COVID-19 related federal legislation and administrative actions have provided an unprecedented amount of federal funding for the District of Columbia. The American Rescue Plan Act alone—the latest in a series of federal legislative initiatives—is delivering the District $2.2 billion in operating expenditure support, $107 million for COVID-19 related capital expenditures, $386 million for public schools, and an additional $21 million for COVID-19 testing at schools, all of which must be spent by December 31, 2024.[1] When combined, this $2.8 billion federal direct support for spending that could have otherwise been paid for by District taxpayers is equivalent to 39 percent of the projected general fund revenue for fiscal year 2022,[2] or approximately nine percent of annual gross revenue the District is expecting to collect over the next three fiscal years during which the funds must be spent.[3]

The District’s spending will no doubt increase well beyond its projected revenue over the next three fiscal years because of these supports. And it will be tempting to use the federal fiscal aid for programs that, once launched, could continue indefinitely. But all this money is one-time and will disappear in the next few years. And the current projections show that the city’s revenue stream is not sufficient to sustain such a level of spending.

The appropriate use of the federal fiscal aid—which is one-time money—is to meet the District’s COVID-related needs and for programs that can be rolled back when the funding is exhausted. The city should use federal funds to make investments in future economic prosperity to bring better job prospects and higher incomes for all residents, and thus, grow the revenue base. Otherwise, government spending buoyed by one-time federal funding could leave the city in need for new revenue it may not be able to raise.

Importantly, the District should hold off on tax increases on its residents and businesses in this budget cycle, and until the economic picture improves. With significant federal supports in hand, the District does not need more resources in Fiscal Year 2022 and should not increase taxes when the economy is still ailing. Lower population growth, declining valuations in commercial real property and multifamily buildings, and significant job losses the District has experienced since the beginning of the pandemic have weakened the tax base. And the District’s desirability in the region has declined with changes in how we work and spend leisure hours under COVID-19 related restrictions. These make it even more important for the city to maintain its competitiveness in the region, and higher taxes–especially when not necessitated by need–will further diminish the District’s desirability and risk future economic growth.

Significant emergency resources are flowing to the District government, residents, and businesses.

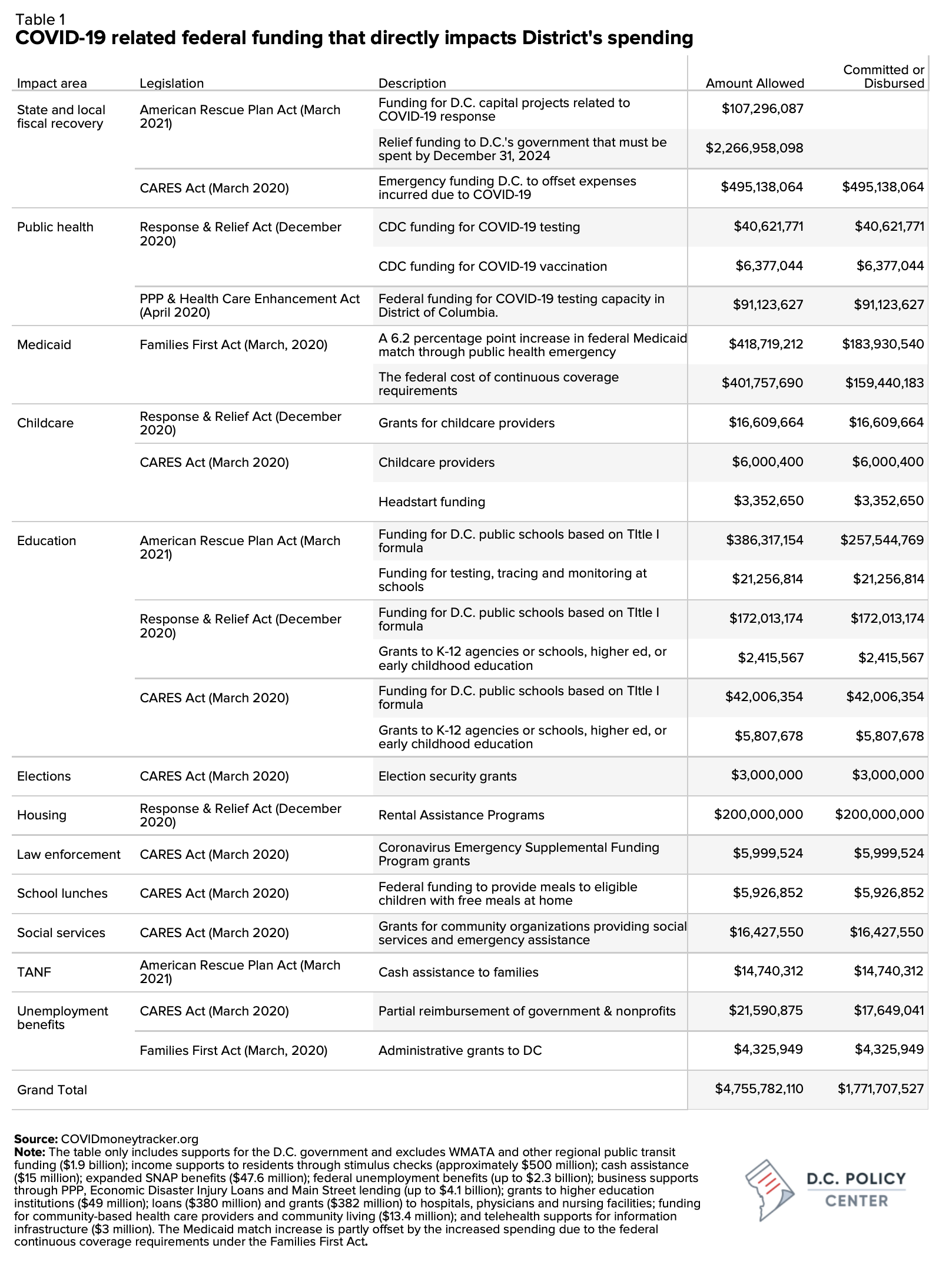

The American Rescue Plan Act is the latest in a series of federal legislation and administrative actions that channeled a significant amount of federal funding to states and localities. When combined, federal legislation passed since March of 2020 has provided the District nearly $4.75 billion in funding that must be incorporated into the city’s budget (See Table 1). These include:

- Direct unrestricted fiscal aid ($2.9 billion);

- Funding for public education and childcare ($656 million);

- Grants for public health and additional funding for Medicaid ($959 million);

- Funding for household supports including rental assistance, free lunches, grants for social services and increased TANF benefits ($237 million); and

- Unemployment related supports including reimbursements for unemployment benefits paid to District government employees and administrative grants for the management of the Unemployment Insurance Trust Fund (approximately $26 million).

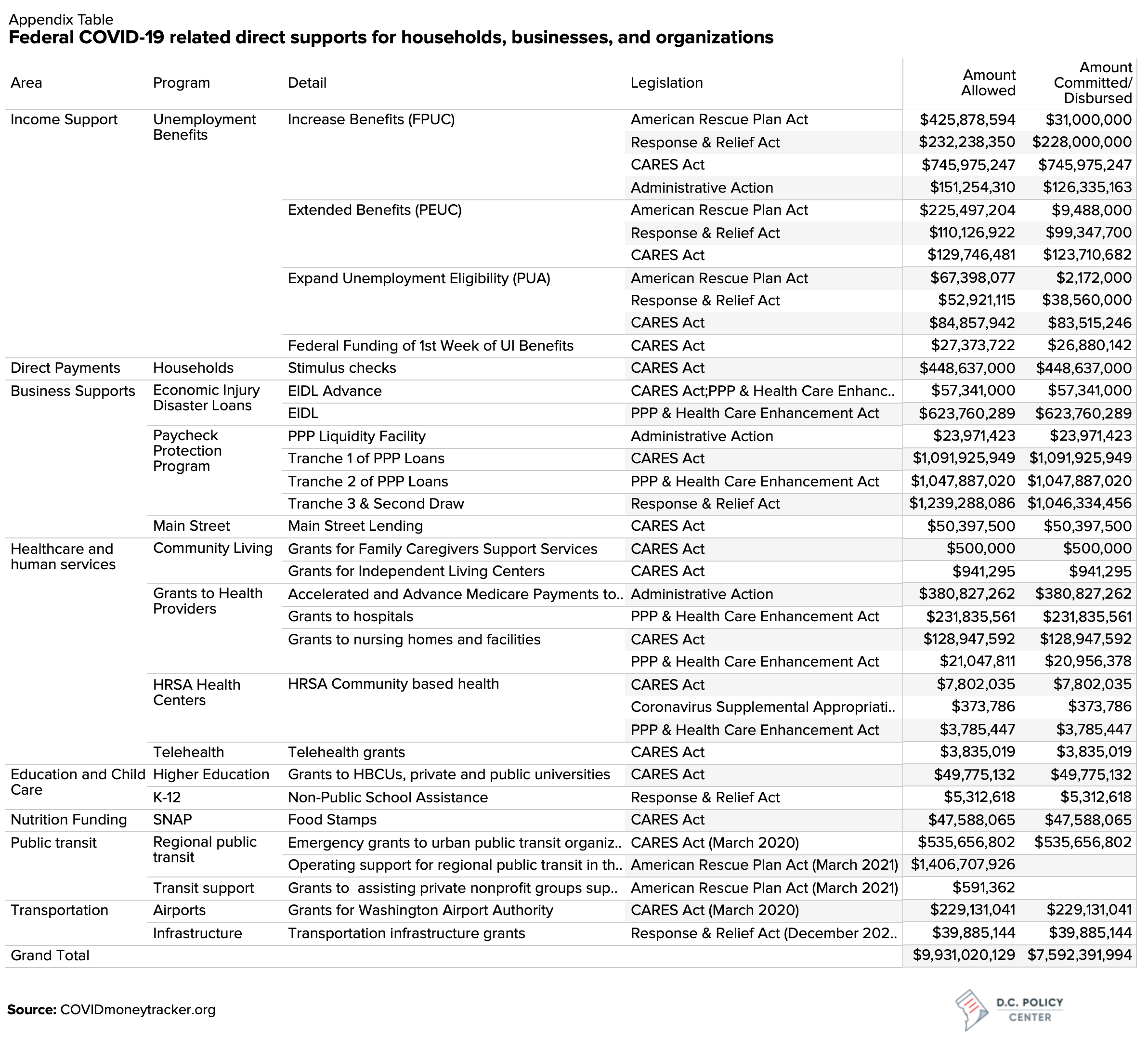

Excluded from these amounts are other federal supports flowing to District businesses, households, and health and education institutions and regional transit agencies that collectively add up to $9.9 billion or 7 percent of the District’s GDP (See the Appendix Table):

- District households received $449 million through the stimulus checks first approved in the CARES Act (1.4 percent of all personal income in fiscal year 2021).[4]

- The value of expanded eligibility and increased and extended unemployment benefits for the District’s workforce is estimated at $2.3 billion (20 percent of all wages paid by the private sector in the District in calendar year 2020).[5]

- The Paycheck Protection Program has sent an estimated $3.2 billion to District businesses (2.5 percent of the District’s GDP). Further, businesses in the District have been able to borrow $681 million in Economic Injury Disaster loans ($57 million of this amount is grant payments that do not have to be paid back).

- District universities and colleges have received $50 million (30 percent of annual revenue received by Title IV institutions in the District of Columbia),[6] and non-public schools received $5 million.

- Health-related grants, advanced payments in Medicaid, and other federal supports total $780 million (5 percent of estimated total healthcare spending in 2020 in the District of Columbia).[7]

- Public transit agencies (mainly WMATA) are slated to receive $1.4 billion through the American Rescue Plan Act in addition to $535 million already committed as emergency grants in the CARES Act.

These direct federal supports do not go through the District’s local budget but by increasing resources available to District residents and businesses, they help preserve the District’s economic resilience and thereby protect future revenue for the city.

Without economic growth, pandemic-induced revenue losses are likely to create longer-term deficits.

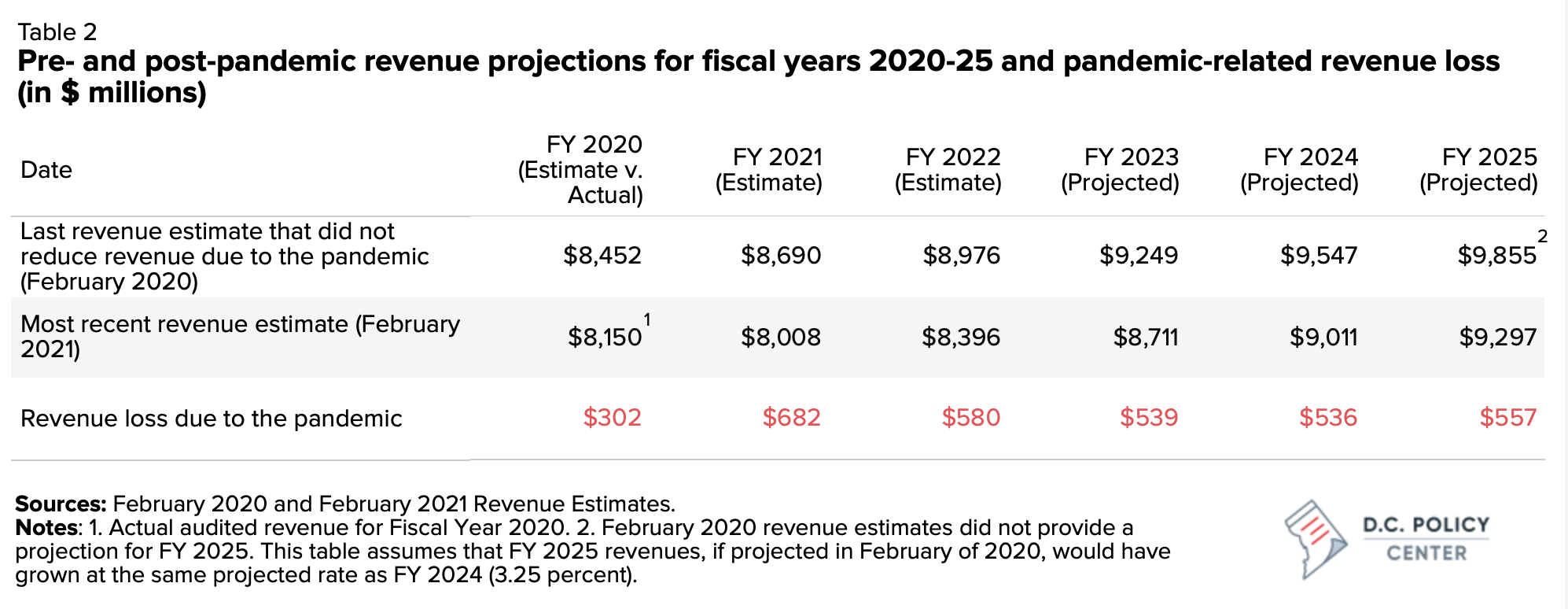

Comparing the last pre-pandemic revenue projection to the most recent one shows that the District has settled into a revenue path that is about $540 million lower each year than previously forecasted.[8]

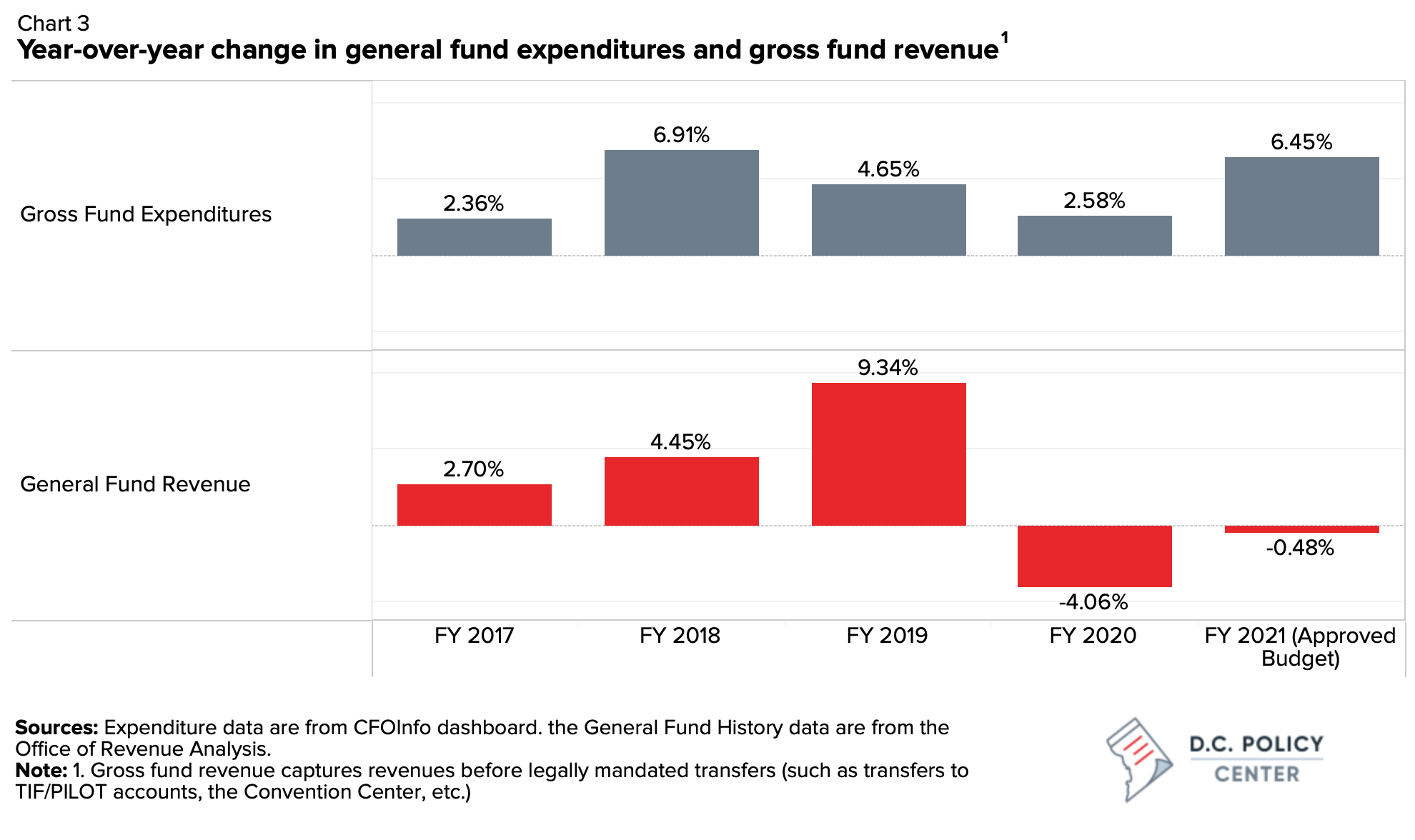

In response to these projected revenue shortfalls, the District has revised its budget multiple times, but spending has been growing through the pandemic, paid for by a combination of previous savings, tax increases, and federal grants. In the first year of the pandemic (Fiscal Year 2020), for example, general fund expenditures increased by 2.6 percent from previous year’s level while gross revenue from all sources (taxes, non-tax revenue, lottery transfer and special purpose revenue) declined by 4 percent. The approved Fiscal Year 2021 budget shows a projected spending growth of 6.45 percent, but the certified revenue is down by 0.5 percent.

The growth in spending was clearly necessitated by the pandemic, but its worrisome by-product is a fiscal picture that is out of balance.

Budget preparation documents show for the first time since Fiscal Year 2016 the city is starting its budget planning with a gap. Despite a projected revenue growth of 6.08 percent in Fiscal Year 2022,[9] the estimated spending that would keep services at Fiscal Year 2021 levels ($8,522 billion)[10] is still greater than the estimated revenue for Fiscal Year 2022 ($8,396 billion),[11] producing a gap of $126 million. This gap is a structural deficit created by the pandemic-induced downturn, as it is the shortfall between a budget that reflects current law with no new programs and no new taxes.

In addition, the city must make up for a projected deficit of about $30 million for Fiscal Year 2021 and find additional resources to balance the out-year spending in the financial plan. Our best estimate of the funding gap over the four-year financial plan period (comparing the most recent revenue estimates for the next four years to a baseline budget that grows at a historical rate of 3.6 percent)[12] is $558 million.

On the upside, even without federal aid, the District has sufficient resources to cover this shortfall over the financial plan period. The city ended Fiscal Year 2020 with its reserves (both locally and federally mandated) full, plus a surplus of $526 million.[13]This surplus alone can make up for the projected deficit for Fiscal Year 2021 and the majority of the funding gaps through the financial plan. On the downside, these resources reflect past savings, and not future revenue growth. And once they disappear, without economic growth, either taxes must increase, or the budget must be cut.

All this is not to say that the District cannot balance its budget, but it is to say that without the federal fiscal aid, the revenue path we are on is not sufficient to continue spending at current levels, let alone add new programs. Economic growth is urgently needed to close this gap.

Federal fiscal aid—if used to fund new recurring expenditures—will worsen future deficits.

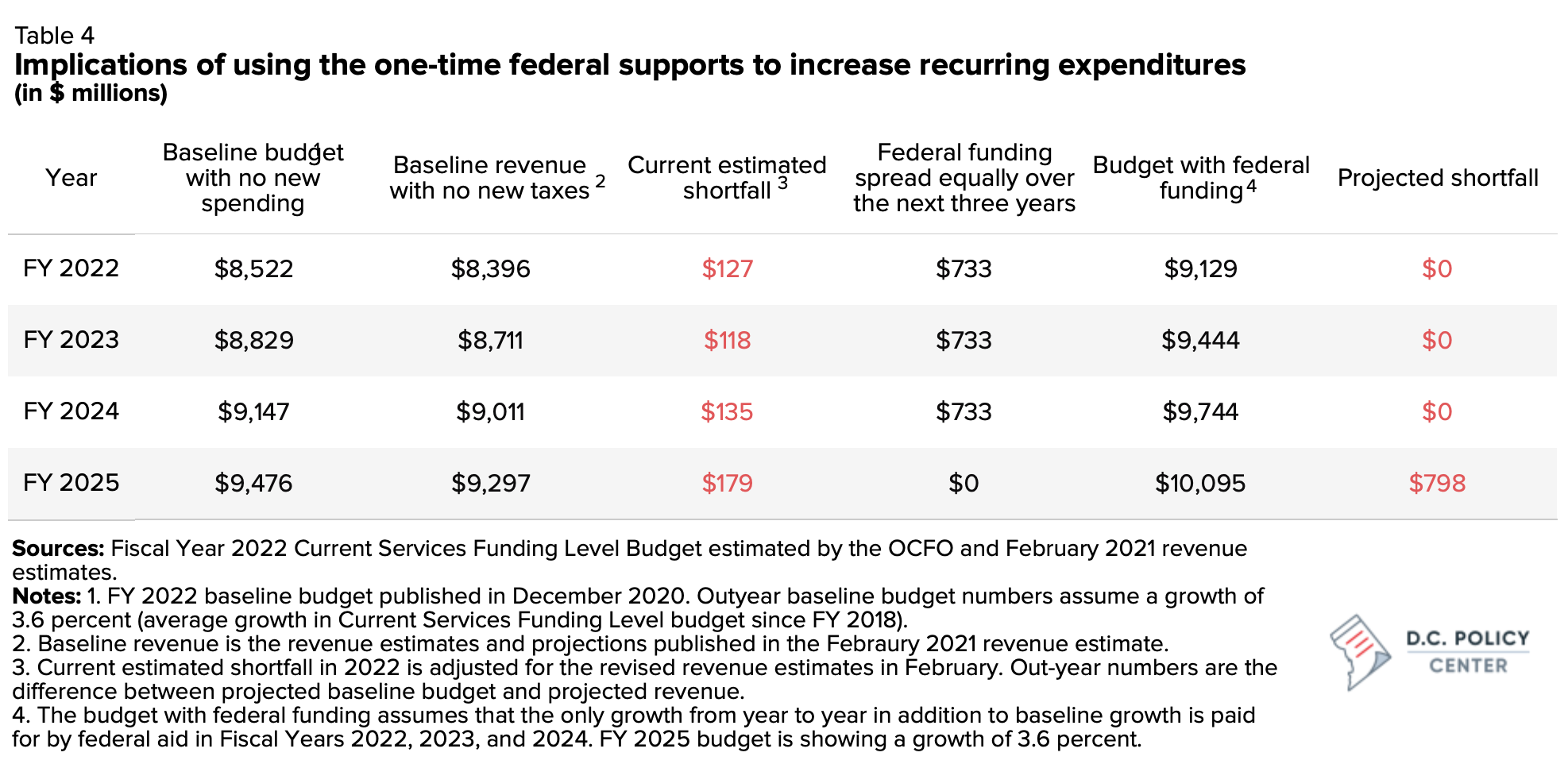

The $2.3 billion of direct fiscal aid to the District alone is certainly sufficient to make up for the revenue losses attributable to the pandemic, and more. But if this aid is used to pay for new programs that continue indefinitely and require recurring expenditures, once the federal funds disappear in Fiscal Year 2025, the District will face a steep fiscal cliff.[14]

To illustrate this point, we set up a hypothetical scenario where the District spends the federal fiscal aid in equal amounts over the next three fiscal years (before the federal spending deadline) to close its existing budget gap and add new programs.[15] If this were to be the case, resources would increase by $733 million each year—sufficient to cover currently projected shortfalls as well as pay for new programs. But unless this new spending is rolled back at the end of Fiscal Year 2024 and the budget cut back to fit the revenue, the city would face a $798 million deficit in Fiscal Year 2025.

This fiscal cliff would be too difficult to bridge by tax increases alone. To put it in context, to raise $798 million annually through a tax hike on high income households, effective income tax rates imposed on households which earn more than $500,000 would have to more than double[16] or the top rate they pay would have to increase to 27 percent![17] Raising $798 million through property tax increase would require the tax rates go up by a third across all types of properties;[18] raising it through a hike on general sales taxes would require a rate increase of 40 percent.[19] In fact, to make up for the disappearing federal aid, all sorts of taxes on all households—rich and poor—would have to increase.

Importantly, the use of reserves (or past savings) to pay for recurring expenditures will only deepen the fiscal cliff. Past savings, like the federal aid, are one time, and any recurring spending that is funded by reserves will have to be paid for by new recurring revenue, eventually.

The federal aid should be used for investments in the District’s future prosperity.

There are already several proposals for how the city should be using the federal aid to address COVID-related needs: to make up for learning loss, support childcare providers, expand mental health services, and increase supports for tenants and landlords who have lost significant income (See for example here, here, and here). These are all important needs and should be met as quickly as possible. [20]

In particular, the District should focus on immediate, inclusive, and impactful investments that can help undo the great economic damage caused by COVID-19 including job losses, address the opportunity gaps, and fund projects that create future prosperity.

Immediate and impactful investments that can increase prosperity could include investing in a racially diverse local talent pipeline that will engage District’s youth directly with employers; supporting the revitalization of Downtown and surrounding employment districts that have served as engines of revenue growth but are now showing signs of distress; investing in closing the digital divide to create connected communities and create equitable access to learning, job training, and entrepreneurial opportunities; and supporting ailing businesses, especially those that did not benefit from direct federal supports such as the Paycheck Protection Program. For example, the federal fiscal aid can be used for relocation grants to fill empty offices in Downtown and create employment opportunities for District residents. The District can set up an economic development budget seeded with a small portion of the federal fiscal aid to provide these grants and aggressively pursue companies that would otherwise relocate elsewhere in the region. Some of these investments can be done through a Tax Increment Financing structure, which ensures that the returns from the investment over the District’s current baseline are invested back into the District. Some funding could be set aside as “return to work” incentives to workers who have been reluctant to return to work because of high level of unemployment benefits. The economic development budget can also be used to invest in business accelerators and incubators with an eye toward elevating businesses owned by Black, Hispanic or Latino, women, and immigrant entrepreneurs (some examples, here); grow sectors outside of tourism and hospitality (for example, with a focus on technology and biomed) to ensure that future growth is driven by a diversified economic base; to provide incentives to employers to engage the District’s youth; or to upskill workers for jobs that offer economic mobility. A one-time investment, for example, in systems that can help track life outcomes for the District’s youth (see Maryland’s version here) and connecting them to high-quality and high paying jobs would create future yields not just in the form of tax revenue, but also in a higher quality of life, wealth building opportunities, and economic and social stability.

Such investments in economic development would not only help return the city to its pre-pandemic revenue path, but their yields would also continue, creating much needed revenue to balance future budgets and expand social programs.

BOX 1.

Someone must eventually pay for the federal recovery and stimulus spending, and it could end up being high-income earners

Federal fiscal aid may appear to be free money, but it is not.

As described in this excellent essay by Greg Ip, a massive fiscal and monetary stimulus led by the Federal Reserve, including the unprecedented amounts of bond buy-backs by the Treasury, has kept inflation low and bond yields lower, reducing the year-to-year increases in cost of running the government. The federal deficit, however, will have to be financed in some form: through more borrowing, higher taxes, or by monetizing the debt (i.e., inflation). All of these will have impact on the District’s budget and economy.For example, more borrowing by the federal government to finance the deficit (or winding back or ceasing of the bond buy-backs by the Treasury) will likely put positive pressure on bond yields (the interest rate earned by bond holders). A byproduct of reduced appetite for bonds would be an increase the costs of future borrowing (or restructuring of debt) for the District of Columbia as well. To wit, the cost of operating the District government is projected to increase by $70 million this year alone[21] because of higher debt service needs. If bond yields increase, these costs could raise more rapidly.

A higher rate of inflation will also increase the year-to-year growth in operating costs. This year, the District’s baseline budget is projected to grow by $15 million because of CPI increases despite relatively low inflation. Excluded from this are all other benefits and tax expenditures that are tied to the Washington metro area CPI, which make the price tag of higher inflation on the District’s budget even higher. The Federal Reserve of Minneapolis now puts the probability of a large increase in the Consumer Price Index over the next five years[22] at 31 percent. Higher inflation would mean higher year-to-year growth in spending that is wholly unrelated to service improvements.

Importantly, easy money has fueled the steady increase in asset prices even through the pandemic, keeping incomes, and therefore income tax collections strong. This experience is very different from what happened during the Great Recession, when job losses were relatively modest and personal incomes held steady, yet personal income tax collections declined by 10 percent, largely because of stock market declines. If interest rates begin to creep up because of Fed action, asset prices could experience a significant correction, further weakening the District’s income tax base and income tax collections, especially from top-income earners.[23]

Increasing income taxes on high income households will not address the root cause of racial injustice in the tax code.

As in past years, once again, there are calls on the District’s leaders to increase taxes—specifically income taxes on higher-income households—during this budget cycle. But unlike past years, racial justice, and not just the need to raise revenue, is a central argument offered in favor of higher income taxes. After the tragic deaths of George Floyd, Breonna Taylor, and too many others to name, the focus on racial equity is vitally important and necessary. And the urge to address racism through a revamped tax code, understandable. However, proposals to increase District’s income taxes in pursuit of racial equity do not address the underlying reasons why tax policies could amplify racial inequities.

The racial inequities in the tax code are not primarily a function of District’s own tax laws, but are largely tied to the federal tax code (see here and here), especially to various preferential tax treatments of wealth. For example, mortgage interest deduction—a very popular tax preference—is a transfer from all taxpayers to those who are fortunate to be able to afford a home. Preferential treatment of retirement savings, pensions, and college savings benefit those who can save for retirement or their children’s college, amplifying wealth disparities. Because the District’s definition of taxable income conforms to the federal definition (with a few exceptions), many of the federal laws that reduce federal income calculations for tax purposes also reduce District residents’ taxable incomes.

Revenue losses the District experiences because of the preferential treatment of wealth by federal tax laws are significant. According to the 2020 Tax Expenditure Report published by the Office of Revenue Analysis, the IRS rule that exempts the capital gains associated with the sale of a principle residence (benefiting homeowners who experienced value appreciation that can be tied, in part, to improving city services) could be reducing the District’s tax collections by as much as $40 million. Federal income tax deductions for mortgage interest and property taxes are estimated to cost the city another $46 million. The tax loss to the District related to contributions to individual retirement accounts (including by self-employed) and earnings on Roth IRA is estimated at $95 million, while savings largely accrue to higher income households.[24] Exempting employer contributions (and the earnings on these contributions) to pension, profit-sharing, stock-bonus, and annuity plans is estimated to reduce the District’s income tax collections by $179 million, while the benefits are enjoyed by the households in the top income quartile.[25] The tax-free Health Savings Accounts (with an estimated foregone revenue of $3 million for the District) are three times more likely to benefit workers with wages of $200,000 or more compared to workers who earn less than $50,000. Federal law excludes from income calculations the value gain on capital assets transferred at the time of death—at an estimated revenue loss of $42 million to the District—and the beneficiaries are those who do not have to sell these assets at the time of inheritance.[26] Tax expenditures (federal and local law combined) associated with college savings accounts reduce income tax collections by an estimated $6 million. And while generally seen as a policy benefiting the middle class, research shows that the benefits from such plans typically flow to high income families who could have supported their children’s college education with or without such preferential treatment.[27]

In contrast, the District’s tax laws—especially its income tax—is far more progressive, and far more targeted to benefit lower-income households, thus having many of the elements that can reduce racial disparities. According to ITEP, whose research is offered by advocates to justify income tax increases, the District has one of the most progressive income tax regimes in the country, and the District is ranked as the second lowest after California, when it comes to state and local level tax burdens (also see here). In addition to progressive income tax rates, the District has a strong Earned Income Tax Credit, a targeted childcare credit, a circuit-breaker program targeting low-income homeowners and renters, all of which provide additional protections for lower-income District residents. Further, unlike the federal government, the District taxes long-term capital gains as ordinary income, and not at a preferential rate. As a result, among the jurisdictions that make up the Washington metropolitan area, the District has the lowest tax burden (income, sales, real property, car taxes combined) for households that make up to $150,000 annually,[28] and the second highest effective income tax rate on households earning $150,000 or more when compared with the largest city of each of the fifty states.[29]

Thus, we are left with a tax increase proposal that will do little to reverse the racial wealth gap because it will not counter the wealth-centered preferences embedded in the federal income tax code. Even with this information, the District’s options for improving racial equity through an income tax adjustment is limited. The obvious alternative to a tax increase is to decouple from the federal law to eliminate such preferential treatments, but doing this (a) is politically difficult (though not always),[30] (b) makes tax administration harder; and (c) without a change in the federal code, would also significantly reduce the attractiveness of the city and weaken its competitive position in the region, and therefore could end up hurting revenue (and consequently spending). Both Maryland and Virginia conform to the federal definition of income, and thus their residents similarly benefit from federal tax expenditures. If the District decouples from federal law, fewer households will likely relocate in the District if they cannot deduct their mortgage interest from their taxes, and more wealth will be invested elsewhere in the region (in homes, retirement accounts, or college accounts) if tax treatment of this wealth is more favorable.

Another reason offered for increasing income taxes in the District is to reduce the combined tax burdens from sales, property, and income taxes on middle-income families. In fact, the combined burden that disadvantage middle-income households is not driven by a regressive income tax policy, but relatively low (and flat) real property tax in the District.[31] But why try to solve this through an income tax increase? If property taxes on high-income households are relatively low, that can simply be solved by taxing higher valued property at higher rates or eliminating local preferences such as the property tax cap. This is, in fact, the closest the District can get to a wealth tax. Such a tax would cause the least distortions, since would be imposed on an asset (the property), which cannot be moved. Further, it would allow the District to recoup some of the returns on public investments as property values are highly contingent on their proximity to things like good schools, transportation, amenities—all functions of government services.

But property tax increases are extremely unpopular, and while the disparate impacts of preferential treatment of property both at the federal and state level are well understood (see, for example, here, for an analysis of California’s Proposition 13 which significantly reduces real property taxes on homeowners, and continues to resist change despite a desperate need for revenue), eliminating them have proven to be very hard. Therefore, it is not surprising to see the more politically popular alternative of taxing the rich receiving attention.

Increasing taxes today to create new programs will undermine economic growth and make it difficult to solve future revenue problems.

The calls for tax increases today miss the long view: without economic growth beyond what we already expect, tax increases are already an inevitable part of the District’s future. And raising taxes today to commit spending to new programs will make it harder to do so in the future, forcing significant budget cuts. When that happens, as this ITEP analysis puts it, underserved communities of color will likely be asked to bear the burden of such cuts.

With significant federal supports in hand, the District does not need more resources in Fiscal Year 2022 and should not increase taxes on residents and businesses when the economy is still ailing. Lower population growth, declining valuations in commercial real property and multifamily buildings, and significant job losses the District has experienced since the beginning of the pandemic have weakened the tax base .[32] The District’s desirability in the region has declined given the changes in how we work and spend leisure hours under COVID-19 related restrictions. These make it even more important for the city to maintain its competitiveness in the region, and higher taxes–especially when not necessitated by need–will further diminish the District’s desirability and risk future economic growth.

Perhaps the most important benefit of federal fiscal aid is the time it buys for the District to think through its tax regime carefully.

A better approach to tax policy would be to apply a racial equity lens to all the District’s taxes that (a) considers past and current systemic racial inequities, (b) identifies who benefits from or is burdened by a decision, and (c) analyzes data to better understand impacts and outcomes by race. At the same time, we need to remember that good tax policy raises as much revenue as possible for public services with the least amount of distortions in economic decision-making and disruptions to economic activity. And this means the District must remain competitive in the region, offering a high quality of life for a relatively low price for its current and future residents, workers, and businesses.

To successfully incorporate a racial equity lens to tax policy, the District must have the data. At present, the District does not collect race and ethnicity data from taxpayers, and tax proposals considered at the Council rarely include a racial impact analysis[33] (see here, and here, for example, on how this could be done). While convincing taxpayers to share information on their race and ethnicity may require significant public education and assurances that the tax agencies won’t abuse this information, the city can obtain at least some of this information by using what it already collects: The District’s Department of Employment Services routinely collects race and ethnicity data from employers for each employee eligible for unemployment benefits (summary data in table ETA 203 here goes back to 1990), and this information can be matched to income tax data, covering all District residents who have, at some point in the last 30 years, worked in a salaried job in the city. By merging information from employer filings with tax return data, the District can begin unpacking the racial equity implications of both federal taxes and the city’s own income tax code. Creating this information for real property and sales taxes is more difficult but with some effort, we can know more about racial disparities in burdens associated with these taxes. For real property taxes, for example, the District could consider matching mortgage finance data to real property tax rolls, or match home addresses to individual income tax filings (one example here). For sales taxes, it could use credit card data or consider instituting a periodic household expenditure survey.

The city will be well-served to think through its tax system through a Tax Revision Commission—an institution that has served the city well in the past. There have already been two Tax Revision Commissions since the Revitalization Act (one in 1996, another one in 2012), and both produced reform packages that reflect sound principles: creating a simple, efficient tax system that maintains competitiveness by imposing as few disincentives as possible on economic activity while reducing tax burdens on low income residents. The District adopted both packages with small modifications.

The D.C. Council recently passed legislation to establish a new Tax Revision Commission and charged it with considering the racial equity impacts of the District’s current tax code in addition to efficiency and competitiveness factors.[34] This is timely, not just because of the importance of using a racial equity lens, but the growing pressures to increase the District’s competitiveness given the weaknesses in population growth, job losses, increased commercial vacancy rates, and the impact of COVID-19 on the desirability of urban areas, with a resulting spread of work from urban employment centers to smaller cities and suburbs.

The city should consider other policy changes that can reduce the racial wealth gap with greater certainty and longer-term impacts.

A review of fines and fees that disproportionately target communities of color and underserved communities, elimination of restrictive land use policies that make it difficult to build housing and increase displacement, removal of unnecessary professional licensing requirements that close the doors to opportunity, and elimination of barriers to starting new businesses by simplifying business applications and increasing the threshold for Clean Hands background checks are some of the steps the city should take to help the city’s Black and brown communities begin building wealth. All of these are much harder to do than increasing income taxes on the rich, but they are necessary to open doors of opportunity for the District’s most underserved and disadvantaged residents.

Data notes

Federal fiscal aid: All information on the federal legislation and the estimated flows of funding to the District of Columbia are from the covidmoneytracker.org website prepared and maintained by the Committee for a Responsible Federal Budget. The information presented in this article was retrieved on April 22, 2022. The underlying data are available here (Link to excel file).

General fund history: The general fund history (including gross tax revenue and revenue after transfers) was obtained from the Office of Revenue Analysis and updated to incorporate the projections for the financial plan period.

Baseline budget: The baseline budget information is from the fiscal year 2022 Current Services Funding Level budget analysis published by the Office of the Chief Financial Officer on December 2, 2020. The projected gap has been updated to incorporate the improved forecast in the February 2021 revenue letter. The baseline budget growth projections use a historical growth rate of 3.6 percent, which is the average growth rate of the five years displaced in the Current Services Funding Level analysis.

Tax increase analysis: The estimated income tax increase required to cover the hypothetical gap presented in Table 3 is developed by using data on from Table 3-6 Distribution of Filers, DC Adjusted Gross Income and Taxes by Income Category, TY 2018 in the 2021 District of Columbia Data Book published by the OCFO. This table shows that the effective tax rate (taxes paid as a share of District’s AGI) is 7 percent for households earning $500,000 or more. Given the tax collections from this group of high-income households, the effective rate would have to increase, to over 15 percent, to raise $798 million.

The top marginal rate for households earning $500,000 or more was estimated using the following assumptions based on information from the same table:4,655 households earning between $500,000 and $1,000,000 with an average annual taxable income of $630,000; and 2,320 households earning above $1,000,000 with an average annual taxable income of $2.3 million. The average income is what produces the current tax collections under current law.

The estimated real property tax increase to cover the hypothetical fiscal cliff is based on the gross real property tax revenue projected for fiscal year 2025 ($2.9 billion).

The estimated sales tax increase to cover the hypothetical fiscal cliff is based on the gross sales tax revenue projected for fiscal year 2025 ($1.9 billion).

Tax burdens: The comparative tax burdens on households earning under $150,000 across metropolitan Washington jurisdictions, and across the largest city in 50 states and Washington DC are from the Tax Rates and Tax Burdens 2019: Washington-Metropolitan Area and Tax Rates and Tax Burdens 2019: A Nationwide Comparison published by the Office of the Chief Financial Officer on April 23, 2021.

The assessment of the progressiveness of District’s tax policy is from the 6th edition of Who Pays? A Distributional Analysis of the Tax Systems in All 50 States published by the Institute on Taxation and Economic Policy (ITEP)

Federal tax expenditures: All information on the federal tax expenditures and their estimated value is from the analysis and research presented in the 2020 Tax Expenditure Report published by the Office of Revenue Analysis. As they note, estimated tax expenditures may not equal actual tax revenue loss.