October is National Women’s Small Business Month.

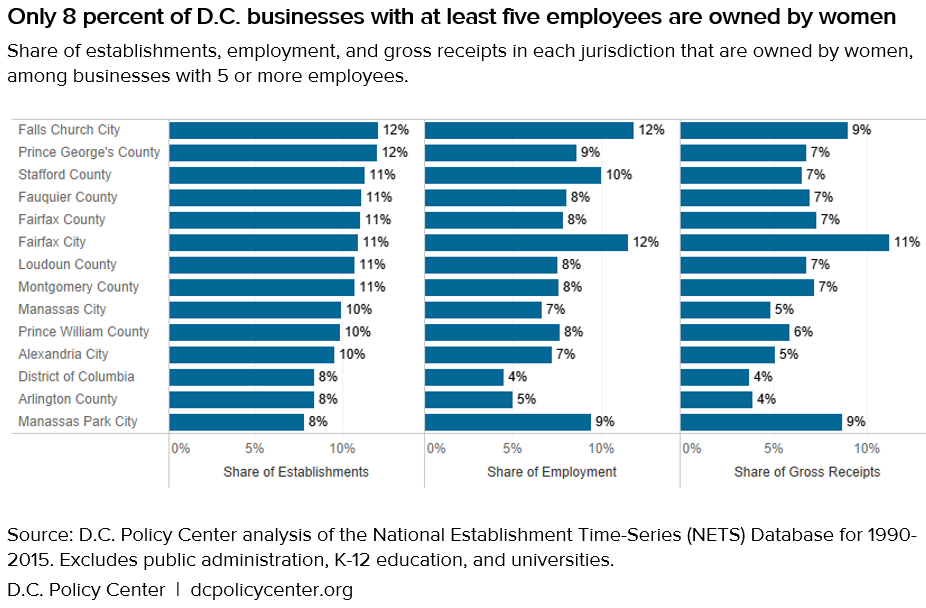

Only 8 percent of business establishments in the District of Columbia with five or more employees are owned by women, as we wrote in the 2019 State of Business report. D.C. has lower shares of businesses owned by women than almost any other jurisdiction in the metropolitan area, with rates similar to those of Arlington County and Manassas Park City. D.C. also has the lowest business ownership rates for women when measured by share of gross receipts (only 4 percent of sales are to businesses owned by women), similar to Arlington (5 percent). The same is true when looking at women-owned businesses by their share of employment (4 percent of workers in D.C. work for businesses owned by women), alongside Arlington (4 percent), Manassas (5 percent), and Alexandria (5 percent).

Across the Washington metropolitan area, the highest rates of business ownership for are in Falls Church City, and Prince George’s County, as 12 percent of establishments. In Falls Church City, 12 percent of workers work at business establishments owned by women. In Fairfax County, 11 percent of all businesses with five or more employees are owned by women, and these businesses account for 8 percent of employment and 7 percent of gross receipts.

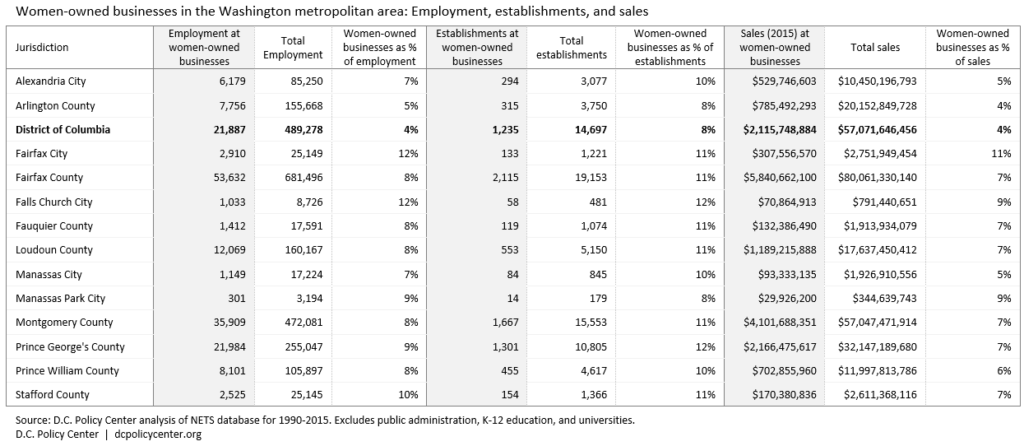

In terms of overall numbers, women-owned businesses in the District employ around 21,887 workers across 1,235 establishments, with annual sales of $2.1 billion.

Until 1988, women could not secure a business loan without a male relative as a co-signer in many states. The Women’s Business Ownership Act eliminated this discriminatory practice, but many other barriers and structural forces remained. For instance, a research article published in 1991 found that while women did not lack in “entrepreneurial traits,” or differ from men in their motivations for beginning a small business, a variety of factors—from less prior financial and managerial experience to the lack of family support men with wives often receive—converged to limit their success. Furthermore, the researchers found that among sole proprietorships in the 1980s, “woman-owned businesses [were] concentrated within traditionally female-typed fields with lower average business receipts than male-typed fields,” such as personal services; meanwhile, women were far less likely to own businesses in industries like construction. Even within broad categories like retail, businesses owned by men were more likely to have higher sales, and women were more likely to be a part of direct sales organizations (such as Mary Kay) with very low individual revenues. Once established, women entrepreneurs continued to lack access to financial capital and the social capital necessary to access government contracts.

Many, if not all, of these forces continue today. Nationally, women-owned businesses are still significantly smaller than those owned by men, on average, in terms of both employment and average sales. Part of this gap now, as in the 1980s, has to do with the settings under which women start businesses, including push and pull factors that often differ from men (such as being pushed into self-employment through lack of other options after a child is born instead of being pulled by attractive entrepreneurship opportunities). As they establish their businesses, women entrepreneurs are more likely to be denied bank loans or receive lower levels of credit. And as guest contributor Shelly Bell wrote in her recent essay on access to social and financial capital, the gaps are even larger for Black women:

Among all businesses nationally, those owned by Black women have average sales per business of $28,000, compared to $768,000 for those owned by white men. And businesses owned by Black women have an average of 8.2 employees and average sales of $557,000, compared to 13.1 employees and $2,866,000 in average sales for those owned by white men.

These present inequities stem from the systematic denial of access to financial and social capital (among other factors) for women and people of color. The inclusion of social capital here may seem surprising at first; after all, we’re used to hearing, “It’s not personal, it’s business.” But personal relationships are vital to any business’s success, especially the success of new ventures. From getting an idea off the ground to connecting with customers, social capital is just as important as financial capital to a new business’s success. And for Black businesses in particular, especially those founded by Black women, many of the same barriers that have prevented equitable access to financial capital are at play in limiting access to social capital, resulting in a broken ecosystem.

Continue reading: Building the ecosystem for Black women entrepreneurs in D.C.

About the data

The data in the charts and tables in this report are from the National Establishment Time-Series (NETS) Database for 1990-2015 from Dun and Bradstreet (D&B). This analysis focuses on businesses with five or more employees, and excludes those in public administration, K-12 education, and universities. For more information, see the 2019 State of Business report.