how paid sick leave and workers’ compensation intersects with unemployment insurance coverage (discussed below) during the COVID-19 crisis—is shown in the following chart from the District Department of Employment Services (DOES).

Image / DOES, coronavirus.dc.gov

Unemployment compensation

The emergency legislation extends availability of unemployment compensation to employees affected by COVID-19 and the public health emergency. From March 13 to April 21, a total of 72,274 claims were filed.

The legislation also removes several requirements and limits on when unemployment compensation can be received. For example, affected employees can receive compensation regardless of whether their employer expects or plans to rehire them at a later date. These changes apply to the duration of the public health emergency, as declared by the Mayor. Workers who receive traditional unemployment benefits can also now receive an additional $600 in Federal Pandemic Unemployment Compensation (FPUC) as a result of the federal CARES Act.

For businesses, unemployment benefits tied to this change will not be included in the calculation of business experience rates, meaning that businesses will not see their unemployment tax obligations increase dramatically in the future as a consequence of the COVID-19 emergency.

Affected employees who can access the extended unemployment compensation benefits include:

- Employees who have become unemployed or partially unemployed due to the public health emergency, because their employers have ceased or reduced operations due to District Department of Health (DOH) guidance, actions by the Mayor, or otherwise have seen a reduction in revenues because of the COVID-19 crisis.

- Employees who are in quarantine or isolation, either because they were specifically instructed to do so or because they are following recommendations from DOH, another government agency, or a medical professional.

- Employees who quit or otherwise left employment because their employer failed to comply with public safety directives from DOH, or because the employer required them to be physically present at work after they were advised to self-quarantine.

The Council’s COVID-19 measures allow eligible workers to receive their unemployment benefits more quickly than in the past—as soon as they apply for them, without the usual one-week waiting period. Workers also are not required to be actively looking for work in order to receive unemployment benefits. DOES Director Unique Morris-Hughes has advised that the fastest way for eligible residents to file for District unemployment compensation is to do so online. Workers can email covid19.ui@dc.gov with questions about a specific claim.

Self-employed individuals and independent contractors can also receive a new form of unemployment assistance, Pandemic Unemployment Assistance (PUA) benefits, as a result of the federal CARES Act. These benefits are available to several types of workers who otherwise do not qualify for regular unemployment compensation, including self-employed workers, those seeking part-time work, and those without sufficient work history. The D.C. government is in the process of implementing these changes, and expects for workers to be able to file for pandemic unemployment assistance on April 24. More information is available at coronavirus.dc.gov/recovery-individuals and at dcnetworks.org; DOES asks that individuals contact pua@dc.gov with questions.

Grant program for nonprofits and small businesses

The legislation allows for the creation of a program to issue grants and loans to affected small businesses and nonprofits. The program was implemented by Mayor Bowser as the Small Business Recovery Microgrant Program, with $25 million in funding. The program provides grants of up to $25,000 not only to nonprofit organizations and small businesses, but also to independent contractors and self-employed individuals who are ineligible for unemployment insurance. Grants can be used to cover employee wages and benefits, inventory, rent, utilities, and other operating costs. Applications for the small business grant program opened on March 24 and closed on April 1.

D.C.’s small business grants program described above is in addition to the federal Small Business Administration (SBA) COVID-19 disaster recovery loans of up to $2 million, which are also now available to D.C. businesses and nonprofits.

Restaurant operations

Restaurants and taverns can now offer beer, wine, and spirits for carry-out and for delivery within D.C., if sold along with prepared food. Approval from the alcohol control board is not required, but businesses must obtain written authorization from ABRA before making alcohol deliveries. Recent legislation also allows nightclubs to deliver food along with alcohol deliveries.

Previously, the Mayor had issued an order closing all restaurants and bars for sit-down service on March 16, and closed all other non-essential businesses on March 24; however, restaurants and other food service locations can stay open for delivery, “grab-and-go,” and carryout, even under the newest closure order.

Protections for commercial tenants

The legislation prevents landlords from evicting commercial tenants for nonpayment, or from raising commercial rents during this time. Landlords also cannot charge late fees for late rent payments during the public health emergency.

Supports for landlords

Commercial landlords have received relief as well, as recent legislation requires lenders to defer mortgage payments for 90 days, but that deferment must be passed on to commercial tenants.

TAXES, BANKING, AND LICENSING

Taxes

The deadline for taxpayers to file and pay their 2019 District of Columbia individual and fiduciary income tax returns, partnership tax returns, and franchise tax returns has been extended to July 15, 2020, in line with the extended federal filing and payment deadline.

The legislation delays hotels’ first real property tax installment until the end of June without penalty. For other businesses, the emergency legislation allows them to postpone their February and March sales tax filing until July 20, although all sales taxes still must be paid in full by the end of the year.

For more information, visit the Office of Tax and Revenue’s page for Coronavirus Information and Guidance.

Banking services

In general, the legislation gives the Mayor the ability to “waive application of any law administered by the Department of Insurance, Securities, and Banking if doing so is reasonably calculated to protect the health, safety, or welfare of District residents.”

The Insurance, Securities, and Banking Commissioner can issue emergency rulemaking during the declared public health emergency order. The Commissioner can also temporarily waive existing laws and requirements to ensure that banking services can continue uninterrupted, such as opening temporary banking locations or mobile branches.

These changes “may not apply for longer than the duration of the effects of a declared public health emergency.”

Licenses, permits, and registrations

During the public health emergency, and for 45 days after, the Mayor can extend the validity of various types of licenses, permits, registrations, and certifications, including drivers licenses, vehicle registrations, and professional licenses. The Mayor can also waive deadlines and any late fees or fines. There will also not be a late fee for a business or nonprofit’s first biennial report for 2020 if it is filed by June 1, 2020.

However, the mayor can “revoke, suspend, or limit the license, permit, or certificate of occupancy of a person or entity that violates an emergency executive order.”

HOUSING AND CONSUMER PROTECTIONS

Protections and supports for residents

Landlords cannot increase rents, evict residents, or charge tenants late fees for the duration of the public health emergency. Utility companies cannot shut off gas, water, or electric service for nonpayment; internet service likewise cannot be shut off, although it can be downgraded. The emergency measures also extend deadlines for tenants and tenant associations for rental housing conversion processes during the emergency.

Supports for homeowners

The most recent legislation requires mortgage companies to offer 90-days deferment to homeowners unable to pay due to the pandemic.

Services for residents experiencing homelessness

The Council’s emergency legislation allows the Mayor to place families experiencing homelessness in interim housing for up to 60 days, with the ability to extend for the duration of the public health emergency. Housing providers can also transfer residents to new housing for public health purposes, as part of the District’s continuum of care for individuals and families who are experiencing homelessness.

The emergency measures also allow housing providers to communicate by email (rather than by mail or in-person) during the emergency.

Price gouging, stockpiling, and debt collection

The legislation places limits on price gouging and stockpiling, and increases the existing penalties for doing so. Some common debt collection practices, such as repossessing cars, are also prohibited during the emergency. More information is available from the Office of the Attorney General.

HEALTH AND HUMAN SERVICES

Extend eligibility for public benefit programs.

For public benefit programs such as TANF, SNAP, and the DC Healthcare Alliance and Immigrant Children’s program, the Mayor now has the authority to extend eligibility and access to these programs, up until 60 days after the end of the public health emergency period. Some of these changes may require additional rulemaking to take effect.

Health insurance, prescriptions, and telemedicine

The legislation allows the Insurance, Securities, and Banking Commissioner to issue emergency rulemaking to address the crisis, which for health insurance could include grace periods for premium payments, postponing premium increases or non renewals, and allowing modifications to existing insurance policies.

The Commissioner can issue rulemaking regarding refilling or filling prescriptions; separately, the legislation also allows pharmacists to refill prescriptions before the end of the refill waiting period. The Commissioner can also issue rulemaking regarding the procedures for obtaining nonelective health care services.

Department of Corrections

Jails and prisons are particularly dangerous places for coronavirus to spread, especially for incarcerated people who are older or have chronic conditions. During the public health emergency, the Department of Corrections can award additional “good time” credits beyond what is currently allowed so people who are incarcerated for misdemeanors can be released early. (“Good time” credits—essentially, “time off for good behavior”—can be earned for good behavior, education, and meritorious service, among other reasons, and can be applied for early release.)

United Medical Center

An approved amendment by Councilmember Vincent Gray removes the Fiscal Management Board trigger for United Medical Center (UMC) for fiscal year 2020.

Prior to this emergency legislation, if UMC were to require an annual subsidy of more than $22.14 million in fiscal year 2020, the Board of DIrectors would be removed and a financial control board would take over operations. The amendment therefore allows for the possibility of greater funding in response to the COVID-19 pandemic without triggering the financial control board, but does not require the Mayor to appropriate any additional funds to UMC beyond what is currently budgeted.

EDUCATION

Related: Resources for the D.C. student and education community to stay informed and safe as COVID-19 spreads

Absences and promotion

Absences due to school closures won’t affect grade promotion. D.C.’s traditional public schools (DCPS) and public charter schools are now closed until May 15, during which time students will learn remotely. With classes moved online, the legislation amends promotion procedures so student absences if the student does not have access to the necessary equipment (e.g., computer, software, or internet connection) for distance learning do not prohibit promotion to the next grade.

Research-Practice Partnership

The emergency legislation allows the review of proposals for the District’s new Research-Practice Partnership to be delayed until seven days after the public health emergency.

Future impacts are unknown

These emergency measures are the first steps in the city’s response to the COVID-19 crisis. It will take time for the full effects of the crisis to become known, but they are expected to be severe.

At the hearing for the first emergency measures, CFO Jeffrey DeWitt told the Council that if the crisis continues into June, D.C. would also need to cut $500 million from its 2020 spending (the current fiscal year), in addition to making significant reduction in the FY 2021 budget.

While the economic effects of the crisis are impossible to forecast completely, DeWitt told the Council that D.C.’s unemployment rate could reach almost 20 percent. For more on the potential impacts of COVID-19 on the District’s finances and economy, please see COVID-19 pandemic and the District of Columbia: What to expect?

This page will be updated as needed with new information about the implementation of the emergency legislation. For more, see our frequently updated timeline of the COVID-19 pandemic and the District’s response.

If you have questions, comments, or updates regarding any of the information in this article, please email Aimee Custis at aimee@dcpolicycenter.org.

Feature photo: Ted Eytan, 2017.03.15 #ProtectTransWomen Day of Action, Washington, DC (Source)