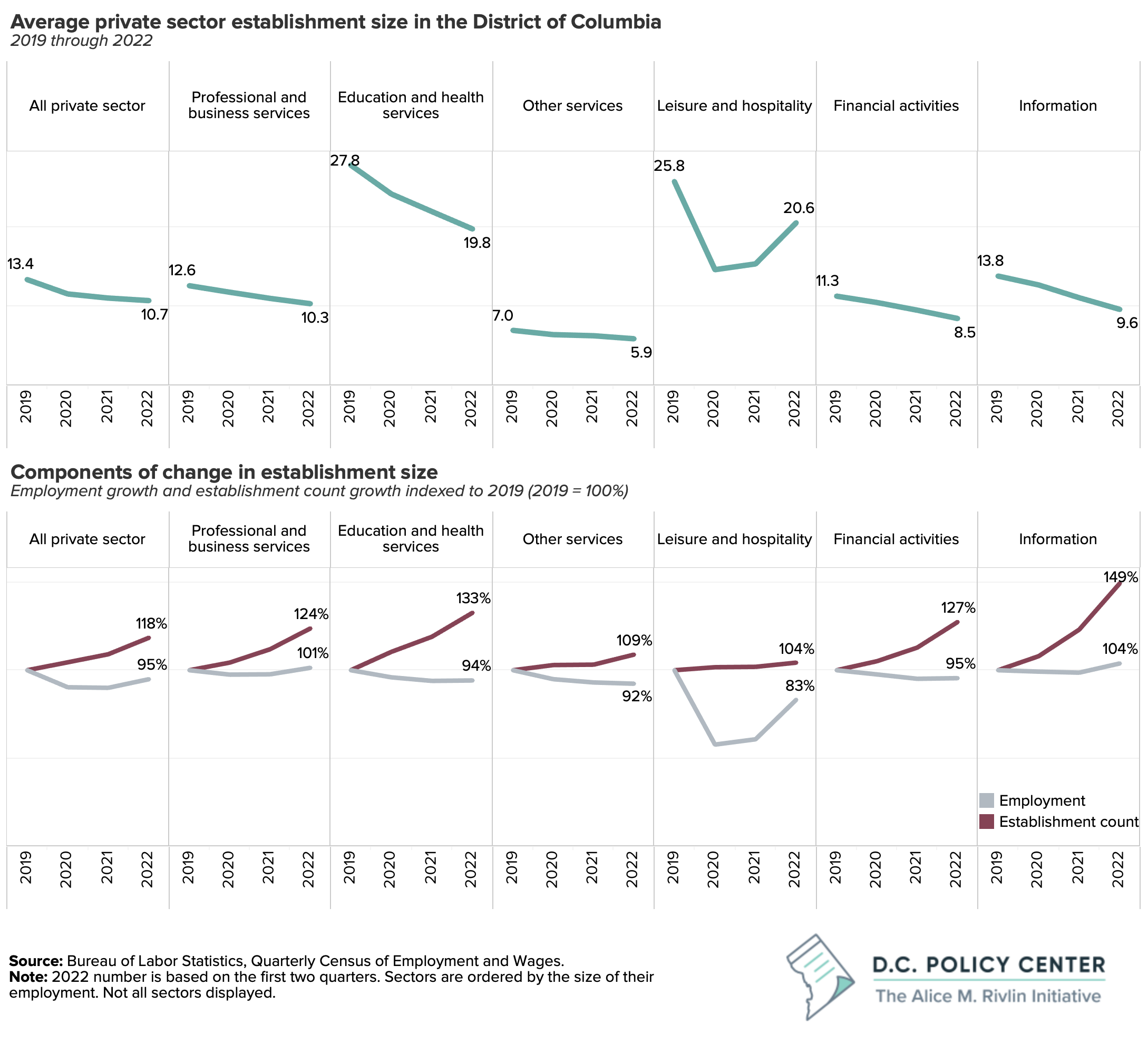

Prior to the pandemic, a typical business establishment in the District’s private sector employed 13.4 employees. By the second quarter of 2022, that number had declined to 10.7, representing a 20 percent contraction in the average establishment size. This decline was observed for all of the District’s major sectors. The average size of establishments in professional and business services declined by 19 percent; in education and health services, and in the information sector, the average size of establishments declined by 30 percent.

It matters, however, why the average establishment size is declining. Is it because existing establishments are getting smaller? Or is the city adding start-ups and new establishments, which tend to be smaller in size, therefore pulling down the average establishment size?

It turns out that the smaller establishment size is more likely driven by an increase in startups. Employment in D.C. is 5 percent below pre-pandemic levels (down by 27,500 from 2019) but there are 7,434 net new establishments: 18 percent higher than the pre-pandemic levels. This, again, holds for every key industry.

In the professional and business services sector—which has the largest private sector employment in the city—employment has now recovered to pre-pandemic levels, standing at 173,000, and the number of business establishments increased by 25 percent (3,212 net new establishments). Similarly, employment has fully recovered in the information sector, but the number of establishments increased by nearly 50 percent (up by 713).

In industries that have not reached pre-pandemic employment levels, such as leisure and hospitality, it is less clear whether the smaller establishment size is driven by startups or continued loss of employment. However, because there has been an increase in new establishments across all industries, it is likely that at minimum there are more small businesses in each sector compared to pre-pandemic.

This is an encouraging sign suggesting that the District continues to have a dynamic business environment, with creative entrepreneurs and a strong business formation. While some of these new businesses will not survive. Data suggest that nearly half the startups close within the first five years of their operations. But some will grow and thrive, and have an outsized impact on employment. The trick will be to keep them in the District. Our previous research found that for every ten jobs the District gains because a business establishment moves into the city from elsewhere in the metropolitan area, the city loses 24 jobs to surrounding jurisdictions because some other company moves out.

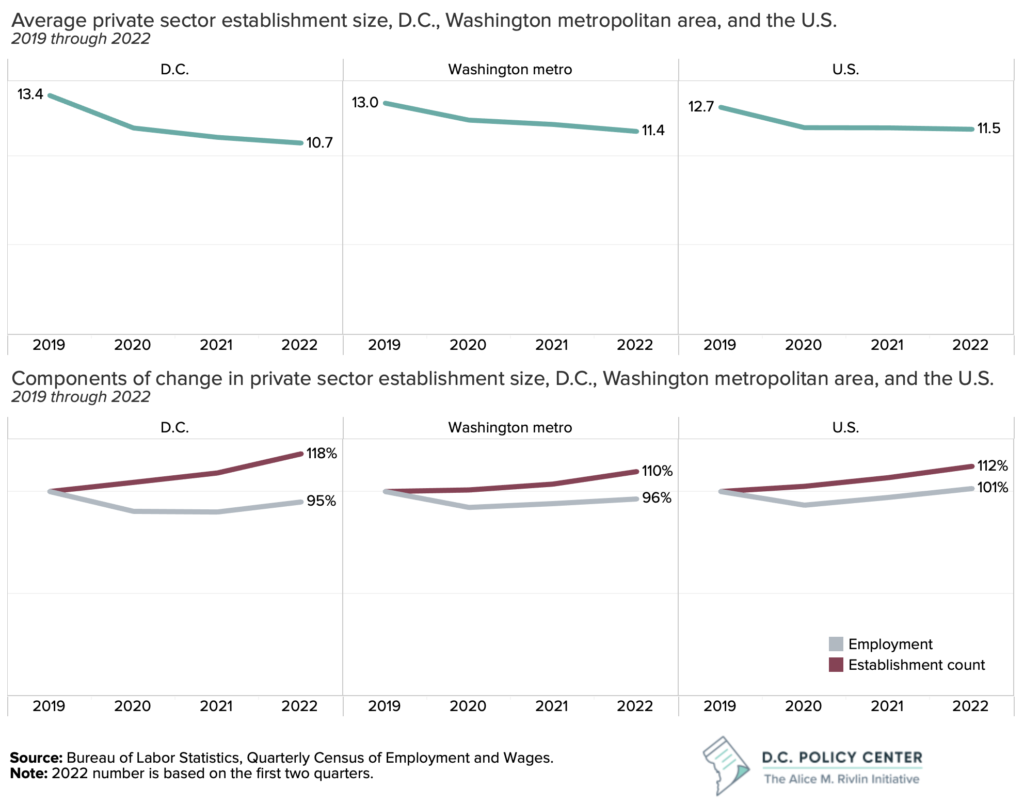

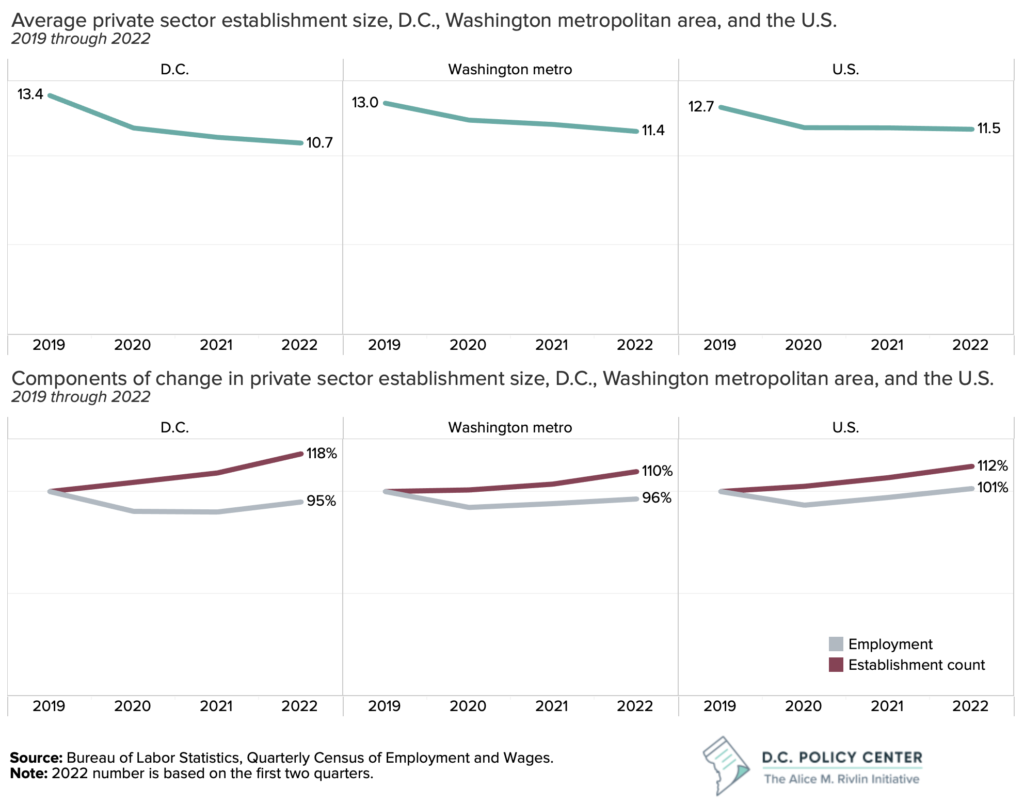

The District has outperformed both the Washington metropolitan area and the U.S. in new business formation in the last three years. The Washington metro area has seen a comparable recovery in employment (96 percent of pre-pandemic employment, compared to 95 percent in D.C.) but the number of establishments in the region increased by 10 percent only, compared to 18 percent in D.C. Establishment size decline is most muted across the entire U.S. largely because employment recovery has been stronger.