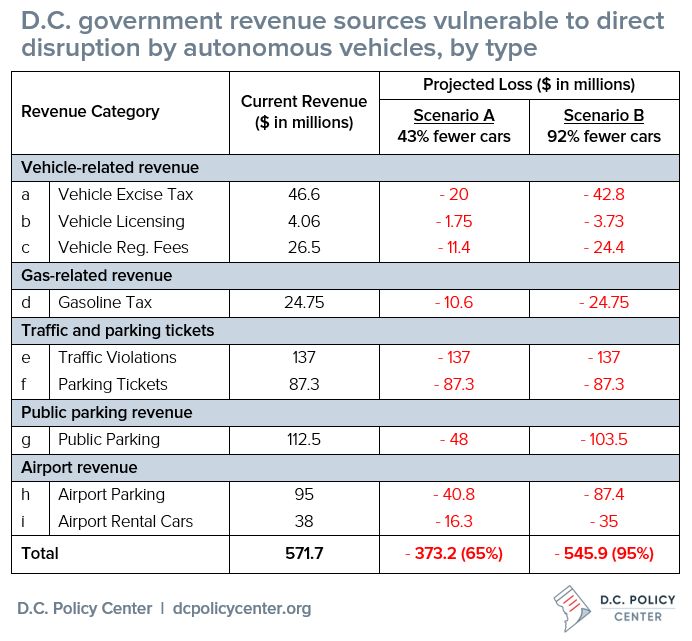

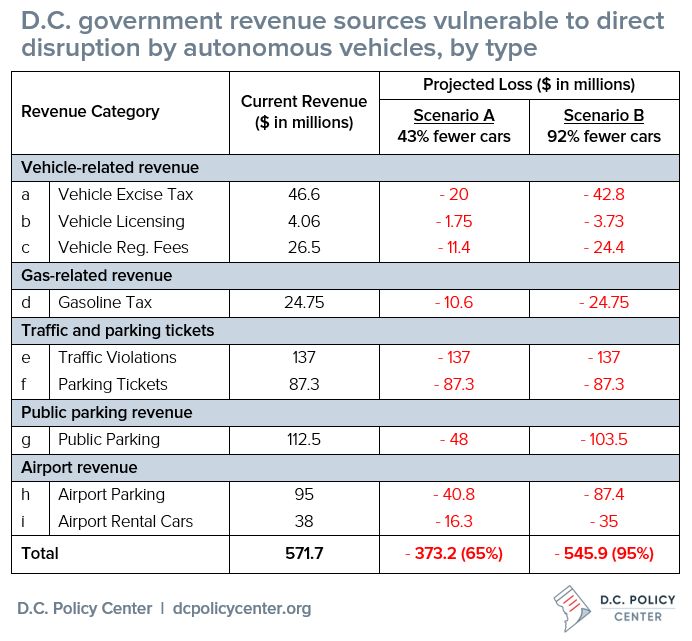

The arrival of autonomous vehicles could cost the District anywhere between $373 and $546 million per year due to reductions in car-related revenue.

Many have written about the ways autonomous vehicles (AVs) will reshape the physical landscape of American cities, but less of the discussion has considered how AVs could reshape municipal and state budgets that have relied on car-related revenue for decades. In Washington, D.C., the gasoline tax, motor vehicle registrations, and parking fees together contribute $214.4 million to the District’s annual revenue, and penalties from speeding tickets and parking violations contribute another $224.3 million. Parking fees and rental car revenue also contribute $133 million to D.C.’s airports.

This piece examines two scenarios for AV adoption in D.C., and how these scenarios could affect District finances. It finds that the arrival of this autonomous vehicles—without policy and taxation changes—could cost the District anywhere between $373.2 and $545.9 million per year due to reductions in car-related revenue. Without new revenue sources designed to fairly charge AVs for their use of public streets, funding for necessary transportation infrastructure and basic District services could be curtailed dramatically.

The cost of inaction

While it’s too soon to know for certain what impacts autonomous vehicles will have, it is not too early for D.C. to start thinking about what fiscal impacts they could have.[1] Combing through various D.C. budget documents, I’ve found the budget items that could be most immediately and directly affected by autonomous vehicles. While this list is not exhaustive, it should serve as a wake-up call to policymakers that inaction will have its own costs.

To estimate budget impacts, I’ve used two potential scenarios. Scenario A assumes that, as AVs come into the mainstream, the total number of cars in the U.S. will decline from 2.1 to 1.2 cars per household, leading to 43 percent fewer cars on the road. Scenario B is more drastic, and assumes that each shared AV will replace twelve traditional cars, leading to 92% fewer cars on the road. In both scenarios, it is assumed that all or practically all cars will be fully autonomous, largely electric, and mostly operated as “fleets” owned by companies and shared by riders on-demand—the difference is only how many total cars will be on the road.[2]

Based on these scenarios, the projected impacts on revenue are straightforward: Fewer car owners means fewer personal vehicles, and therefore reduced revenue related to them. For most types of car-related revenue, we’ll assume that revenue will decrease in proportion to the number of cars (that is, by either 43 or 92 percent, respectively.) The only exceptions are the revenue from traffic violations and parking tickets (which will be eliminated in both scenarios) and the estimates for the gasoline tax (which declines proportionally in Scenario A but is assumed to disappear entirely in Scenario B).

Sources: (a-d) The 2016 D.C. Tax Facts from the D.C. Office of Revenue Analysis; (e-f) The D.C. Non-Tax Revenue Report produced by the Office of Revenue Analysis; (g) The D.C. Fiscal Year 2015 Proposed Budget and Financial Plan; (h-i) The 2017 Metropolitan Washington Airports Authority Budget; The D.C. Government’s Fiscal Year 2016 Approved Budget, Gross Funds. |

The explanations behind these projected revenue reductions are discussed in detail below.

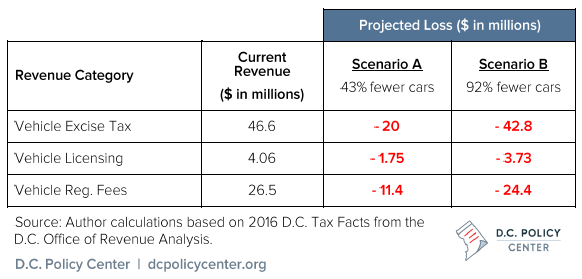

Vehicle excise taxes, license and registration fees

Washington D.C. primarily taxes personal vehicles in three ways: vehicle excise taxes, vehicle registration fees, and driver’s license fees. In 2015, D.C. took in $46.6 million in vehicle excise taxes and received $26.5 million in vehicle registration fees. In 2014, D.C. took in $4.06 million in various fees related to vehicle titles and driver’s license acquisition and renewal (including driver’s license road test, knowledge test, and license procurement fees).[3] Revenue from these three sources adds up to approximately $77.2 million annually.

If the taxation and fees structures remained the same, Scenario A’s 43 percent reduction in the number of cars in D.C. would reduce these combined revenue sources by at least $33.2 million (to $44 million), and Scenario B’s 92 percent reduction in cars would cause these revenue sources to decline by as much as $71 million (to just $6.2 million).

Even Scenario A’s more conservative loss of $33.2 million is nearly as much as D.C. spent on the Office of Planning, the D.C. National Guard, and the D.C. Housing Finance Agency combined in 2016. Scenario B’s more precipitous loss of $71 million is equivalent to nearly three quarters of the entire D.C. Department of Energy and the Environment’s 2016 budget.

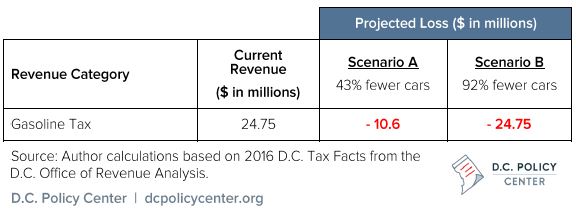

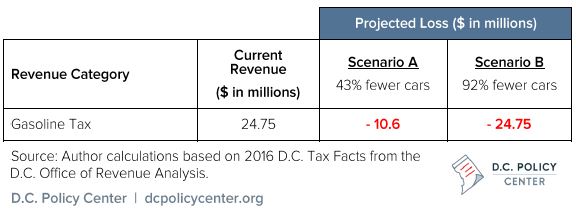

Gasoline tax

The advent of hybrid and electric cars has already made the gas tax a less lucrative source of revenue than it once was, at least per vehicle. Most experts believe that AV and electric vehicle technology will advance together, and thus per-vehicle fuel tax revenue will continue to decline. Even if electric vehicle technology were to remain where it is today, providers of shared autonomous taxis would have a big incentive to “go electric” or “go hybrid” because their vehicles will be used frequently and will rapidly offset higher purchase costs with fewer stops at the pump.

D.C.’s current gasoline tax, which sits at 23.5 cents per gallon, brought in about $25.25 million in 2015. Budget forecasters already expect this to drop to $24.75 million in 2017. A 43 percent cut in the gasoline tax revenue in Scenario A would be $10.6 million, about equal to the Department of Small & Local Business Development’s budget in 2016. A full loss of gasoline tax revenue would be an even more significant loss, as this revenue amount (almost $25 million) equals the 2016 combined budgets for the Mayor’s Office and D.C. Department of Human Resources.

Of course, significant reductions in revenue from the gas tax would have far-ranging effects beyond the District’s budget. Currently, revenue from D.C.’s gasoline tax is earmarked for the federal Highway Trust Fund, and thus goes directly to construction, repair, and management of nationally-owned roads in the city. An autonomous vehicle future will still rely on well-maintained roads, perhaps even more so than now. Finding an alternate roadway funding source to replace the fuel tax is therefore imperative.

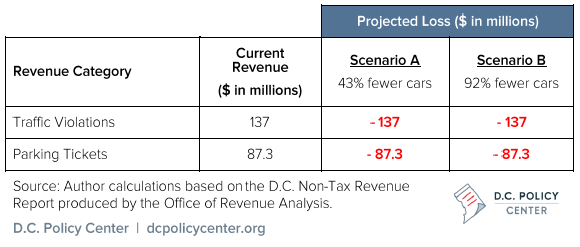

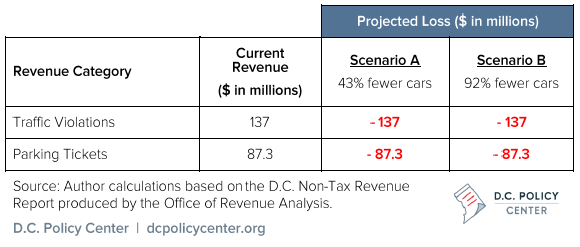

Traffic violations and parking tickets

Traffic violations and traveling above the speed limit are inherently human errors. While early autonomous vehicles may continue to provide their operators with a “manual mode” that could allow them to speed or break the rules of the road, long-term considerations suggest that liability concerns will lead manufacturers to make AVs fully autonomous all of the time, leaving human “drivers” no choice but to follow the law. This rigid adherence to the law is part of what will make AVs so much safer than regular cars, but it also threatens a major revenue source for cities like D.C.

In 2014, traffic violation fines, speeding tickets, and other forms of revenue from punishments for unruly driving added up to nearly $137 million in District revenue. The city received another $87.3 million from tickets for illegal parking and associated booting, towing, and impoundment fees. Together, these two sources of revenue based on human error add up to about $224 million per year. Losing that $224 million per year would be equivalent to the 2016 budgets of the Department of Public Works’ and the D.C. Public Library system combined.

Recent data already foreshadows this future. D.C. revenue from parking tickets declined by $20 million between 2015 and 2016. While this trend likely reflects various changes, such as parking meter rates increases and smart meters that allow pay-by-phone, it’s also possible that more people are avoiding parking mishaps by using ride-hailing services like Uber or Lyft instead. This trend will only continue when autonomous vehicle technology makes such options cheaper and more ubiquitous.

Public parking revenue

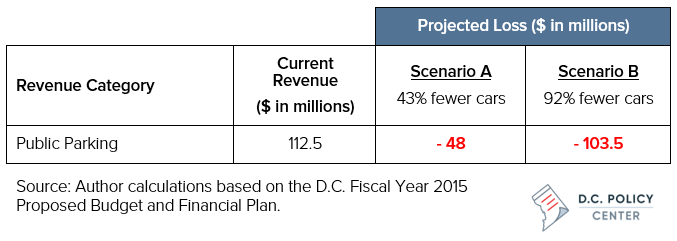

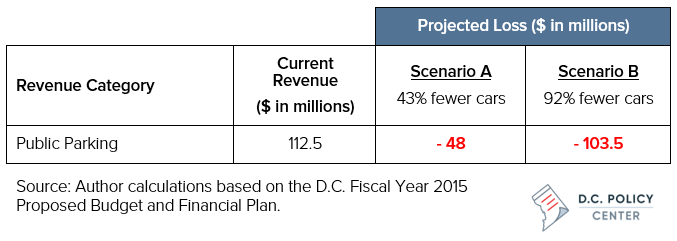

Much less parking will be necessary when self-driving vehicles are widespread. Demand for public parking (and thus revenue from it) will likely plummet as AVs offer cheap hassle-free transportation to residents and visitors alike. Add up recent revenue from D.C. employee and resident permits, library, school, and public metered parking fees, the parking meter pay-by-phone transaction fees, and the D.C. sales tax on parking, and you get roughly $112.5 million in District revenue per year.

If parking demand falls in proportion to car ownership rates (by 43 or 92 percent, depending on the scenario), then D.C. could lose $48 million at best and $103.5 million at worst. While much of this revenue is earmarked for Metro, it’s worth noting that the first figure would be the equivalent of the D.C. Parks and Recreation Department’s 2016 budget, and the second is equal to the District’s entire 2016 contribution to the Housing Production Trust Fund.

Airport revenue

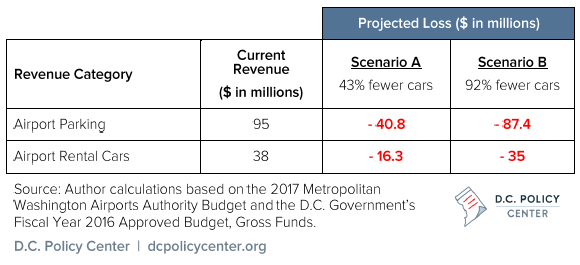

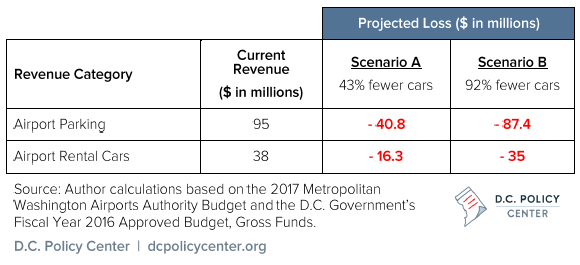

The loss of car-related revenue will be felt in unexpected places. For instance, Reagan National and Washington Dulles airports received a combined $95 million from public parking in 2015, out of $717 in total operating revenue. According to the Metropolitan Washington Airports Authority, which governs the two hubs, this accounts for its largest source of non-airline revenue.

Parking revenue loss is just the start for these airports. D.C. airports could lose as much as $38 million annually if shared AVs knock out the rental car industry. Going even further, some shorter flights could be replaced by self-driving cars so comfortable you can sleep in them as they whisk you to your destination. Losing revenue from parking, rental car companies, and a drop in air travel demand would be damaging for such seemingly resilient institutions.

An opportunity to create a more equitable, sustainable, and financially stable transportation infrastructure funding system

Altogether, the arrival of this autonomous vehicles—without policy and taxation changes—could cost the District anywhere between $373.2 and $545.9 million per year due to reductions in car-related revenue.

Policymakers should further study the fiscal impacts of this technology and proactively instituting AV-ready policies and taxes to ward off this deficit. But beyond reacting to these potential revenue losses, policymakers could use the arrival of autonomous vehicles as an opportunity to create a more equitable, sustainable, and financially stable transportation infrastructure funding system:

- D.C. could charge AVs a vehicle miles traveled (VMT) tax to offset reduced gasoline tax revenue and discourage zero-occupancy vehicles from roaming city streets.

- D.C. could charge AVs a “space tax” for use of the right-of-way to encourage (but not mandate) ride-sharing and right-sizing.

- Philosophically, D.C. could shift from thinking of cars as a consumer good to thinking of transportation as a utility, the use of which is tracked and paid for, much like electricity or water. This change would make the aforementioned VMT or space taxes more politically feasible and underpin a more financially sustainable infrastructure funding model.

There are many possibilities and questions to think about, but the important thing is to start thinking about them today. The cost of inaction is high, and D.C. planners should not embrace AVs without also finding new ways to fund the infrastructure AVs will use and upon which we all rely.