One feature of real estate is we are never sure how much a property is worth until it is sold. Usually, when estimating the value of a commercial office building, appraisers and tax assessors rely on the sales price of comparable buildings that had been recently sold. Comparable sales data offer a reality check on other valuation methods (such as income approach), which, invariably, require some other type of guessing (such as the cap rate).

Too few transactions

Recently, it has become increasingly difficult to figure out how much office properties are worth in the District. According to the city’s tax rolls, the District has 654 taxable commercial office buildings that are assessed at $10 million or more (including planned development sites).1 These buildings account for 40 percent of the property taxes the city collects each year.2 A data pull from CoStar shows that between 2017 and 2019, each year, on average, about 35 properties valued at $10 million or more were sold through a market transaction. Between 2020 and 2022, the annual average number of sales dwindled to 16. And this year, so far, only 9 commercial office properties valued at over $10 million have changed ownership.

These numbers are even lower for property valued at $50 million or more—the real workhorses of commercial property tax revenue.3 We saw only 25 such transactions since the beginning of 2021, which is what happened in a typical year prior to the pandemic. (Of course, this may change rapidly after September when the deed taxes are slated to be cut by half.) Because of lack of sales, it is not clear if the market has fully incorporated the COVID expectations into prices.

Back to Great Recession?

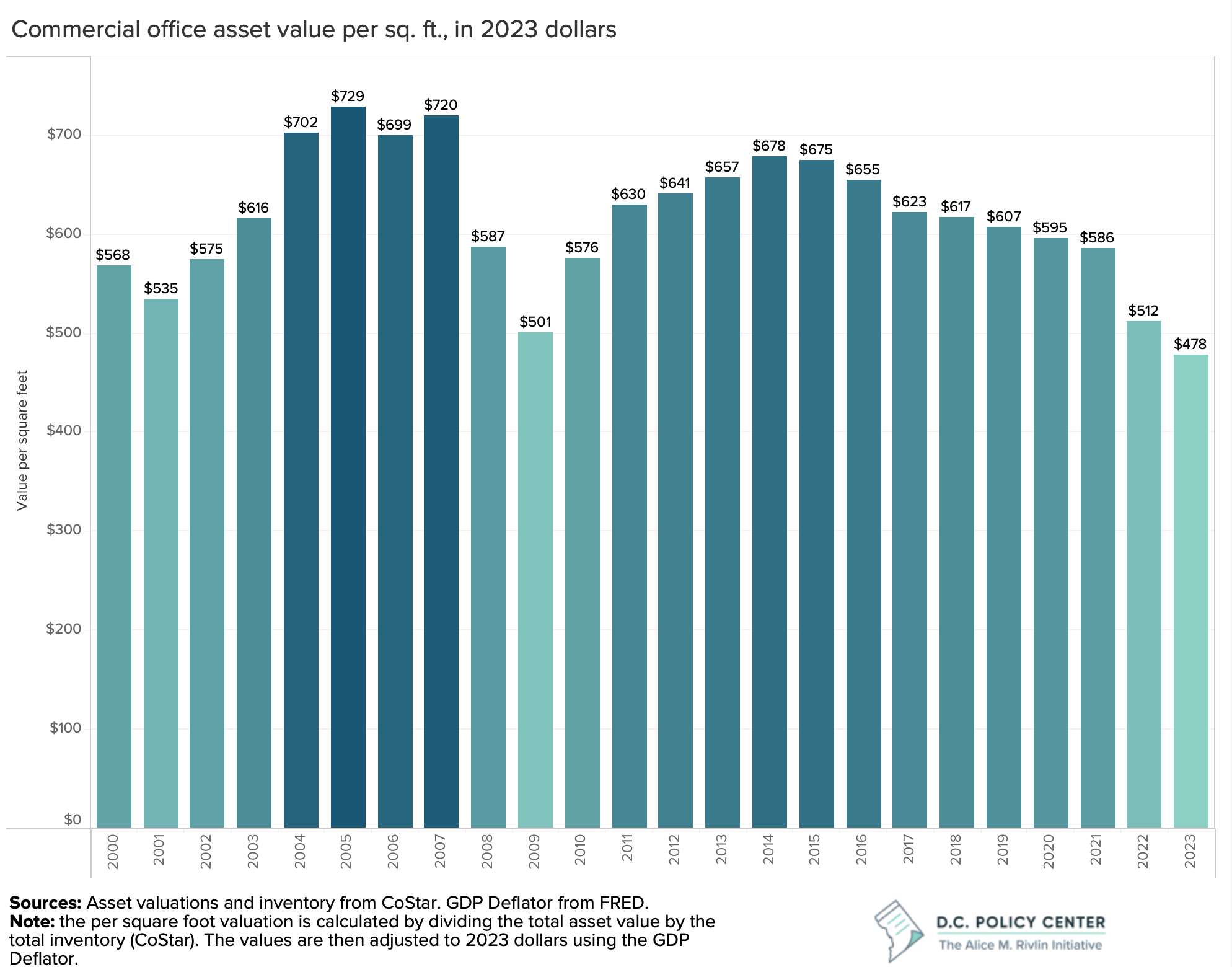

This week’s chart shows a history of commercial real property values in D.C., adjusted for inventory, and presented in in 2023 dollars, using data from CoStar. I am not sure if this is the right approach, mainly because I cannot figure out how CoStar calculates their asset values. (And please email me with your thoughts and suggestions). Still, the chart is interesting because it shows that, when adjusted for inflation, the District is more or less in Great Recession territory. If this analysis is correct, we should expect to see continued declines in commercial office values. This is because the negative shocks associated with COVID, together with remote work, have led to faster increases in vacancy rates (up 6 percentage points across the city) and much less confidence about the future demand, compared to the three years that followed the Great Recession.4

Impact on tax revenue

What, then, could happen to the commercial property tax collections? Looking at the Pertinent Data Book assessors use (TY 2024, TY 2023), it seems like the that base cap rates for TY 2024 assessment have increased by 5 basis points for trophy office buildings, and 20 to 25 basis points for Class A and Class B.5 Those adjustments, plus increased vacancy, which also factors into assessments, should drive down the assessed values for commercial office buildings.

Some of this is already baked into the estimates. The February estimate incorporated a $53M decline in real property tax collections for Fiscal Year 2024 (and more in the outyears). Additionally, the Office of the Chief Financial Officer shared some alternative scenarios with the Tax Revision Commission. These show that rapid increases in vacancies can wipe away another $80 million from commercial property taxes in FY 2024, and nearly $150 million per year in the out years.

Research from other markets suggest that values could be dropping more. Last year, researchers from Columbia and NYU published findings that commercial buildings in NYC will likely experience a 44 percent long-term decline in value because of COVID and remote work. Values are projected to decline an additional 30 percent (on top of losses already experienced) in Seattle and San Francisco. And Avison Young’s most recent report on commercial office buildings in DC show that sale price per square foot is now standing at $314, at about half of what it was at the peak. (But this low price reflects the type of sales that are taking place, which are almost entirely for conversion purposes.)

Looking forward

This year’s budget preparation for Fiscal Year 2024 was already difficult, given fiscal headwinds. In this fiscal year, and during the next four years, there is not a single year where the city can pay for recurring expenditures with recurring revenue. Next year will even be harder because federal fiscal aid will expire, schools will lose ESSER money, and the city will have to find a solution for WMATA’s budget woes, along with Virginia and Maryland. Any additional hits to the commercial property tax revenue will make this picture even bleaker.

Endnotes

- This is calculated by filtering the real property tax database for taxable commercial office properties with a tax rate of $1.89 per $100 assessment. The underlying data has been retrieved from Opendata.dc.gov on August 13, 2023.

- They are also taxed at the highest rate (with the exception of vacant and blighted properties), at $1.89 per $100 assessment.

- The 465 commercial office buildings with assessed values over $50 million account for 37 percent of all property tax revenue collections.

- During which office vacancy increased by 3 percentage points.

- The 2024 Pertinent Data Book has one more digit in the cap rate tables (for example 5.65 percent for Trophy Office, and 6.45 percent for Class A) than the 2023 Pertinent Data Book (5.6 percent and 6.2 percent respectively) so I cannot be sure exactly how much the cap rates moved.