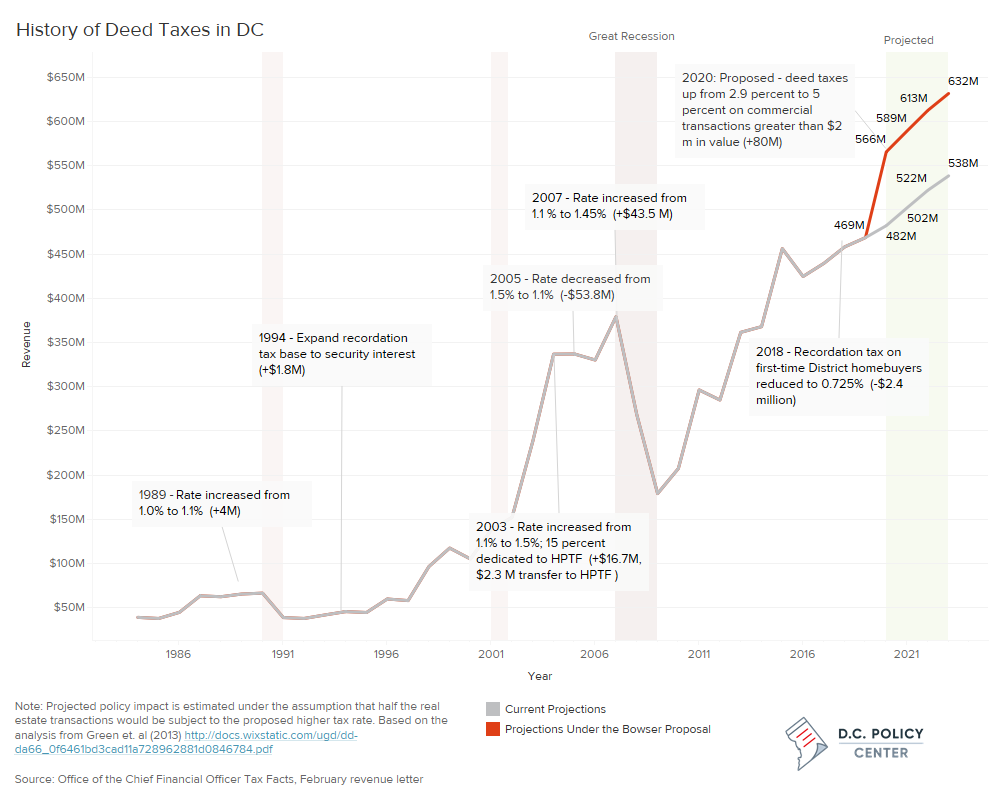

Last night, Mayor Bowser announced that her budget proposal would increase deed recordation and transfer taxes on commercial property valued at $2 million or more, in order to generate an estimated $80 million for affordable housing in the District. The chart below shows the history of deed tax revenue in D.C. since 1984, and how this proposed increase would affect its projected growth through 2023.

As the chart shows, deed tax revenue has increased since the 1990s, but is also very sensitive to housing booms and busts. Revenue increased dramatically in the early 2000s, but then fell sharply during the Great Recession. The District government increase or decreased the deed tax rate three times between 2003 and 2007, but has generally not changed the rate since then, except for a small change for first time home-buyers in 2018.

Going forward, deed tax revenue is projected to increase from $469 million in 2019 to $538 million in 2023 under current rates, but would be projected to rise even further to $632 million during that time under Mayor Bowser’s proposal.

About the data

Tax revenue projections under the current rate are from the February 2019 Revenue Estimates for FY 2019 – FY 2023, published February 28, 2019. Tax revenue historical data from various CAFR documents. Information on significant policy changes are from the Office of the Chief Financial Officer’s 2018 DC Tax Facts, published August 22, 2018.

The projected policy impact is estimated under the assumption that half of D.C.’s real estate transactions would be subject to the proposed higher tax rate, based on a 2013 analysis of deed recordation and real property transfer taxes from Dr. Rodney D. Green and Dr. Judy Mulusa, Howard University Department of Economics.