In response to a Freedom of Information Act lawsuit, on December 1, 2020, the U.S. Small Business Administration (SBA) released additional details regarding the loans received through the Paycheck Protection Program (PPP), including recipient names as well as exact loan amounts. In contrast, the previous disclosure included only loan ranges for loans over $150,000 and withheld company names for loans under $150,000.

The updated data show that a total 13,335 small businesses (businesses with fewer than 500 employees) in the District were approved for a collective $2.14 billion in PPP loans. Of these 13,335 businesses, 10,528 (79 percent) received loans under $150,000 and 2,807 (21 percent) received larger loans.

Less than 2 percent of recipients account for a third of total PPP money

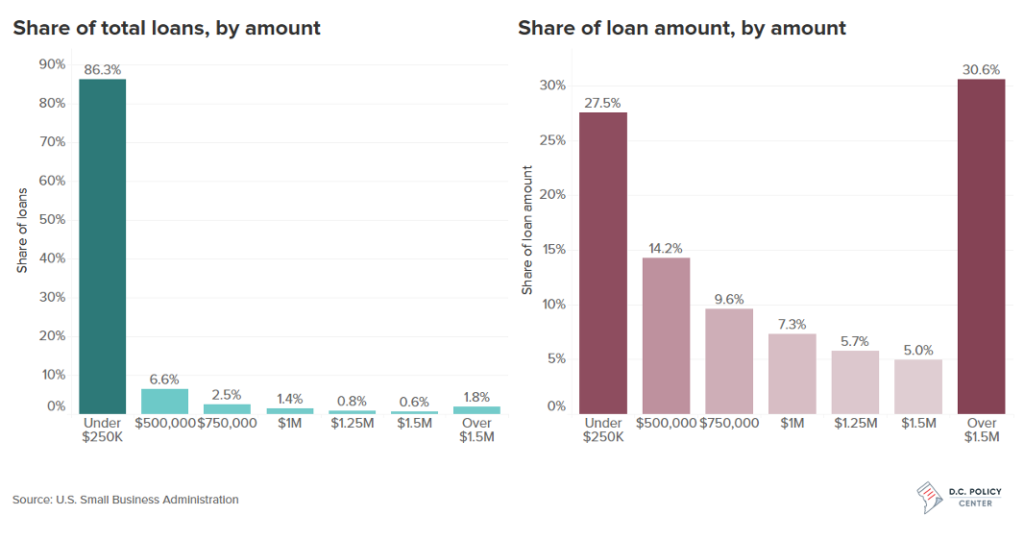

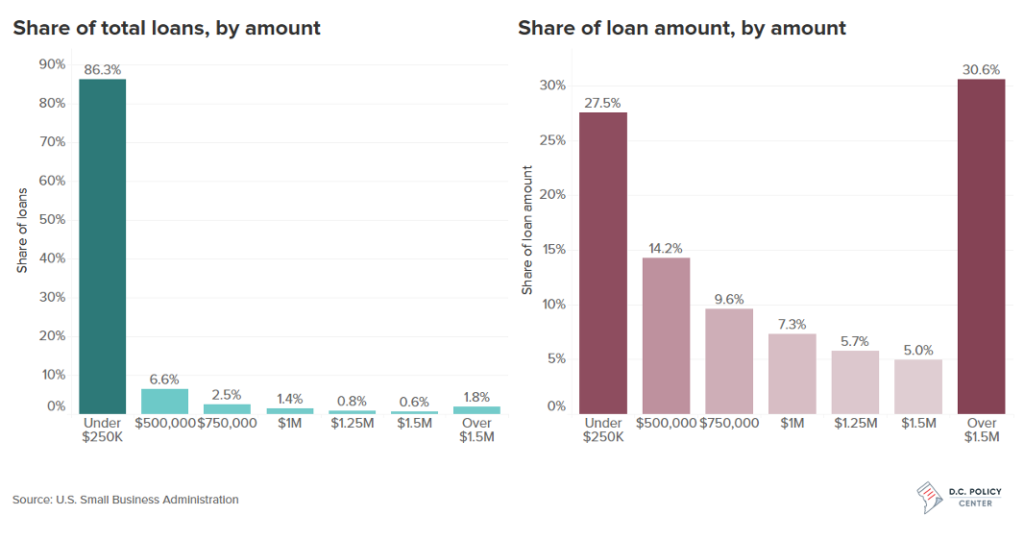

According to the data, 86.3 percent of all loans received in D.C. were for $250,000 or less and accounted for less than 30 percent of the total amount of money. Loans over $1.5 million constituted only 1.8 percent (241 businesses) of the total number of loans, however these businesses received the largest share (30.6 percent) of the total amount of money provided in the District. Among all the borrowers, only two received the maximum loan amount of $10 million allowed under the program – Cava Mezze Grill, and the American College of Cardiology Foundation.

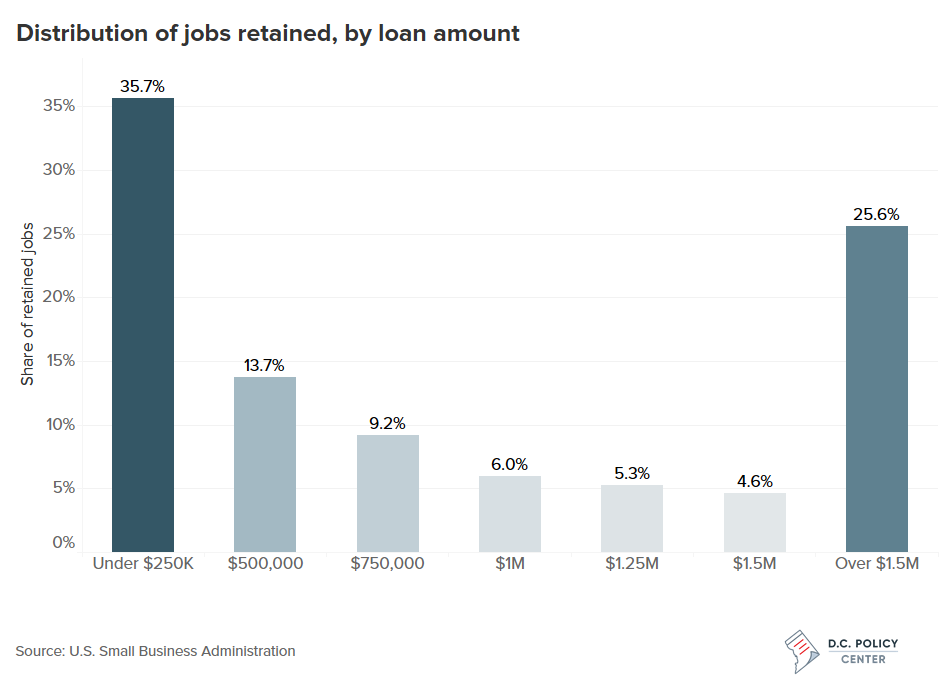

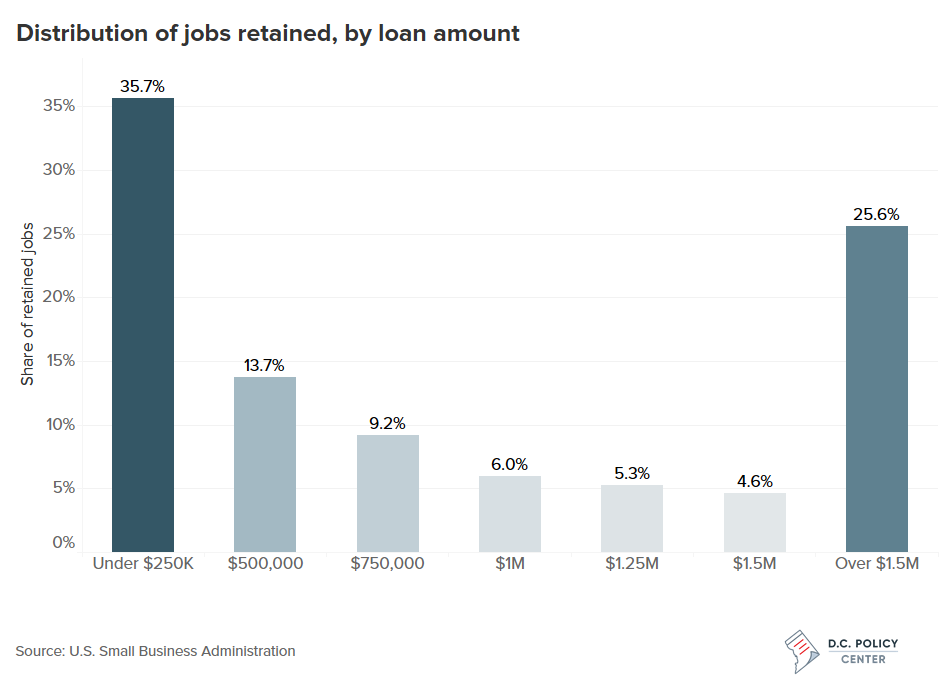

The program has led to a total of 168,317 jobs being retained in the District. Jobs from the Accommodation and Food Services sector constitute 20.1 percent of the preserved jobs, holding the largest share among all sectors. 35.7 percent of retained jobs came from loans under $250,000, and 22.8 percent were a result of loans between $2.5 and $5 million.

The data show that the reported number of jobs retained for 15.1 percent of companies is listed as zero, and as missing for 6.3 percent of the companies.

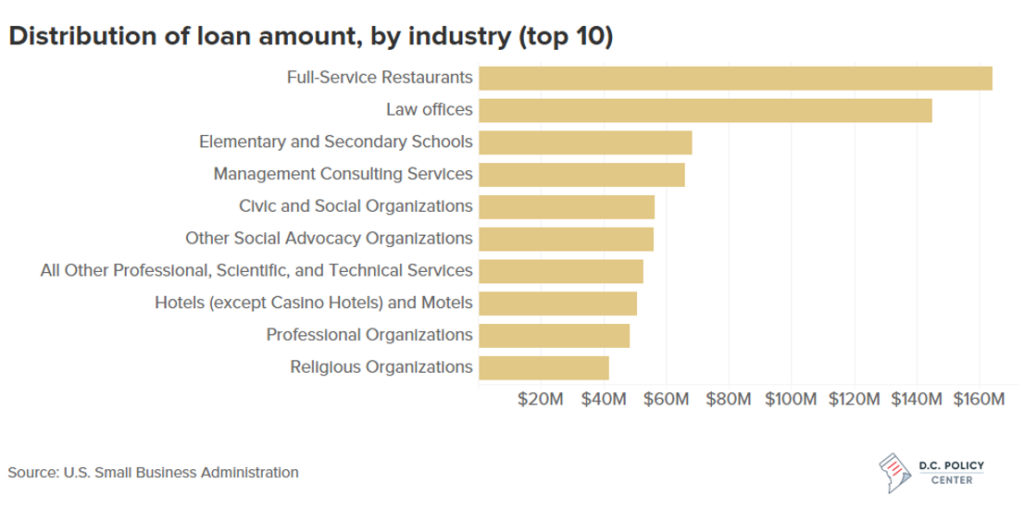

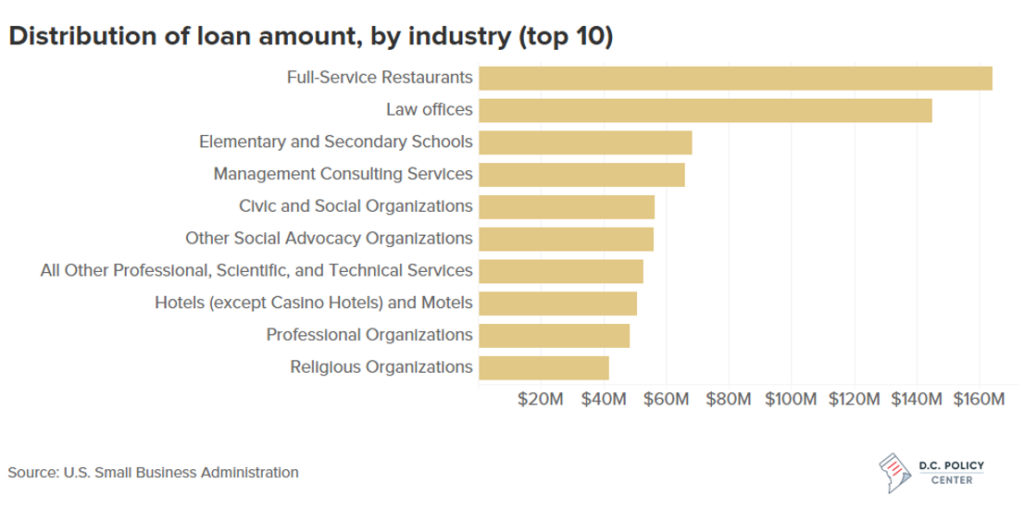

The largest share of PPP loans went to full-service restaurants

Restaurants in the District were among the hardest hit businesses, many of which were shut down early in the pandemic and continue to be affected by various COVID-19 restrictions. The data show that 763 full-service restaurants (representing 5.7 percent of borrowers) received $164.3 million in PPP loans, the largest share among industries (7.7 percent), with an average of $215 thousand per loan. Law offices in the District saw the second largest share of the total loan amount, receiving $145.1 million in loans across 688 firms.

The Paycheck Protection Program was designed as part of the CARES Act in March to help small businesses, which can use the funds for payroll costs, rent and utility payments. Loans will be fully forgiven if 75 percent of the funds are used for payroll costs. The terms of the program changed several times before it stopped accepting new applications in August, and exposed the inequitable access to banks for smaller firms and firms owned by people of color or women. Legislators are considering another recently introduced relief package, which includes almost $300 billion in additional funding for a second round of PPP and other SBA programs, targeted at the hardest-hit businesses. With the rising COVID-19 case numbers and questions about the availability of a vaccine, small businesses continue to remain uncertain about their survival.