Note: D.C. updates on the spread of the coronavirus and COVID-19 are available at coronavirus.dc.gov.

This page will be updated as needed as new information becomes available. For more, see all of the D.C. Policy Center’s COVID-19 analysis here.

The CARES Act (Coronavirus Aid, Relief and Economic Security Act) is the latest round of federal relief packages to address the COVID-19 pandemic. Following on the Families First Coronavirus Response Act, which provided sick leave and expanded FMLA for those affected by COVID-19, the CARES Act was passed by the Senate late in the evening on Wednesday, March 25, and is expected to be passed by the House of Representatives on Friday, March 27. The President has indicated that he will sign it upon receiving it on Monday.

This article looks at Title 2 of the legislation, “Assistance for American Workers, Families, and Businesses,” which creates certain unemployment supports for state unemployment programs and those who are applying for benefits. A summary of the major unemployment supports, and how they are likely to impact D.C., is included below.

In addition to the unemployment assistance summarized in this article, Title 2 of the CARES Act will also provide direct stimulus checks to individuals and households, regardless of employment status. The stimulus checks will be $1,200 for individuals earning up to $75,000 per year and will phase out after $99,000 in annual income. Married couples will receive $2,400 for incomes under $150,000 a year, and the checks will phase out after $198,000. Married couples also will receive an additional $500 for every child, which will also be phased out by income. For more, see the Washington Post’s stimulus payment calculator.

Unemployment assistance for self-employed workers and independent contractors

The temporary Pandemic Unemployment Assistance Program will be effective from January 27, 2020 (retroactively) to December 31, 2020. The program provides payment to those not traditionally eligible for unemployment benefits. This include workers who are self-employed, independent contractors, and those with limited work history, as well as others if they are unable to work as a direct result of the coronavirus public health emergency (Section 2012).

Assistance covering unemployment insurance costs for nonprofits, government agencies, and Indian tribes

The bill also provides temporary funds to reimburse nonprofits, government agencies, and Indian tribes for half of the costs they incur through December 31, 2020 to pay unemployment benefits (Section 2013).

In the District, the D.C. government and many nonprofits are on the reimbursable schedule. These entities, rather than paying unemployment insurance taxes, receive a bill from the Unemployment Insurance Program for the benefits paid for their laid-off employees. In 2018 (the most recent data available), there were 76,231 covered employees for nonprofits under the reimbursable schedule. And in 2019, 680 nonprofits had active accounts with the District’s unemployment programs and they were charged, collectively, $18.6 million to cover the cost of benefit paid to their laid-off workers. (Data from ETA 204 – Experience rating).

$600 increase in weekly UI benefit amounts through July 31

The temporary Pandemic Unemployment Assistance will add $600 per week to state-level unemployment insurance (UI) benefits ($425 in the District) through July 31 (Section 2014). The District would have to change local law to be able to benefit from this additional funding.

Temporary elimination of the one-week UI eligibility waiting period

The federal bill also eliminates the one-week waiting period through December 31, 2020. The federal government will cover the cost for this additional week of benefits (Section 2015). Under local D.C. law, there is a one-week waiting period before benefits are paid, but the March 17 emergency legislation adopted by the District removed this one week waiting period for those affected by COVID-19 pandemic and accompanying economic impacts. So the District is already in compliance with the federal requirements to qualify for these benefits (barring small changes to conform to federal language).

13-week extension of UI benefits beyond state benefits

The CARES Act makes an additional 13 weeks of unemployment benefits available through December 31, 2020 to help those who remain unemployed after they exhaust their state unemployment benefits. (Section 2017). In the District, this term is 26 weeks and the most recent data from the fourth quarter of 2019 show that the exhaustion rate is 36 percent. The District would have to change its local laws to benefit from this provision.

Federal funding for states’ existing or new “short-time compensation” programs

The legislation also provides federal funding to support “short-time compensation” programs for states with already such programs in place (Section 2018). Under this provision, it appears that the federal government would pay for up 100 percent of the costs between the reduced benefits and the full benefits. A short-time compensation program is one where employers reduce work hours rather than laying off workers, and the Unemployment Compensation program pays for benefits prorated for the hours lost. The full definition is set by the tax code §3306 (Section V), but essentially refers to a program where an employer reduces a workers’ hours instead of laying them off entirely. The District had enacted such a program in 2010, but it is not clear if there are any unemployment claimants that are applying under the short-time provisions. Available data suggests not.

There is also a similar provision for funding to support states which begin “short-time compensation” programs (Section 2019). This provision would pay 50 percent of the costs that a state incurs in providing short-time compensation through December 31, 2020. It does not appear that this applies to the District because the city already adopted such a program. For these states that do not have legislated short-time compensation program, the federal government has set aside $100 million in grants to help them implement and administer these programs.

What do these changes mean for the District of Columbia?

As of December 2019, the District’s Unemployment Insurance Trust Fund had $521 million in it. This high fund balance is the result of continued good times for the District’s economy and employment picture since the end of the Great Recession as the total benefits paid continuously stayed below the amount of taxes collected.

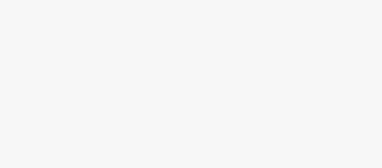

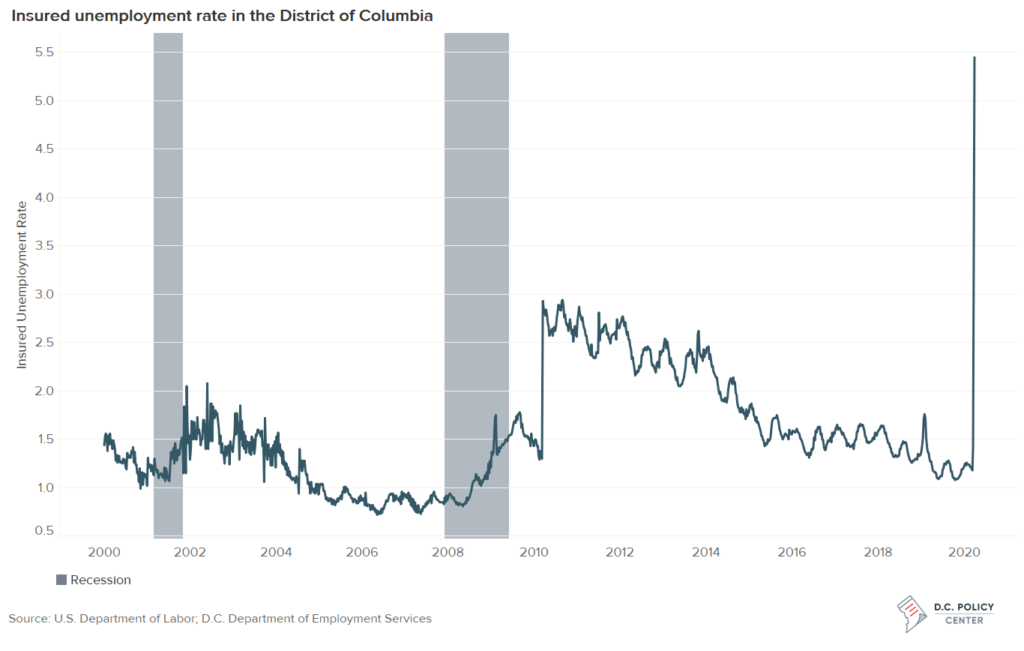

These last two weeks alone, 24,686 persons applied for unemployment benefits:

This number is 46 time[i] the average number of claims we have seen in the entirety of 2019, an even much higher than the average number of claims we have seen through the great recession. This means the insured unemployment rate now stands at 5.45, which is 3 times the highest rate we have seen through the great recession.

Title 2 of the CARES Act, assuming it will be enacted tomorrow without significant changes, will be an important help to District residents and will increase the strength of the District’s Unemployment Trust Fund. The D.C. Policy Center will continue to monitor the progress of this federal legislation and update these points as needed.

Find more of the D.C. Policy Center’s COVID-19 analysis here.