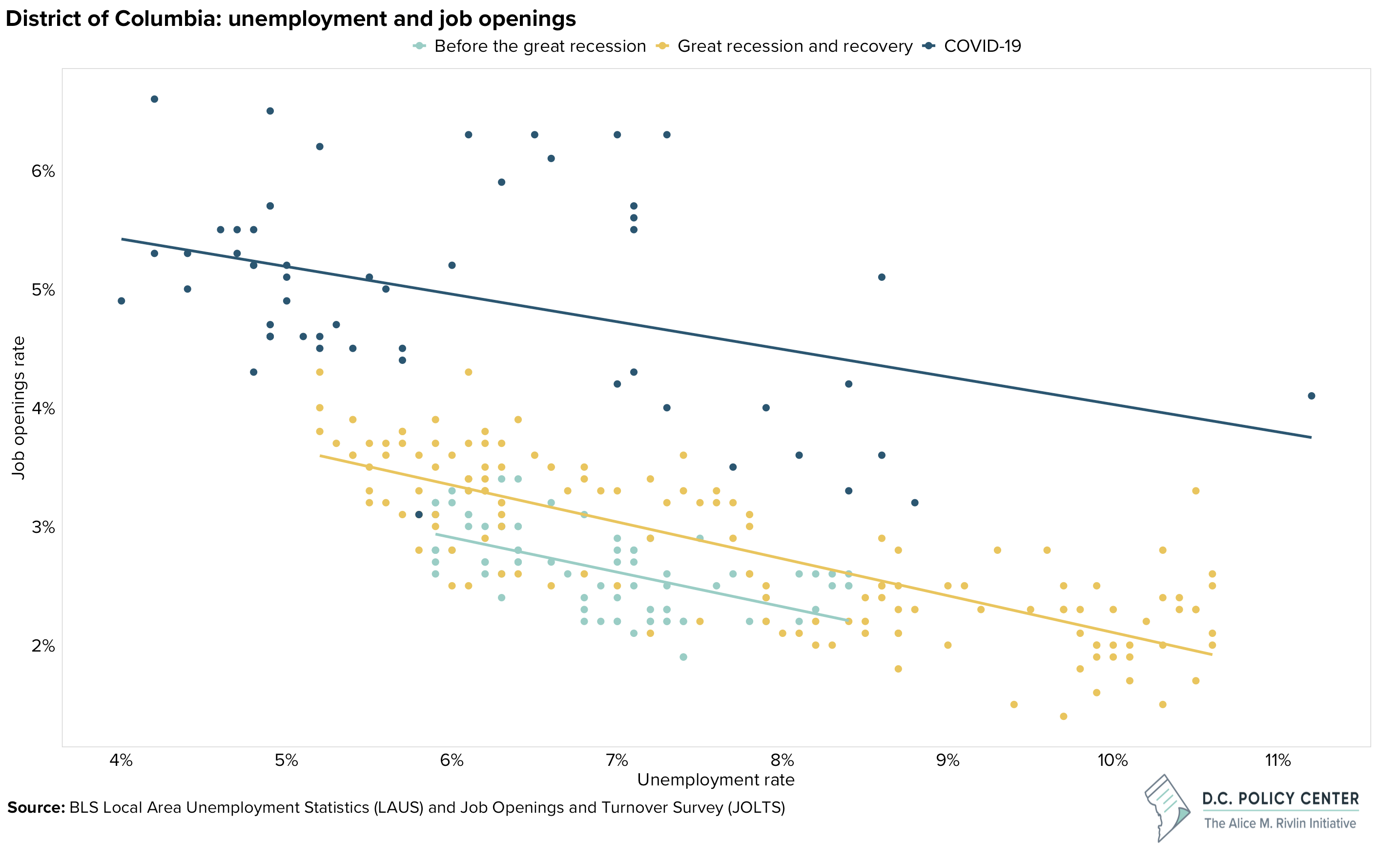

One way to assess the performance of the local labor market is to examine the relationship between the unemployment rate and the job openings rate. Economists call this relationship the “Beveridge curve.”[1] The dots on the chart represent the job openings rate and the resident unemployment rate in the District for a given month. The lines on the chart slope downward because higher unemployment rates are often associated with a lower job openings rate. The intuition behind this association is that higher unemployment rates often signal a weaker job market. And in a weaker job market, employers will often pull back on hiring.

Since the Great Recession, despite a greater number of job openings, unemployed D.C. residents are still struggling to secure employment. As the chart above shows, compared to the years before the Great Recession, the years of the Great Recession and the subsequent recovery from it saw a somewhat higher rate of job openings for a given unemployment rate. This point is captured by the outward shift from the lagoon-colored line to the yellow-orange line. During and after COVID-19, the District saw a notably higher job openings rate for a given unemployment rate than during the Great Recession and its recovery.

Raw numbers help make the overall trend more vivid. Before COVID-19, there were, on average, approximately 0.85 job openings for every unemployed resident. During and after the pandemic, this ratio increased to an average of 1.80 job openings per unemployed resident—more than double the pre-pandemic years.

The broader upshot is that the local labor market has likely become less efficient at matching unemployed D.C. residents with available jobs. While a fuller analysis would be needed to identify all the factors behind the increased inefficiency, two potential factors stand out.

The first is that unemployed D.C. residents may lack the specific skills or formal education needed for the available jobs. Research by the D.C. Policy Center indicates that, between the school years 2017-2018 and 2021-2022, a declining percentage of high school graduates in the District enrolled in a higher education institution within a half year of graduating. This decline raises the question of whether the District’s public high school system has become less effective at preparing its graduates for college and, in turn, potential careers.

The second is the difficulty D.C. residents with children may face in finding affordable childcare. This difficulty may prevent some residents from accepting a job. According to the Economic Policy Institute, a family of three —or two adults and one child—pays roughly 17,000 dollars per year for childcare, and a family of four—or two adults and two children—pays even more—35,000 dollars.[2]

[1] The date classification scheme for this piece is borrowed from and indebted to Gadi Barlevy, R. Jason Faberman, Bart Hobijn, and Ayşegül Şahin, “The Shifting Reasons for Beveridge Curve Shifts,” NBER, Working Paper # 31783. In this chart of the week, “Before the great recession” includes all months between December 2000 to December 2007. “Great recession and recovery” includes all months from January 2008 to February 2020. ‘COVID-19” includes all months from March 2020 to September 2024. Note that the ending date for the “COVID-19” period differs from the one in the cited paper.

[2] Annual costs in 2023 dollars for “Washington, DC.” Estimates are from EPI’s Family Budget Calculator.

Note: The piece was updated to clarify that the data shown is monthly, not quarterly.