First Take is a regular opinion column by D.C. Policy Center Senior Fellow David Brunori.

I must admit I am astonished by the strong opposition to ending the federal deduction of state and local taxes. More astonishingly, much of that opposition comes from liberal political leaders. On Monday, November 13, 2017 area politicians gathered at the capitol to decry the proposal in Congress to end completely (in the Senate) or partially (in the House). Delegate Eleanor Holmes Norton blasted the proposals as being unfair to the District. Mayor Bowser, who understands sound tax policy very well, criticized the elimination of the federal deduction. Other local political leaders joined in the chorus bemoaning the change.

I am not defending the current federal tax reform proposals. But it seems that from a tax policy perspective, ending or limiting the SALT deduction while providing a much larger standard deduction and lowering rates will be a good thing for lower and middle income citizens. There are many other parts to the Senate and House proposals that may help or hurt lower income folks. But let’s face it, the SALT deduction creates benefits that advantage the wealthiest among us. The wealthy pay the greatest share of state income taxes. And because they own the biggest houses, they pay the greatest share of local property taxes. That is why 88 percent of the SALT deduction benefits go to those earning over $100,000, while only one percent of those benefits go to those earning less than $50,000. Moreover, half the benefits go to a half dozen states: California, New York, New Jersey, Illinois, Texas, and Pennsylvania. An incredible 20 percent of SALT deduction benefits go to California alone.

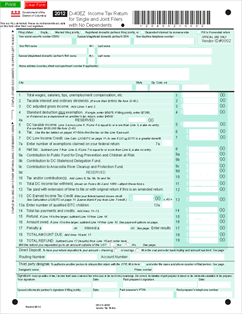

I realize that an income of $100,000 per year is not “rich” in the District, but we should not pretend that the SALT deduction is a good vehicle for providing tax relief to the poor. Indeed, the SALT deduction is a rare regressive federal tax policy: The richer you are the more you benefit. In the District, for instance, about 39 percent of return filers itemize. The average SALT deduction for those returns was about $15,400.00. That is the average. I can assure you that poor people aren’t paying $15,400 in income and property taxes. Eliminating the deduction at the federal level a lot more than poor or middle income workers. Every analysis shows that.

Public finance experts have long asserted that the “best” tax system is built on a broad base with low rates. That has been the mantra of every tax reform effort in the last fifty years. Ending the deduction will broaden the base. And it will lower rates. Curiously, many of the political leaders—not necessarily those in the District—who vilify the removal of the SALT deduction criticize the Congressional tax proposals for giving to many tax cuts to the rich.

The federal deduction for state and local taxes is really a subsidy. It allows states and localities to impose taxes knowing that—for the wealthy—Uncle Sam will reimburse folks for some of that burden. Many argue that provides an incentive to keep state and local taxes high. Others argue that the deduction shifts federal money from modestly taxed states to high tax states. But whether those arguments have merit, they are not my issues. I simply believe that poorer people don’t use this deduction nearly as much as richer people.

Swapping the SALT deduction for a much larger standard deduction and lower rates on low incomes is good for the poor and working class. But at least our rhetoric does match that of New York. New York Mayor Bill De Blasio has warned that New York City was going to fight back. Governor Andrew Cuomo claimed that ending the SALT deduction would destroy New York. So much for Big Apple resilience. In any event, I am sure the hedge fund guys, investment bankers, and big firm lawyers appreciate such champions.

David Brunori, who writes the regular column First Take, is a partner in the Washington office of Quarles & Brady LLP and a research professor of public policy at The George Washington University. He is a nationally known expert in state and local tax and public finance.