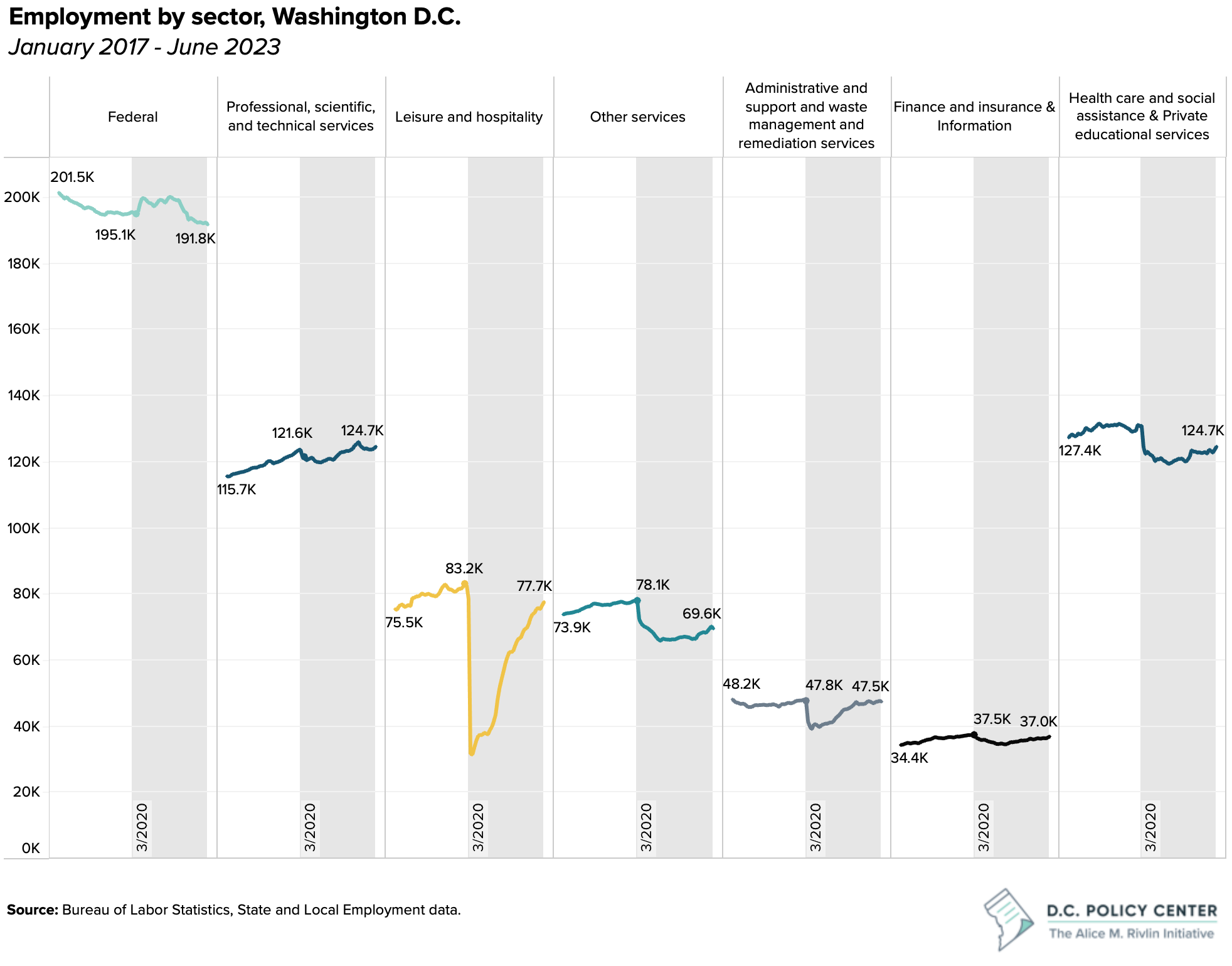

The U.S. Bureau of Labor Statistics released the most recent state and local employment numbers on Friday, July 21. These data show that as of June 2023, roughly 39 months after the pandemic began, private sector employment in D.C. is still very much in recovery.

In the last year, private sector employment has been growing at an annualized rate of 4.22 percent.1 This is a lower growth rate than the year before (5.54 percent), but still far above the pre-pandemic long term growth rate of just under 1.44 percent (measured for the 39 months—or about 3.5 years—preceding the pandemic). Despite this performance, the total private sector employment in D.C. still remains 23,000 below the pre-pandemic peak employment.

Recovery in the last year has been fueled mostly by hotels and restaurants.

The leisure and hospitality sector was hit the hardest, both immediately and during the first year of the pandemic. In March 2021, a year into the pandemic, employment in this sector was still stuck at 37,600—less than half of the pre-pandemic peak of 83,200. Since then, its rebound has been remarkable, with employment growing at an average annualized rate of 37.7 percent. There is still some more catching up to do, but leisure and hospitality remains the fastest-growing sector in the city.

Federal government employment in the District is in a steady-state decline.

In the past, the District has always been “recession-proof,” since it benefited from both increased federal spending and growing federal employment during downturns. During the Great Recession, for example, the District lost 3.5 percent of its private workforce from peak employment to the lowest level (a decline of 16,400). Yet during the same time, federal employment grew by nearly 10 percent (18,000). The federal government is still the largest employer in the city, but with remote work as the main mode among many federal workers in the region, the change in federal employment is no longer a particularly relevant factor for recovery.

Employment in the professional, scientific, and technical sector—the second largest sector behind the federal government—is no longer growing in any meaningful way.

During the pandemic, this sector did not experience deep declines, and it more than made up for the 1,700 jobs it lost in the first year of the pandemic. But growth in the last year averaged at an annualized rate of 1.60 percent, which is below its long-term growth rate of 1.96 percent prior to the pandemic. In fact, in the last six months, this sector barely grew at 0.5 percent, adding only 700 jobs. Such a low rate is not common in D.C. outside of recessions. Looking at data from 2000, I found only two other six-month periods when employment in professional, scientific, and technical sector grew below half an annualized rate below percent (in 2006 and 2014).

Interestingly, this seems to be the case for the entire Washington metro region. Prior to the pandemic, professional, scientific, and technical jobs were growing at 1.97 percent in the Washington metro region. Since April 2020, the annualized growth rate was 1.19 percent—below the pre-pandemic growth. But in the last six months, employment in this sector remained virtually flat. This is surprising given the prominence of news on the growth of processional, scientific, and technical sector in Northern Virginia, driven by investments by companies like Amazon. County level data are available only through the end of 2022, and only annually, but it shows that employment in the professional, scientific, and technical sector declined from 2021 to 2022 in Arlington and grew by only half a percent in Fairfax.2

All other large sectors continue to recover, but still have a bit to catch up.

Health and education, which collectively constitute the second largest private employment source in D.C., are still 5 percent below pre-pandemic peak levels, and other services, which is largely comprised of personal services, is 11 percent below. This is where the rest of the region looks different. Across the entire metro area, employment in health and education has completely caught up with pre-pandemic employment peak. While other services sector is still running behind regionally, it has recovered 94 percent of its pre-pandemic employment compared to 89 percent in D.C.3

Endnotes

- This is the average of the 12-month growth rate BLS publishes for each month.

- Through 2022, Arlington lost 1,200 jobs in this sector and Fairfax added only about 650 new jobs. It is important to note that monthly jobs data are collected through a survey of employers, where county level data, from the Quarterly Census of Employment and Wages, is based on administrative reports filed by employers. The two data sources track slightly different groups, but the Bureau of Labor Statistics revises the monthly numbers once a year to reconcile them with administrative data.

- These data are not seasonally adjusted, so I am comparing here 3-month moving averages.