This article is adapted from “The 2018 State of the Business Report: Towards a More Inclusive Economy,” a report D.C. Policy Center prepared for the DC Chamber of Commerce.

When we discuss the District’s rental housing supply, those discussions usually center on units in apartment buildings, as opposed to units that are rented out by their owners. However, in the District of Columbia, units rented out by their owners—often referred to as the shadow rental market—account for a significant portion of the overall housing stock, and are an important source of housing for low- and middle-income families.

This market encompasses approximately 82,000 units, or 26 percent of the District’s total housing stock, according to D.C. Policy Center estimates. The shadow rental market also includes 46 percent of non-apartment units, including approximately 22,000 single family homes and 55,000 units in condominium or a cooperative buildings.

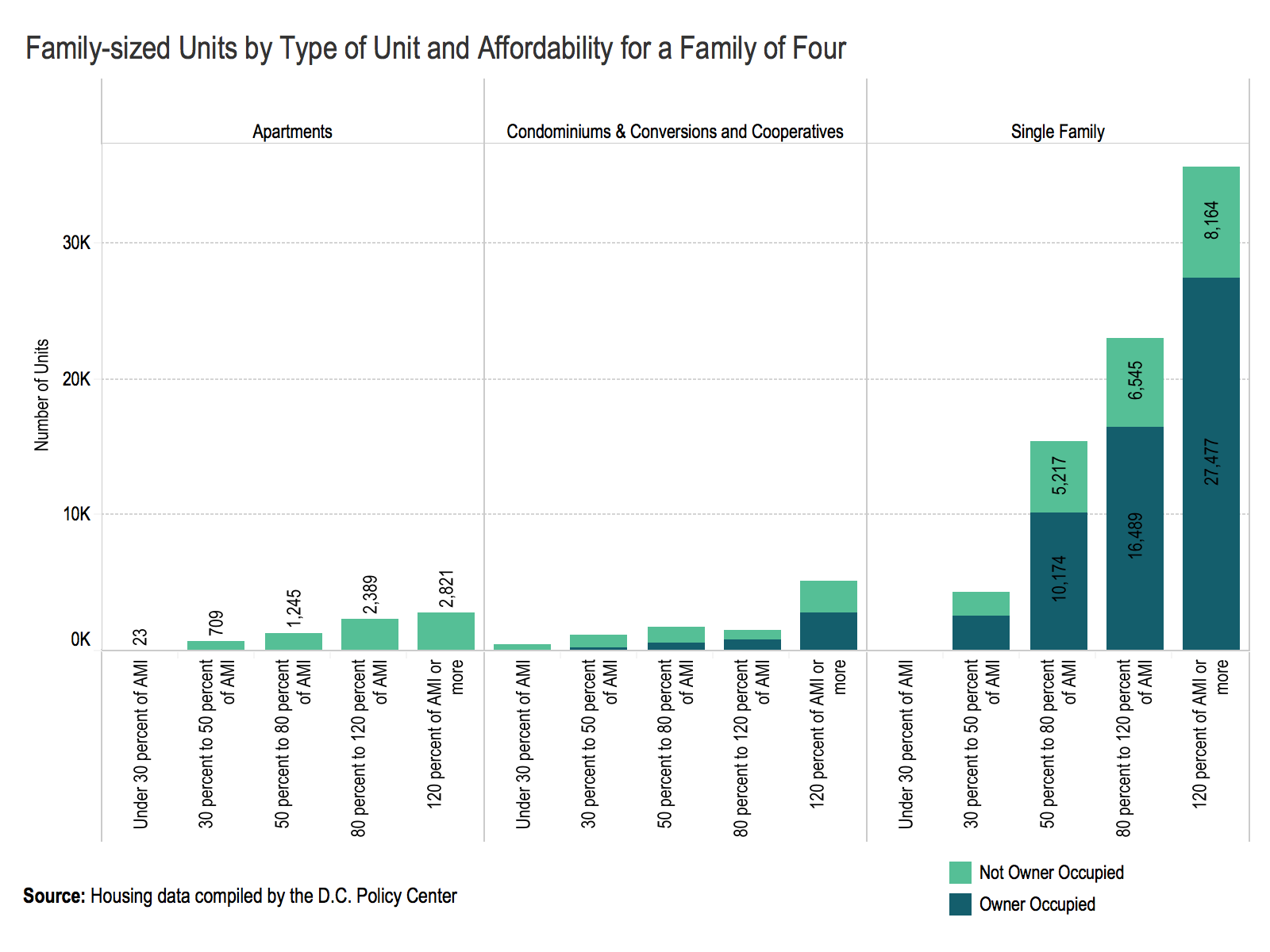

When we focus on the subset of units that can comfortably accommodate a family of four or more, we find that the largest source of affordable units are in the single-family housing stock that are already rented. For example, there are approximately 18,400 family sized units affordable for families that earn between 50 and 80 percent of Area Median Income (AMI), and of these units 7,725 of them are currently not occupied by their owners. Furthermore, most of these units (5,217) are single-family homes. In contrast, among the District’s over 118,000 rental apartments, families have a slim picking, of about 1,245 units, most of which are in Far South neighborhoods in Ward 8.

Many low- and middle-income families in D.C. live in shadow market rentals, and therefore are in greater danger of displacement. For example, in Ward 7, neighborhoods around Deanwood and Fort Dupont have many single-family units that are potentially affordable to low- and middle-income families, and these units are largely rented out to low-income families who pay for them with the help of vouchers and subsidies they receive from the government. Should there be increased competition for these units from affluent singles and couples, as it is anecdotally the case, the owners could be persuaded to part with them, as they have done in newly gentrified neighborhoods in the Central Corridor, such as Mount Pleasant, Petworth, and Brookland.

Read more: The 2018 State of the Business Report: Towards a More Inclusive Economy