THREE | HOW AFFORDABLE IS THE DISTRICT OF COLUMBIA’S RENTAL HOUSING?

This chapter compares prevailing rents to the income profiles of District households to examine the extent to which rental housing can meet renter demand at different income levels. This analysis shows that rent-controlled housing offers a significant discount over the uncontrolled stock—apartments that were constructed in the post-rent control period. Rent differentials are especially large in parts of the city where housing is generally expensive, and where rents have increased faster, and for larger sized units, regardless of their location.

However, rental apartment buildings have too few units to meet the demand from renters. They face pressures both from the bottom (many lower-income households and not enough apartments in their rent range) and from the top (many higher-income households and not enough apartments in their rent range). In this environment, rent control laws have been an effective means of keeping rents low in parts of the city where a strong housing demand would otherwise push rents higher. But, when both high-income and low-income households compete for the same unit, lower rents in rent-controlled units do not automatically create housing opportunities for lower income households.

The units in the shadow rental market help relieve the pressures on the market for rental apartments buildings. The shadow rental market provides both very expensive homes and very inexpensive homes. Analysis of market valuations of the shadow rentals suggests that there could be as many as 13,000 deeply affordable homes (meaning that rents do not exceed 30 percent of their income for households earning under 30 percent of Area Median Income) that can potentially serve lower-income renters, and as many as 51,000 units that can serve as affordable those who earn under 80 percent.

How much lower are rents in rent-controlled buildings?

Full and reliable information on rents is difficult to collect. Publicly available data on rents can vary wildly depending on the methodology used to compile the rent information, or the goal of the dataset.[1] For example, the American Community Survey collects rent data from renters, but rent estimates are increasingly unreliable for smaller geographical units such as census tracts—especially for single-year survey data—making American Community Survey unsuitable for the level of detail necessary for this analysis. Commercial websites such as Zillow look at comparable units and tax assessments to estimate rent; others rely heavily on advertised rents, but do not factor in concessions, or otherwise account for the rent that is actually paid by renters.

This study uses information from CoStar, a private company specialized in real estate research, to examine prevailing rents across rental apartments. We chose CoStar because this data source presents various advantages over other data sources. First, CoStar tracks rents per unit and per square foot for most apartment buildings in its database, as well as rents by unit size. Since CoStar is focused on the income-generating capacity of rental buildings, their database separates the asking rent from the effective rent, keeping track of both concessions and vacancy rates. However, the CoStar database does not track all rental apartments in the District, and its count of units does not always match the unit information in administrative databases. Of the 3,121 rental apartment buildings that are in the District’s tax database, CoStar tracts 1,777 (approximately 99,000 of the 124,600 units) and has rent information for 976 (approximately 75,400 units).[2]

Rents in all rental apartment buildings

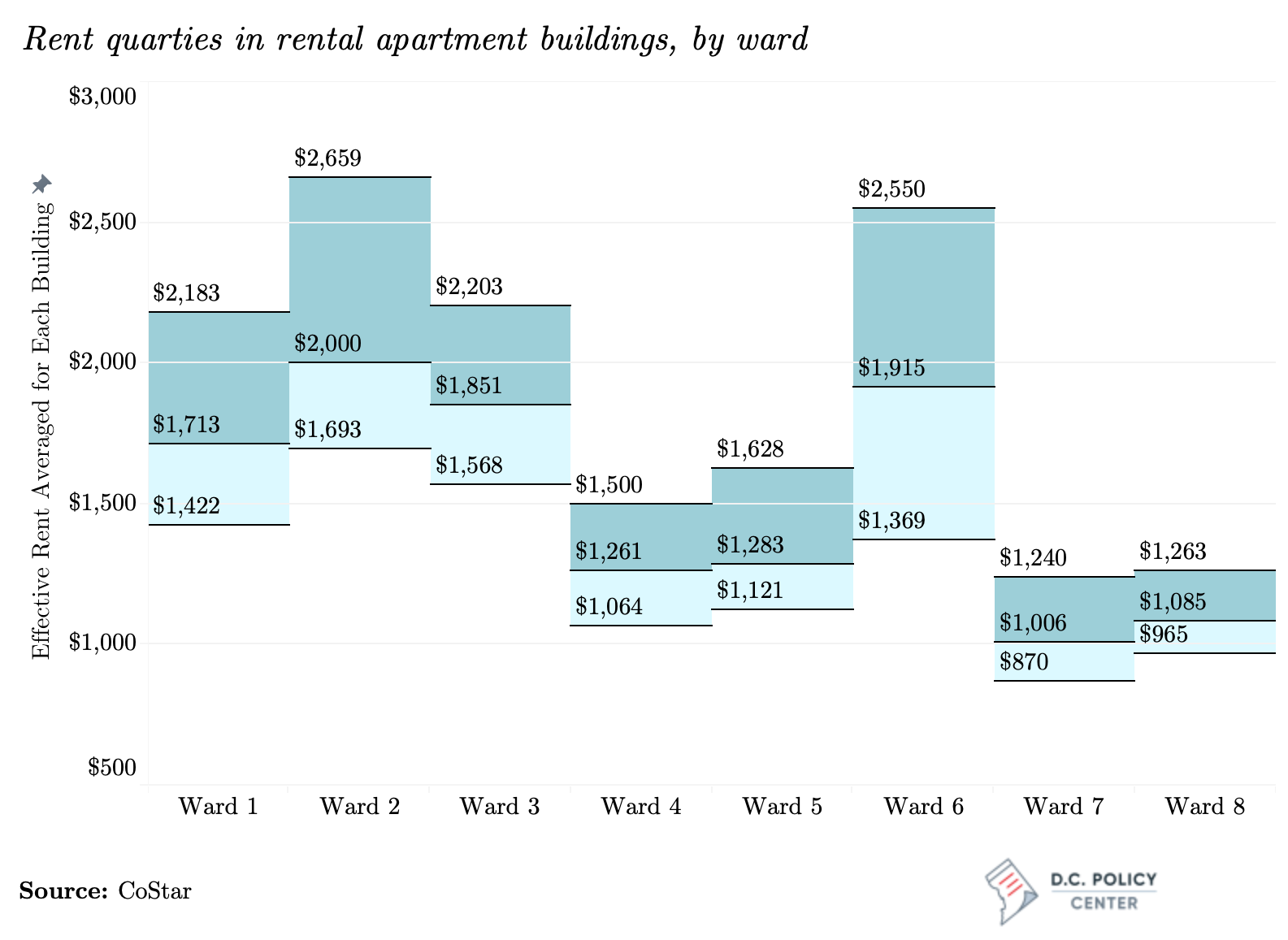

According to CoStar data, in 2019, the median effective rent that prevailed across all taxable rental apartment buildings in the District of Columbia was $1,512 per month.[3] Given how the data are presented in CoStar, this should be interpreted in the following way: the average rent for half of rental apartment buildings in the District was under $1,512 per month.[4]

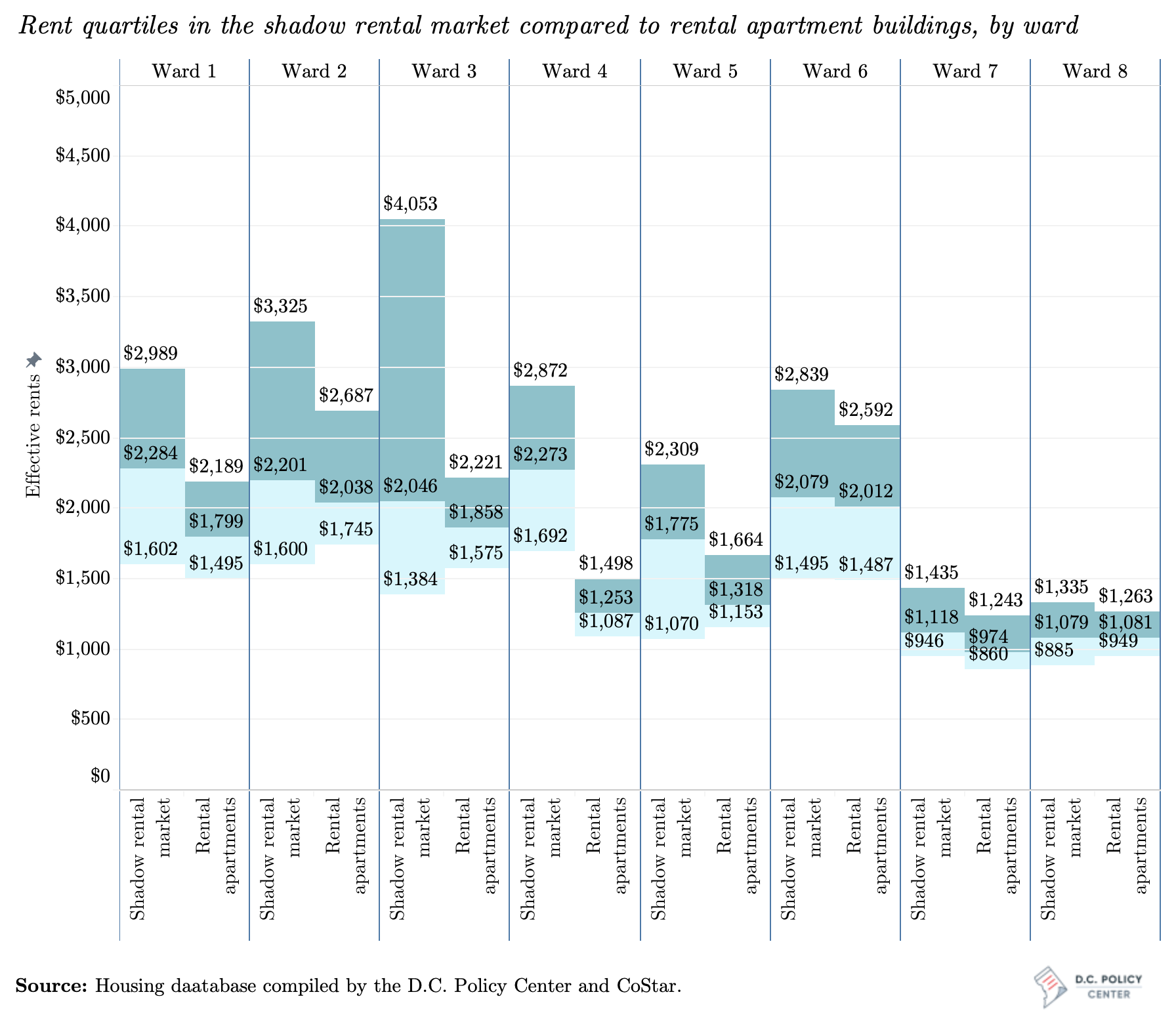

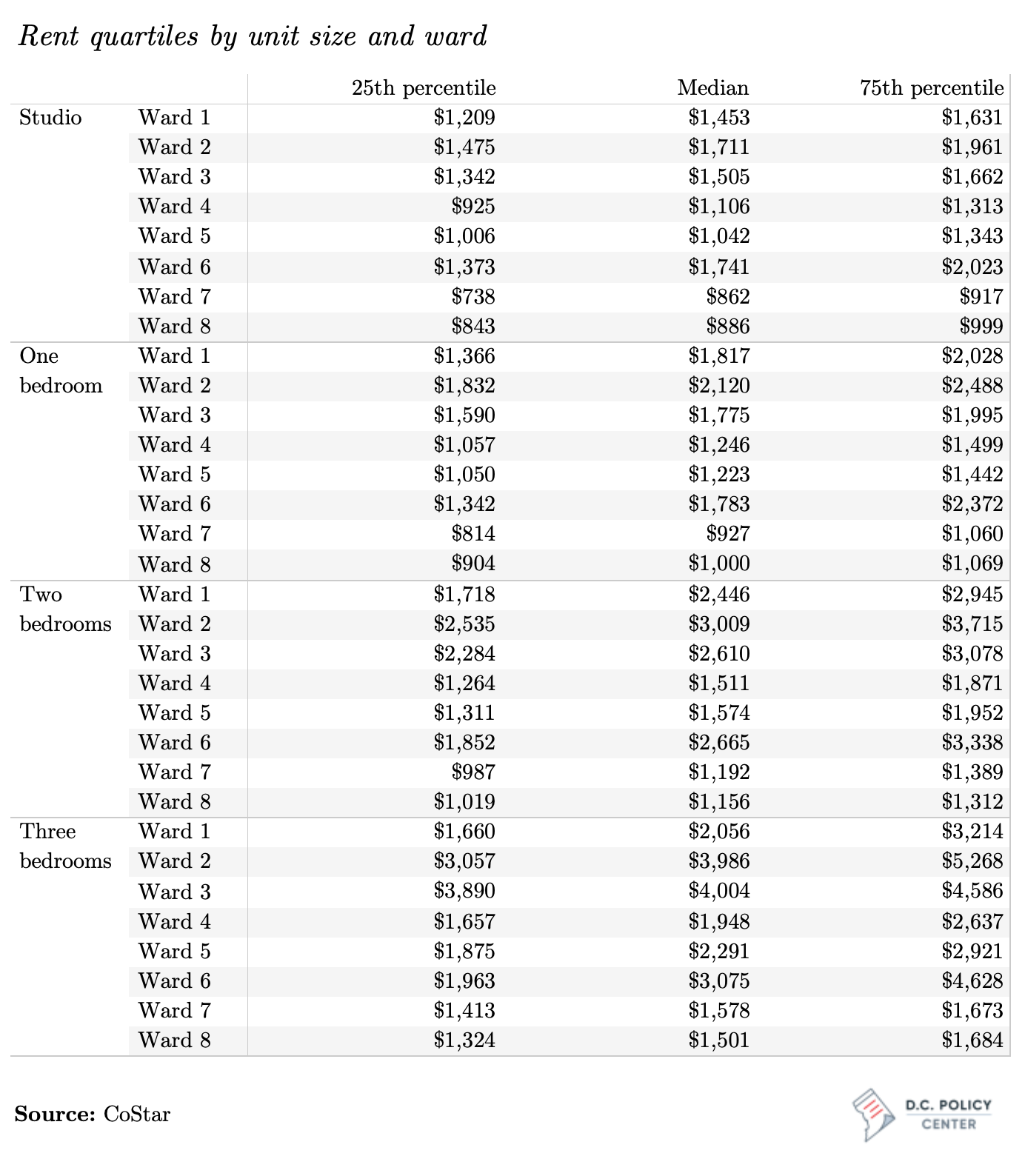

Effective rents across different apartment buildings show a great variation by size and location and could go as low as $650 per month and as high as $7,750. Not surprisingly, rents vary greatly across wards: they are usually higher where home prices are also high, and lower where home prices are low. Ward 2 is most expensive: its median rent of $2,034 is more than twice the median rent that prevails in Ward 7 ($973 per month).

Rents vary substantially within the same ward as well, and variations are greater for more expensive wards. In Ward 6, for example, the bottom quartile monthly rent ($1,369 per month) is $1,100 lower than the top quartile rent ($2,259 per month). This is largely a reflection of the mix of old and new rental apartments in this ward. In Ward 2, where 85 percent of rental apartments are in buildings under rent control, this differential is still large, at just below $1,000. To compare, the differential between the bottom and top quartile rents is only $314 in less-affluent Ward 8, and under $500 in Wards 4 and 7.

The variation in rents across different parts of the city becomes even more obvious when considering rents for differently sized units. When displayed this way, the data once again reveal the difficulty of finding potentially affordable units with two or more bedrooms outside of Ward 7 and 8.[5] For rental apartments with two bedrooms, a household able to spend $1,400 on rent each month can potentially afford units in three quarters of the buildings in Wards 7 and 8. To have a similar reach, the monthly rent budget for the same household would have to extend up to $3,720 in Ward 2 and $3,340 in Ward 6. The gaps are greater for units with three or more bedrooms: the top quartile rent is under $1,600 in Wards 7 and 8, approximately $4,600 in Wards 3 and 6, and north of $5,300 in Ward 2, where such large units are rare.

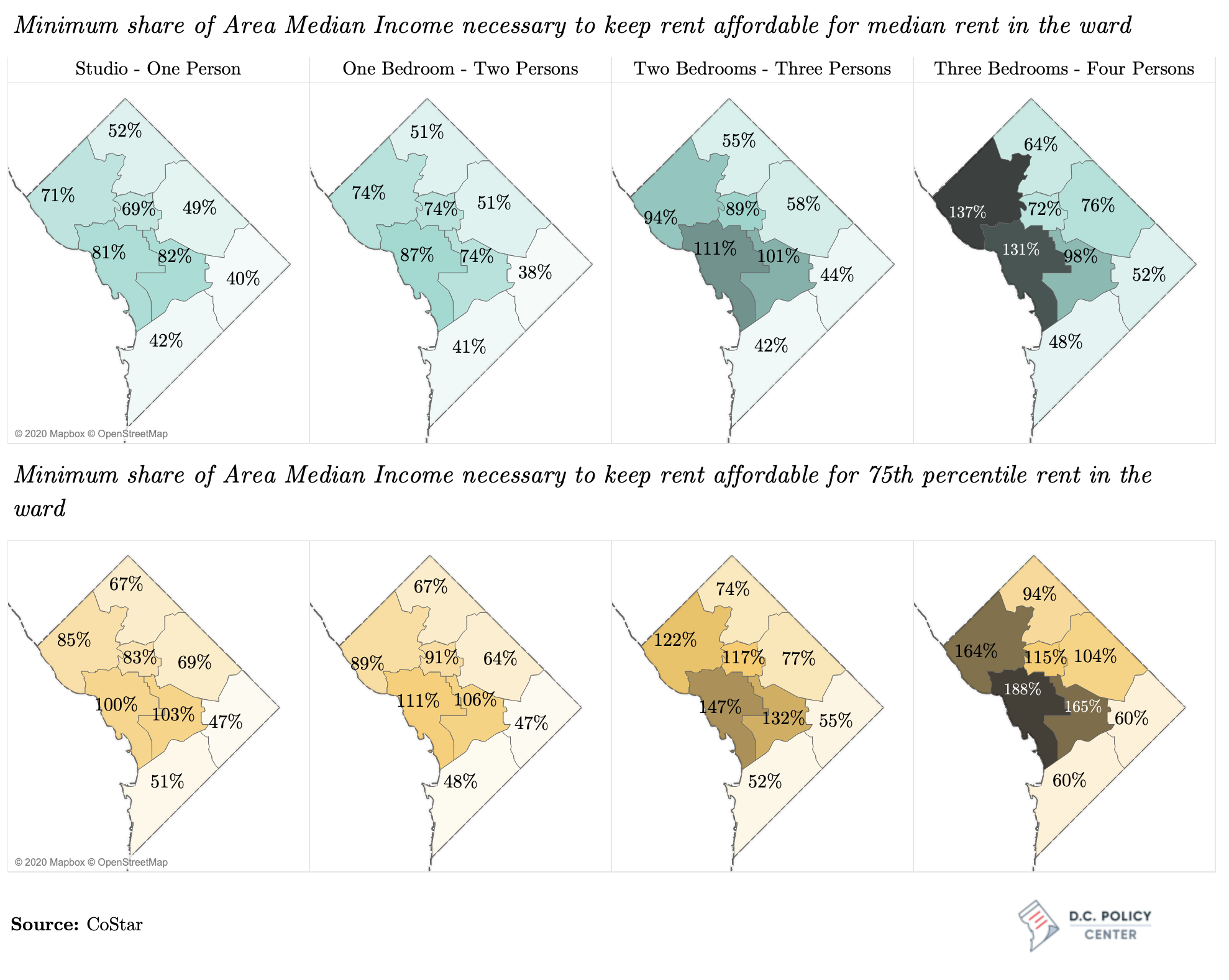

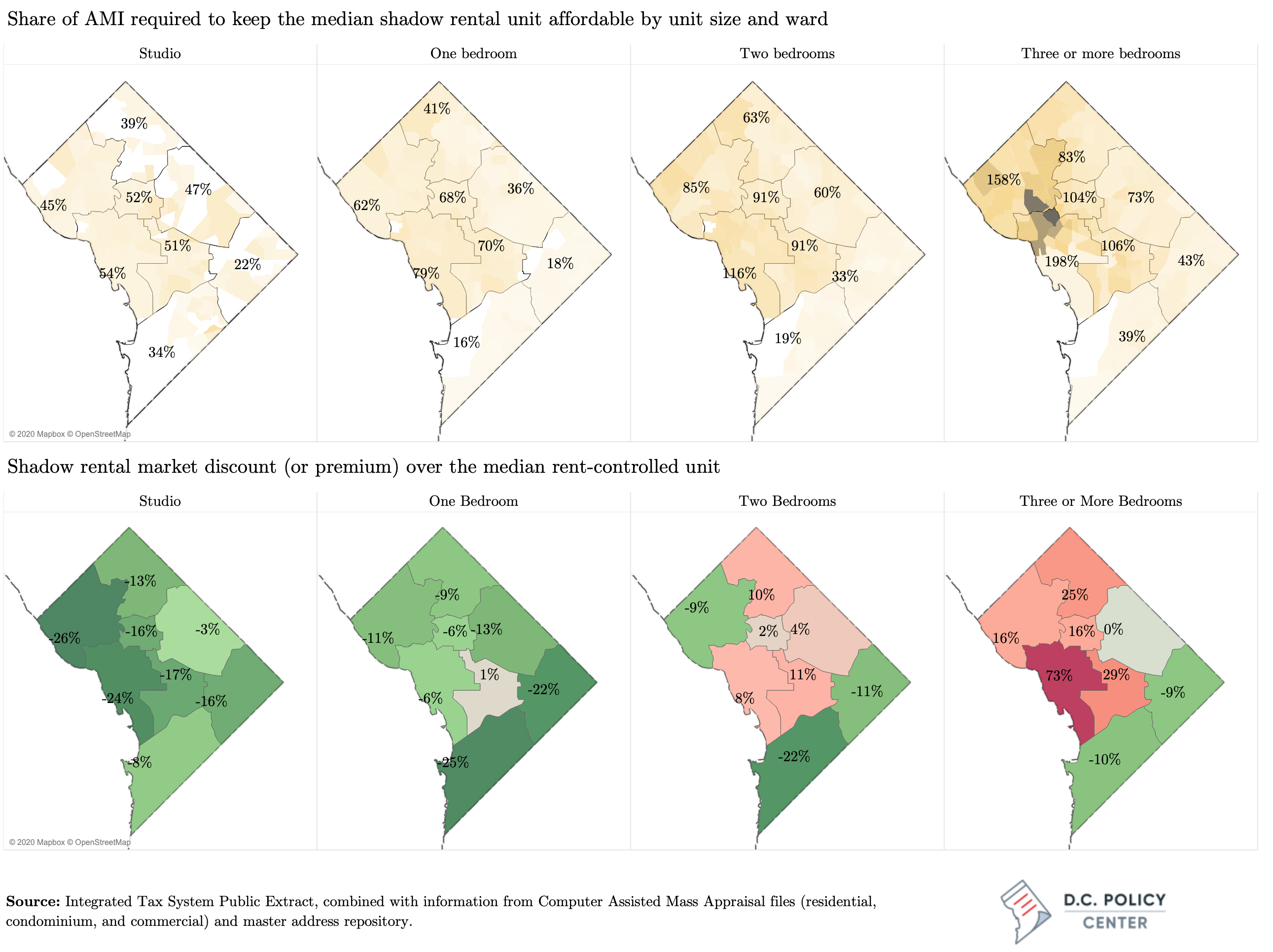

What do these rents mean for affordability? To assess this question, this report compares the income necessary to keep rent affordable (we use this term to mean that rent expenditure is under 30 percent of the renter household income) to the Area Median Income, as this comparison is the basis of affordability programs in the District. The median income for a single-person household is used for a studio apartment, a two-person household for a one-bedroom unit, a three-person household for a two-bedroom unit, and a four-person household for a three-bedroom unit. This analysis shows that larger households must earn more relative to the Area Median Income be able to afford a unit, and the income threshold for affordability increases faster in neighborhoods west of the Anacostia River. For example, a single-person household earning the full Area Median Income ($84,900 for 2019) can afford units in three quarters of rental apartment buildings across any ward in the city (notes as the 75th percentile rent below). But for a family of four earning the Area Median Income ($121,300 for the same year) 75th percentile rents are affordable in Wards 4, 7, and 8 only, and, realistically, only in Wards 7 and 8, where larger units are more common.(Figure 13, bottom panel).

What do these rents mean for affordability? To assess this question, this report compares the income necessary to keep rent affordable (we use this term to mean that rent expenditure is under 30 percent of the renter household income) to the Area Median Income, as this comparison is the basis of affordability programs in the District. The median income for a single-person household is used for a studio apartment, a two-person household for a one-bedroom unit, a three-person household for a two-bedroom unit, and a four-person household for a three-bedroom unit. This analysis shows that larger households must earn more relative to the Area Median Income be able to afford a unit, and the income threshold for affordability increases faster in neighborhoods west of the Anacostia River. For example, a single-person household earning the full Area Median Income ($84,900 for 2019) can afford units in three quarters of rental apartment buildings across any ward in the city (notes as the 75th percentile rent below). But for a family of four earning the Area Median Income ($121,300 for the same year) 75th percentile rents are affordable in Wards 4, 7, and 8 only, and, realistically, only in Wards 7 and 8, where larger units are more common.(Figure 13, bottom panel).

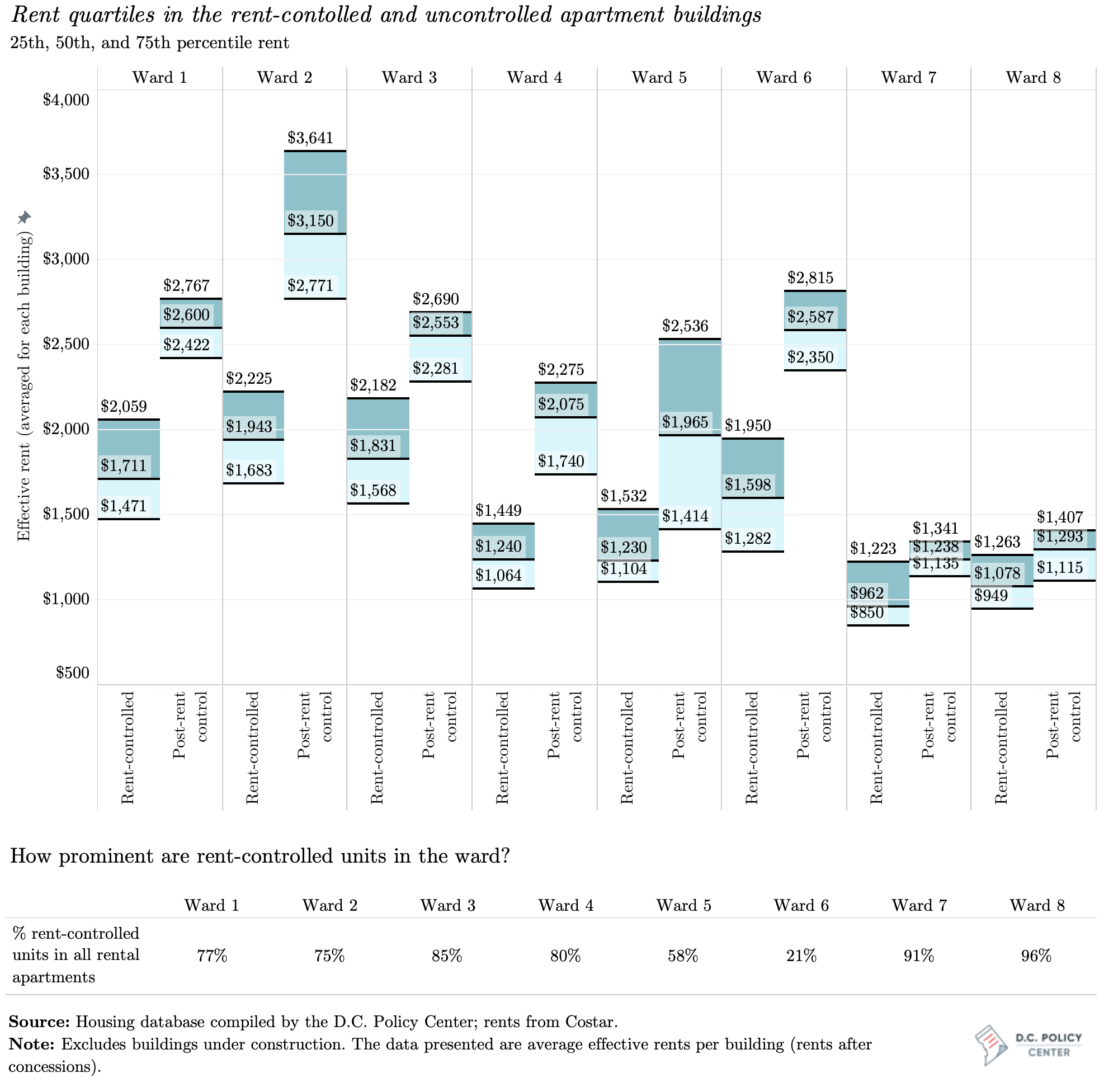

Rents in rent-controlled units

Rents in rent-controlled buildings can be significantly below the rents in uncontrolled buildings. CoStar data suggest that the median rent-controlled building in the District commands a rent of $1,442 per month (averaged across all its units). This is less than 60 percent of the rent the median unit commands in the uncontrolled stock ($2,554 per month). The median rent for the rent-controlled stock, regardless of unit size, is highest in Ward 2 ($1,943 per month) and lowest in Ward 7 ($962 per month). In Ward 3, where 85 percent of the taxable rental apartment units are subject to rent control, the monthly rent in the median rent-controlled building is nearly $720 lower than in the median uncontrolled building. In Ward 6, where the rent-controlled stock is 21 percent of all units in rental apartments, this difference is nearly $1,000.

Rent control laws have the smallest impact on rents in Wards 7 and 8, suggesting that rents in these wards have been growing at a slower pace than the rest of the city: the median rent differentials between the rent-controlled and post-control stock in these wards are under $300. This is not necessarily trivial, as it represents a 22 percent discount over the post-rent control stock in Ward 7, and a 16 percent discount in Ward 8. But it is relatively small compared to elsewhere in the city, where the rent-controlled stock can offer a discount of up to 40 percent.

That there are sizeable differences between the rents in rent-controlled units and uncontrolled units may seem unsurprising, but it is an important finding. The interest in tightening rent control laws in the District of Columbia is sometimes driven by the concern that the features of the District’s rent control laws that allow faster rent increases than the standard CPI+2%—for example, when units turn over or remain vacant for long periods of time, or when tenants sign a voluntary agreement to increase rents in return for amenities—have too much of an impact. But the prevailing rents show wide rent differentials between the rent-controlled and uncontrolled stock, suggesting that the exceptions to the CPI+2% rule may be weakening the impact of rent control, but not diluting it in a way that makes rent control irrelevant.

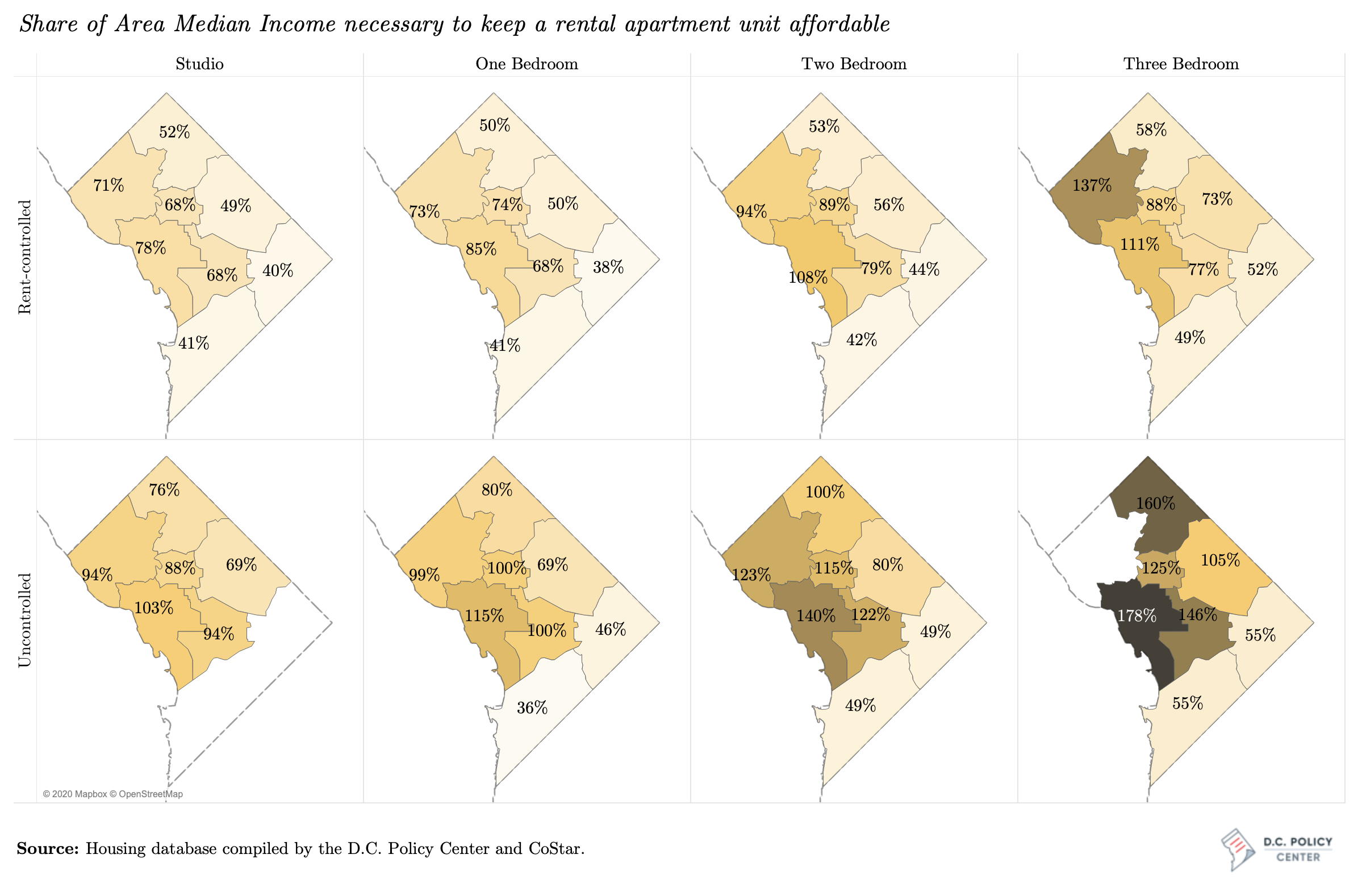

The impacts of the rent differentials between the rent-controlled and the uncontrolled stock becomes more obvious when one compares the affordability of rent-controlled units to uncontrolled units. As before, this chapter uses the term affordable to mean that the rent expenditures are at most 30 percent of the annual household income.

Across all wards in the District, the median rent for studio apartments is affordable at about 80 percent of Area Median Income for the rent-controlled stock—that is, an annual income of $67,950 for single person household. To rent a studio apartment from the uncontrolled stock in Ward 3, and keep their rent expenditure under 30 percent of their income, the same household must earn $87,500—a nearly $20,000 difference in annual income. A two-person household can afford a one-bedroom rent-controlled unit in Ward 1 if they earn $71,800 (74 percent of Area Median Income), but their income needs to rise by more than $26,000 to afford an uncontrolled unit in the same ward ($97,050 or 100 percent of the Area Median Income). The similar income differential that would render an uncontrolled one-bedroom equally affordable as a rent-controlled one is $31,000 in Ward 6, but only $7,700 in Ward 7. And the additional income necessary to move from a rent-controlled three-bedroom apartment to an uncontrolled one while keeping rent burdens the same is $39,000 in Ward 5, $81,000 in Ward 2, and $128,000 in Ward 4.

Despite these large differences in rents, rent control has not created a broad level of deep affordability (defined to mean that the unit is affordable at 30 percent of Area Median Income) across the city, and especially for larger households. The units that are affordable to very low-income residents are those in Wards 7 and 8 that are smaller than three bedrooms. These median building in these wards, regardless of their coverage by rent control laws, can serve households that earn 50 percent of Area Median Income, and only about one tenth of the buildings in Wards 7 and 8 have low enough rents to be affordable at 30 percent of Area Median Income for households with one to two persons.

Can rental apartments meet affordability needs in the District?

Of the District’s 124,600 rental apartments, approximately 107,000 are fully taxable, and approximately 72,800 units appear to be under rent control. An analysis of the District’s renters and their incomes shows that there are simply too few rental apartments to serve the demand from renter households.

First, there are not enough rental apartments to serve all renters in the District. The District has an estimated 162,000 renter households with varying incomes, but only 124,600 apartments, including subsidized units. The remaining renters are served by the shadow rental market.

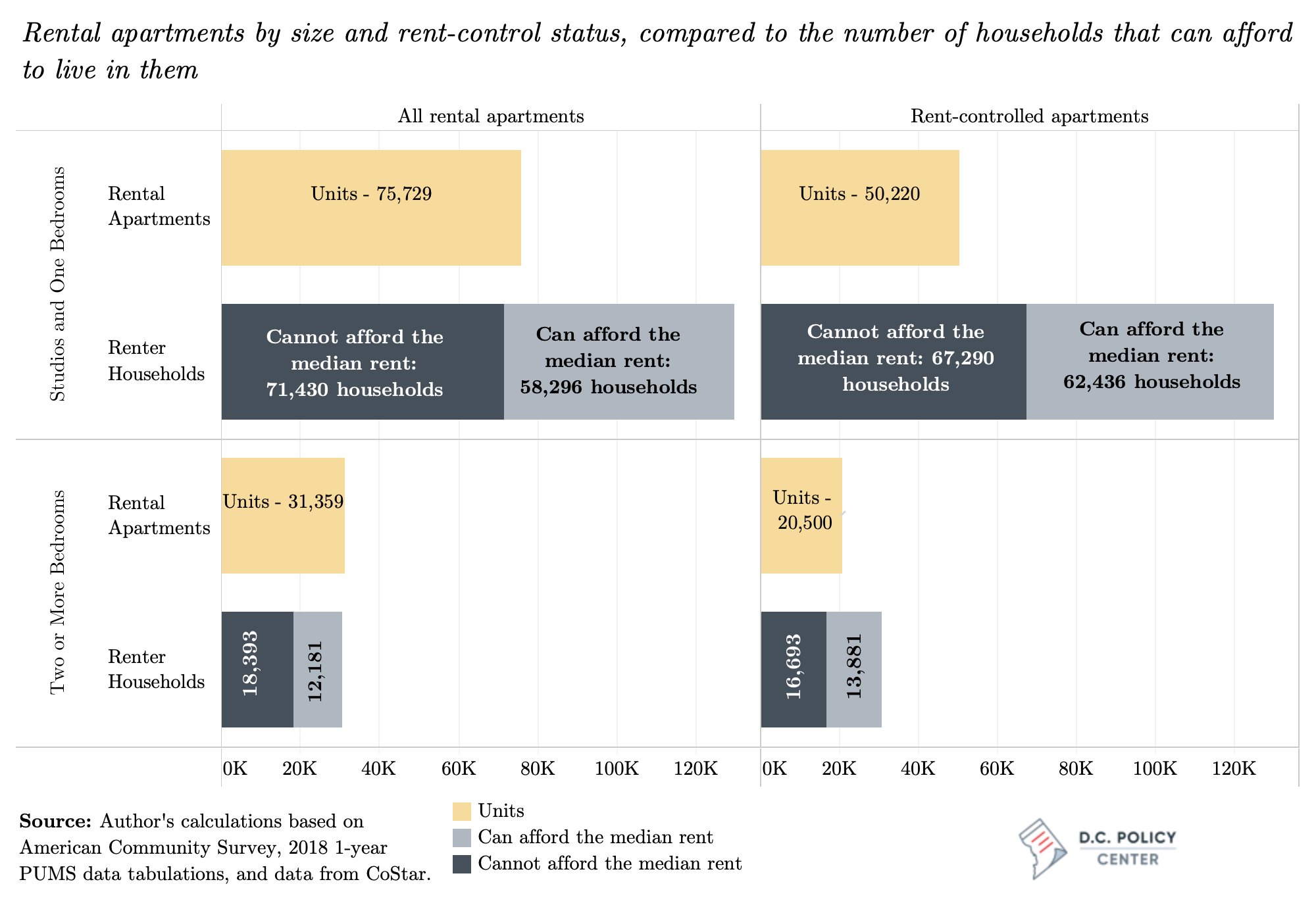

Second, a significant share of households with high rent burdens are small households. Given the prevailing median rents in the entire rental apartment inventory, an estimated 71,430 of households with one or two persons do not make enough to keep their rent expenditures under 30 percent of their income. And they must compete against approximately 58,300 households that earn more. Rent-controlled units have lower rents, and judging by median rents, could potentially serve many more low-income households without burdening them—67,290 households earn enough to live in a rent-controlled unit unburdened. But there are even fewer units—50,220—available to cover these lower-income households, even if they exclusively housed renters from this income bracket.

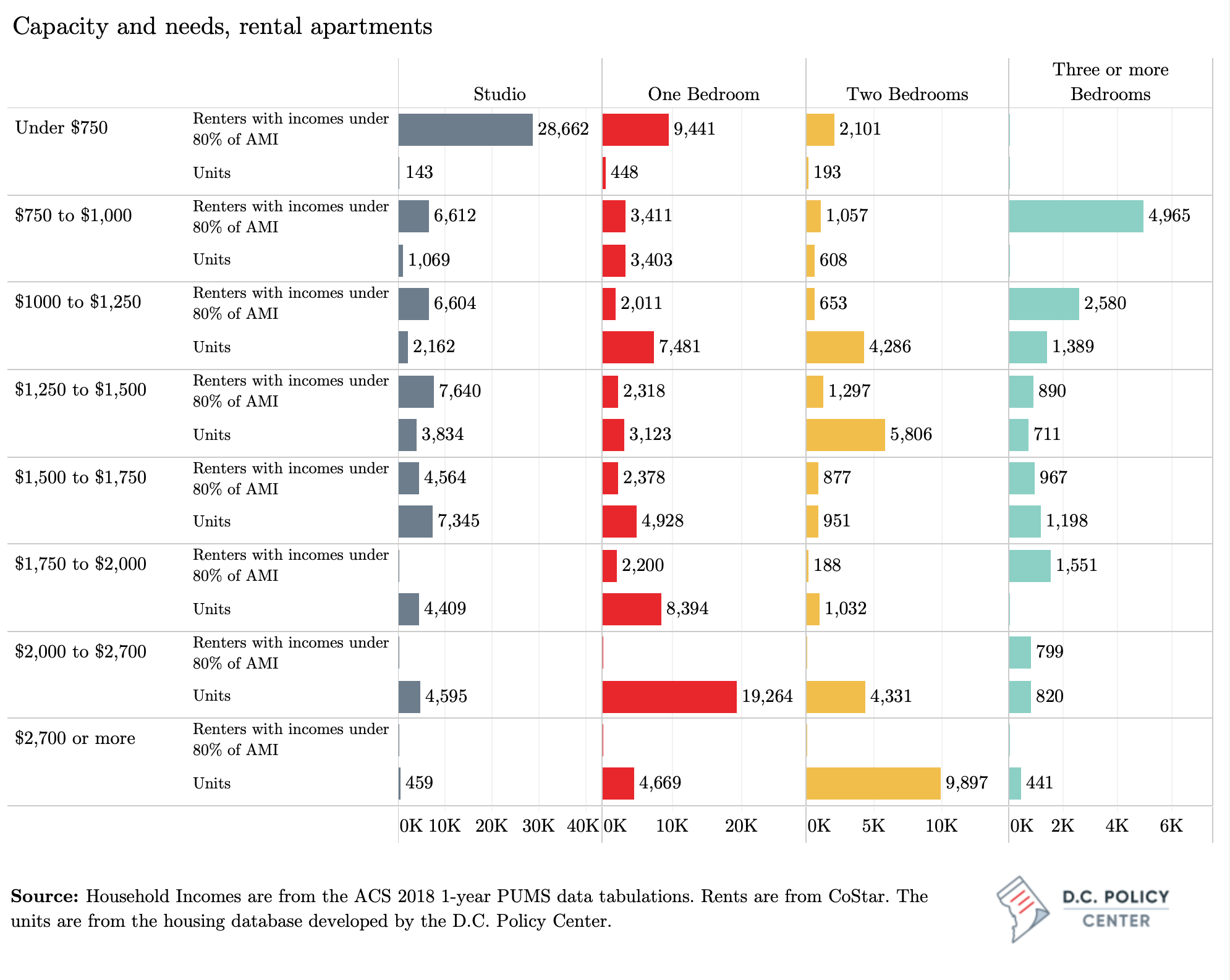

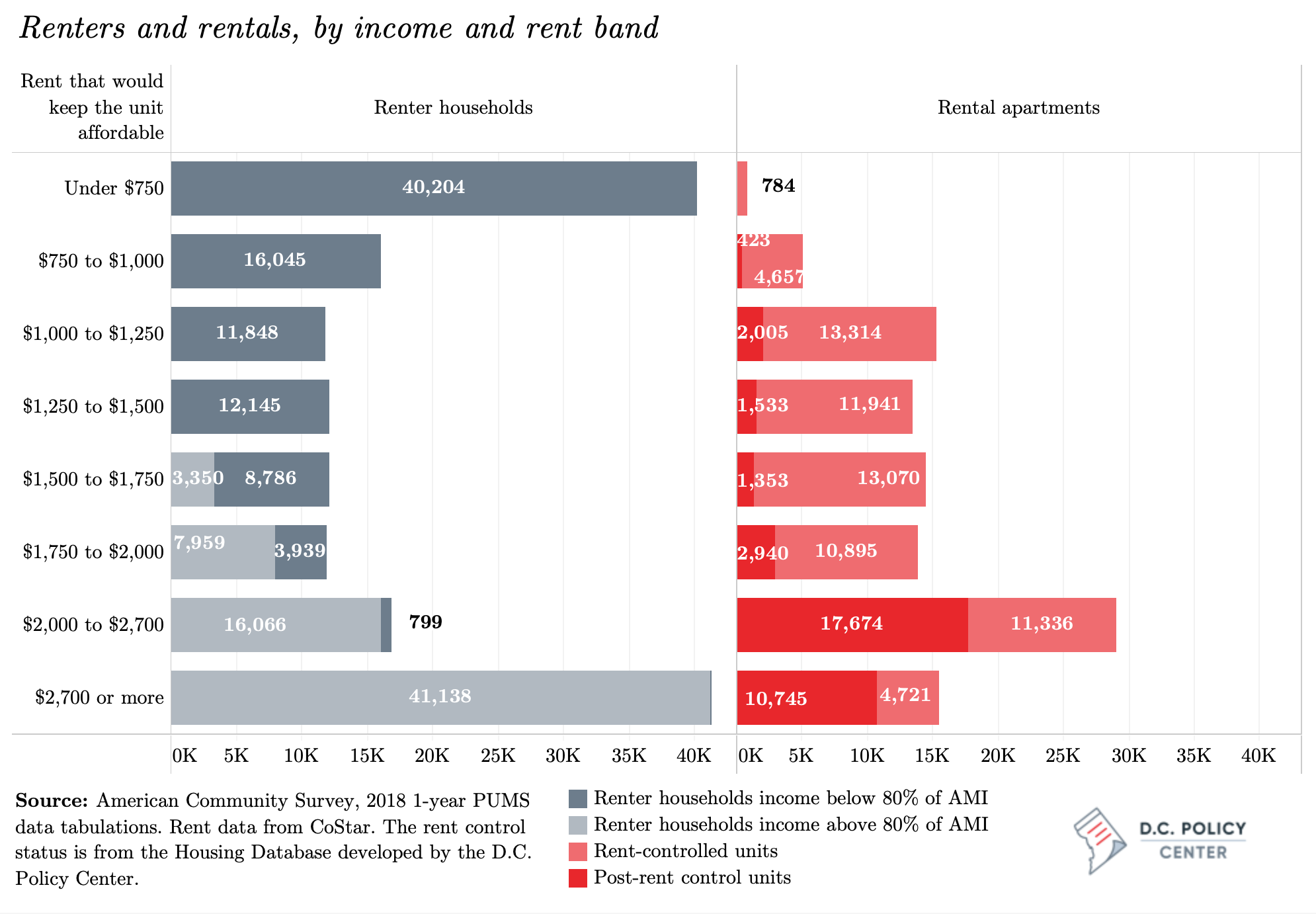

Third, there is a lot of pressure from the bottom. Of the 93,000 households that earn less than 80 percent of Area Median Income, 38,000 can pay at most $750 to keep housing affordable. To compare, there appear to be fewer than 800 rental apartment units with a rent below $750. As a result, these renters must seek housing in more expensive units. This pressure from the bottom is intensified by the 17,000 households that earn between $30,000 and $40,000 per year, and therefore should be paying a rent of $750 to $1,000 per month to keep their rents affordable. However, there are only 5,000 rental units that charge this rent—most of them one-bedroom apartments.

Fourth, there is also a lot of pressure from the top. Competing with the 40,200 renter households who must keep their monthly rents under $750, are the 41,100 households that conceivably can spend over $2,700 per month on rent and still not be rent-burdened. Of this group, all have incomes above 80 percent of the Area Median Income (by definition), and therefore understandably are not a priority under the District’s affordability programs. For them, the District’s rental apartment buildings offer fewer than 15,500 units with rents over $2,700 per month (including 4,700 units under rent control). With their higher incomes, these households could help drive rents up for units that are not under rent control. But for the rent-controlled units, the higher-income renter households simply compete on the same terms as lower-income households.

Given these pressures on rental apartment units, how are the renters’ needs being met? For that, we turn to the shadow rental market.

Is the shadow rental market closing the affordability gap?

In an overall market with more renter households than apartments units, the shadow rental market plays a substantial role in meeting demand for rental housing. This report has shown previously that the shadow rental market is an important source of larger rental units. In this section, the analysis also shows that it is an important source of affordability.

CoStar data do not include comprehensive information on rents for the shadow rental market. Therefore, this report uses information from tax records to impute the rents that landlords might be able to command if they put their units in the shadow rental market. The methodology for deriving potential monthly rents is explained in the Methodology and data appendix.

Based on this analysis, the potential median rent for the District’s shadow rental market is estimated to be $1,868 for rental apartment units. The median rent gaps are greatest in Ward 1 ($480) and Ward 5 (nearly $1,000), and smallest in Wards 6 and 8 (under $100). The rents in the shadow rental market are also more varied—with bigger differences between the lower- and upper-quartile rents. However, this is largely a reflection of the variation in types of units, which could include basement apartments as well as mansions.

This analysis shows that in every ward except Ward 8, the median rent for the shadow rental market is greater than the median rent per month, or about $410 more than the median rates that prevail for units in rental apartment buildings. This estimate is characterized as “potential” because, unlike the rents for apartments (which are directly collected from each building), the estimated rents for the shadow rental market are imputed from taxable assessments.

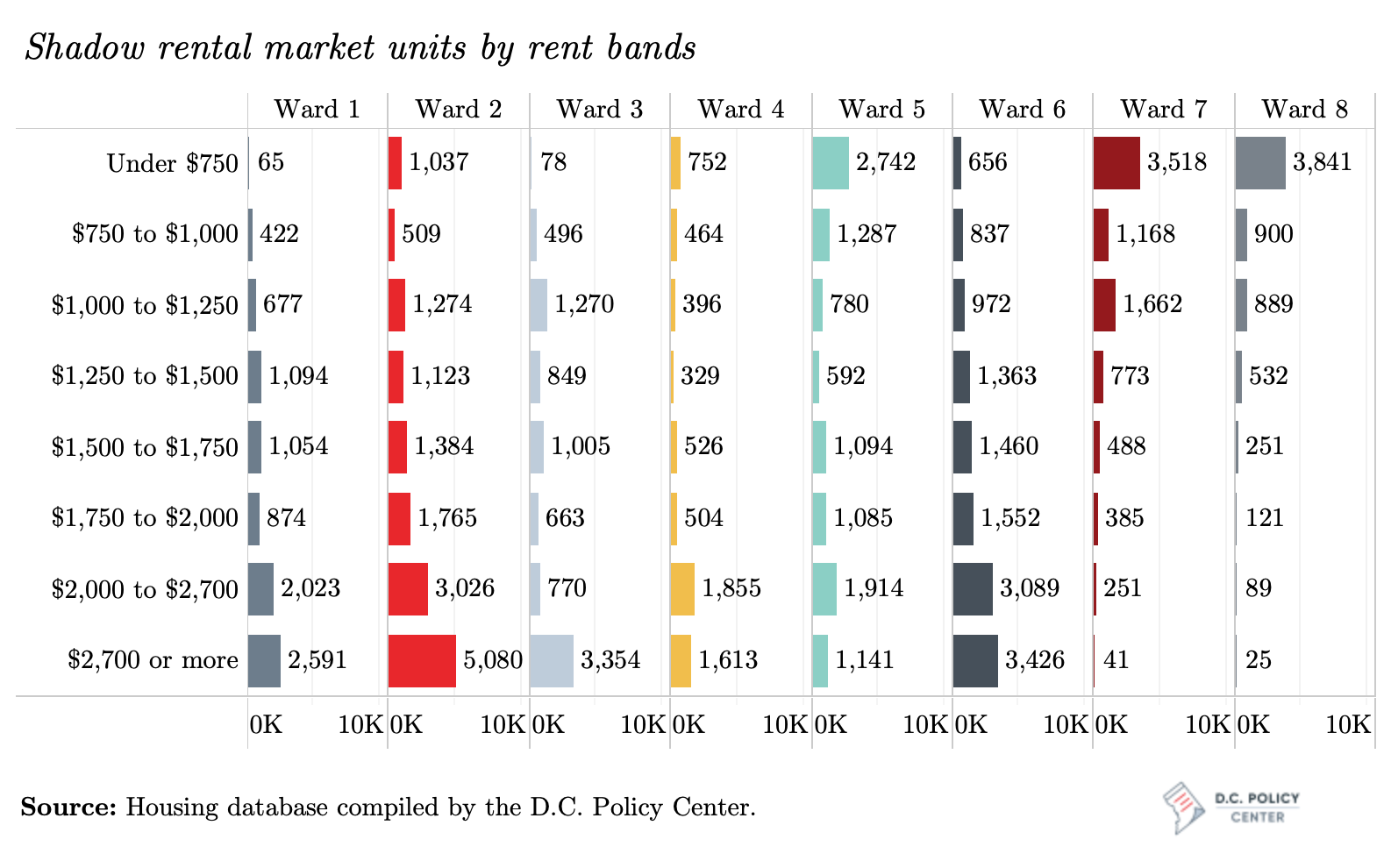

By offering a combination of both low-priced and high-priced units to renters, the shadow rental market relieves the pressures on the rental apartment buildings both from the bottom and from the top. Grouping the shadow rental market units by their estimated rents, there appear to be 12,700 units that could potentially serve the lowest end of the rental market, with rents at or below $750 per month. Most of these units are in Wards 5, 7, and 8. There are many high-priced units too: an estimated 17,000 units, or approximately 22 percent of the units in the shadow rental market, likely command monthly rents above $2,700 per month. This is outside the affordability threshold for any household that earns less than 80 percent of Area Median Income, regardless of household size. Most of these units are in Wards 2, 3, and 6.

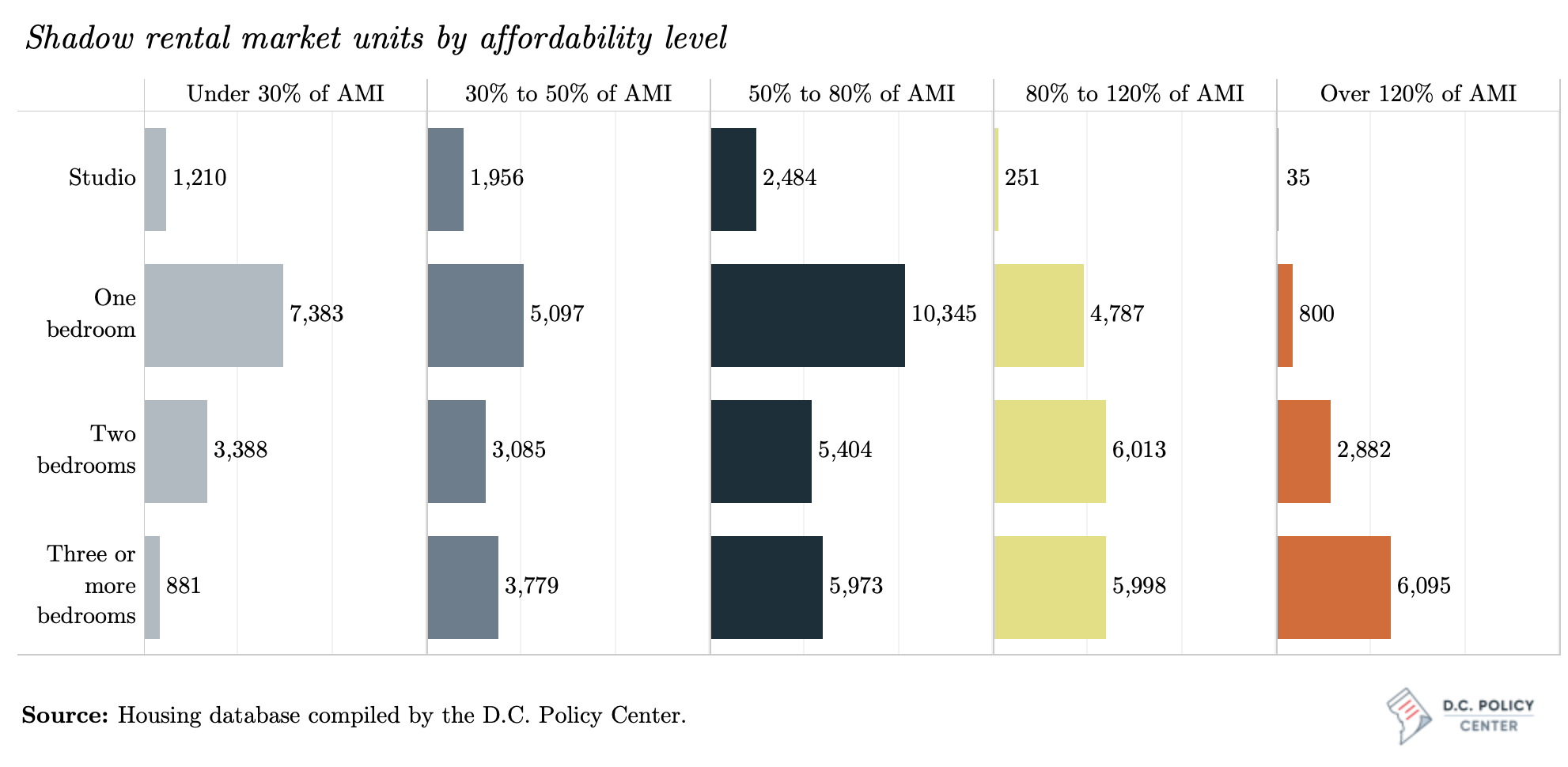

What does this mean for affordability? The shadow rental market might supply as many as 51,000 units that are affordable at 80 percent of Area Median Income, based on these estimates, and potentially 13,000 units that are deeply affordable, at 30 percent of Area Median Income.[6] Among the units affordable at 80 percent of the Area Median Income nearly half are one-bedrooms, one quarter are two-bedrooms, and one in five have three or more bedrooms. The estimated 11,000 shadow rental market units that meet some level of affordability test for families of four or more are an important source of housing and reduce some displacement pressure. But the shadow rental market, too, fails to provide deep affordability for families of three or more. Approximately 3,400 units can potentially be affordable for a family of three with an income at or under 30 percent of Area Median Income, and fewer than 900 units can potentially be affordable for a family of four that earns the same.

Despite higher median rents, the shadow rental market offers a greater variety of units at a greater variety of rents than in rental apartments, including the rent-controlled units (Figure 22). The median rents for smaller shadow rental market units—studios and one-bedroom units—are lower than the median for comparable rent-controlled units. As an example, the median one-bedroom unit in the shadow rental market can potentially be affordable for a household of two earning under $64,000 per year, whereas a similarly sized unit in a rent-controlled building would require $10,000 more in income. Why does this difference exist? It is likely because of the type of units—conversions from single-family homes into multiple units including basement apartments—can be smaller in size than one-bedroom apartments in rent-controlled units, or possibly have separately metered utilities that add to the monthly cost. Rents in the shadow rental market could also be lower because of lower levels of services and maintenance where the tenants do not receive services common in rental apartment buildings such as concierge, could be responsible for the general upkeep of the unit, or receive limited or no support from the landlord to maintain the grounds.

For larger units, rent-controlled stock typically offers lower rents, but only west of the Anacostia River. For example, in Ward 3, a family of four must earn over one and a half times the Area Median Income (nearly $183,000 in 2019) to be able to afford a shadow rental market unit of three or more bedrooms—that is, $19,000 more than what is required for a rent-controlled unit in the same ward. But this does not mean that households have a large number of options to choose from in rent-controlled buildings: the shadow rental market offers 22,000 units with three or more bedrooms (25 percent of all shadow rentals) and rent-controlled apartments offer fewer than 3,000 (four percent of all rent-controlled units). Finally, the shadow rental market provides affordability to larger households in almost every part of Wards 7 and 8: For the median three-bedroom unit, a family of four would have to earn 43 percent of the Area Median Income in Ward 7 ($52,150 in 2019) and 39 percent in Ward 8 ($47,300)—an amount $9,000 to $12,000 less than the required incomes for the rent-controlled stock in these same wards.

This chapter has shown that rental housing is an important source of affordability, and that both rent-controlled apartments and the shadow market are important to provision of affordable units. The next chapter examines whether the city’s rental housing market can also create economic inclusion by mixing renters of different income levels across neighborhoods.

You’ve reached the end of Chapter 3.

<< Back: Chapter 2 | Next: Chapter 4 >>

Or return to the main publication page.

Notes

[1] Joshua Feldman and Graham MacDonald, “Rents are too high. Here are three ways to get the data we need to fix that,” Urban Institute (Washington DC, 2019).

[2] The American Community Survey, on the other hand, finds only 162,190 rental units in the District, regardless of the type of unit. According to its count, of these 13 percent are studios, 42 percent are one-bedroom units, 40 percent are two- or three-bedroom units, and slightly less than 5 percent are four-bedroom units.

[3] This figure excludes tax exempt apartment buildings, which are either owned by the D.C. government or by a nonprofit with an affordability mission. When these units are included, the estimated median rent is $1,449.

[4] The estimated number of taxable apartment units for the same year is 107,000.

[5] It is important to note that rent coverage by CoStar accounts for about 57 percent of all units tracked by administrative data and becomes increasingly weak when one considers the unit size. The details on CoStar’s coverage are provided in the Methodology Appendix.

[6] This estimate is based on the 72,000 shadow market units for which researchers can conduct this analysis.