The D.C. Policy Center’s Rivlin Initiative recently completed the third round of the Business Sentiments Survey. The survey’s goal is to provide systematic, comprehensive information on the business community’s experiences to elected officials, the media, and the broader community.

In the third round, 214 respondents filled out the survey. Many survey respondents were owners or executives from small and established businesses. Respondents from the professional, scientific, and technical services sector had the greatest representation in the survey—with 18 percent of all participants coming from this sector. Meanwhile, 14 percent of respondents were from real estate, 12 percent were from the nonprofit sector, and 9 percent were from the restaurant sector.[1]

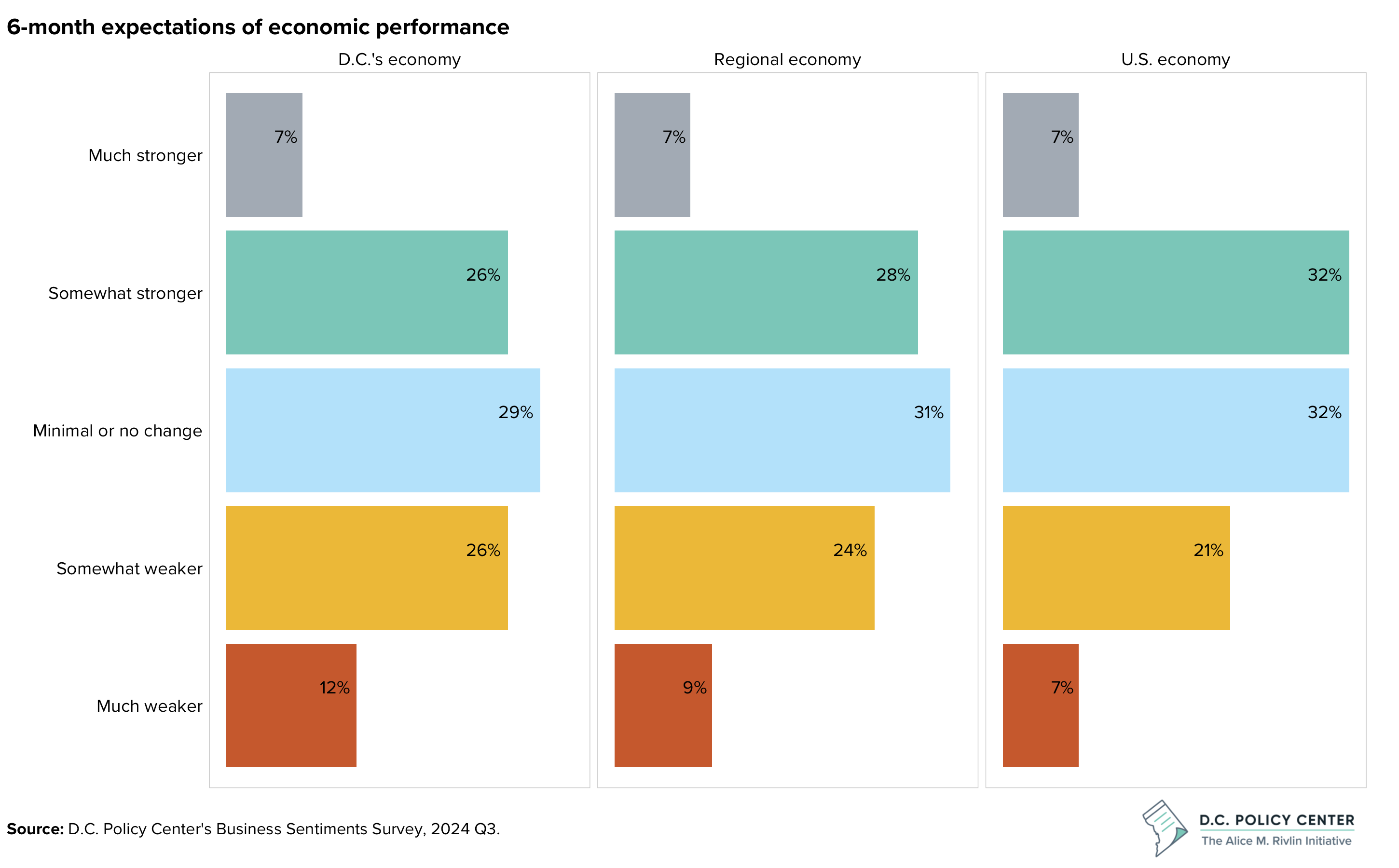

In each round, survey respondents are asked about their six-month expectations for the local, regional, and national economies. As with the past two rounds, third-round survey respondents held more pessimistic expectations about the D.C. economy than the regional or national economies. 38 percent of respondents expected the D.C. economy to be somewhat or much weaker, compared to 33 percent for the regional economy and 28 percent for the national economy.

Recent economic data sheds light on why survey respondents are more pessimistic about the District’s economy. Over the past year, the D.C. economy performed less well compared to the regional and national economies. For example, between June 2023 and June 2024, national nonfarm employment grew by roughly 1.7 percent. In contrast, nonfarm employment in the District grew by slightly less than 0.4 percent, and it is possible that this growth is just statistical noise.

The D.C. economy also experienced the largest increase in its unemployment rate during the period in question. Between June 2023 and June 2024, the District’s resident unemployment rate increased from 4.8 percent to 5.4 percent. During the same period, the regional unemployment rate rose from 2.9 percent to 3.3 percent, while the national unemployment rate increased from 3.6 percent to 4.1 percent.[2]

It will be interesting to see how expectations change in the upcoming survey rounds. Given the Federal Reserve’s decision to keep rates unchanged and the July jobs report, expectations might become more pessimistic if evidence continues to mount that the national economy is slowing down.

[1] The sentiments expressed by round-three survey respondents may not be representative of the D.C. region’s business community. Furthermore, this article’s structure is borrowed and adapted from previous charts of the week covering the Business Sentiments Survey results.

[2] The regional unemployment rate reported is preliminary and not seasonally adjusted.